Life is increasingly happening online. The world wide web is where you communicate, it is where you shop, and order food. It is the place where you can get entertained and learn new skills. Today, you can even buy digital art. But how does it work exactly?

What is an NFT?

NFT is short for "Non-Fungible-Token", and it is essentially a special token with a unique ID that is impossible to replicate. They are used to create a verified ownership of a digital asset in the worlds of crypto art, crypto collectibles, and all sort of other cryptoassets.

The token is, like cryptocurrencies, part of the blockchain, a permanent ledger accessible to anyone with a computer and internet. As a contrast, an example of a fungible asset is a dollar bill: I can use any dollar bill for exchange, and it will not change a thing to you. With NFTs, you can buy a digital picture, prove your ownership of it, and sell it later on.

The question is always the same: what stops someone from simply downloading the image you acquired? Well, nothing. A bummer right? Anyone can still download the image, have it on their computer, use it as a wallpaper or whatnot.

However, the piece of media they have on their computer is worth nothing, as only you hold the key through the NFT. You have the original, with the value that comes with it. In the same logic, you can buy a poster of a Da Vinci painting. It looks the same, but it is only worth $30 because it is not the original. In this regard, any downloaded image looks pretty, but holds no value.

Applications of NFTs:

Many artists started selling their art on various platforms, such as SuperRare, Rarible or KnownOrigin. Of course, the artist will be paid through a crypto wallet, and this all happens on a blockchain (posting fees will also be paid in crypto). An artist uploads its digital content – e.g. a single piece 1/1, a thirty-copy series 1/30 –, and sets up a price for it. And there, their art is available to the market!

NFTs can also be used for many other elements, such as collectibles, virtual or real-world assets, and even for real estate, but in this article, we will focus on digital art.

Here is what the KnownOrigin's platform looks like (Source: knownorigin.io)

The Crypto Art Market

This space is seeing more and more inflows as investors get excited over this new opportunity. However, many people ask why some pixelized versions are reaching higher valuations than the originals: how does it make sense that infinitely reproductible pixels are worth more than the original physical copy?

Well, it surely does not have more value, however, it is far more accessible. Digital works of art can be displayed in many more ways than in a gallery: online galleries, digital frames, streaming, in a VR world, and so on. Also, as they have no weight. They are much easier to transport than any given painting or statue. Finally, there is hardly a way to break them. Digital art does not fear careless manipulation, fires, floods, nor your annoying friend who never understood that watching did not have to involve hands. All you need to access it is a key, that can be stored on the cloud or even in your head.

The NFT solves the problem of proving the scarcity and provenance of a certain digital piece, allowing a certain rarity – and thus, value – to be attributed to a digital work of art.

It seems that investors were just waiting for this solution: the crypto art asset class is now growing 300-400% on a quarterly basis. It seems that short term investors who are looking to scrape quick profits as well as long-term investors who will hold their acquisition will both be interested.

How is the Blockchain technology changing the art market?

For investors, it is a way to easily invest online, and own art you enjoy. We already mentioned the advantages of a digital work in the previous section. But there are other ways that the blockchain is changing the way investors collect art works.

The process of securitization (converting art to be a tradeable security) has become increasingly simple with NFTs; the elimination of intermediaries, makes the ownership of various pieces of art easier. You may not have the means to buy a Picasso painting, however, you might be able to own a fraction of it. Blockchain-based digital assets are far more liquid and transparent, thanks to the absence of a central authority and traditional markets intermediaries.

Secondly, secured tokens representing a verified asset have brought an increased trust from investors, who can be certain that their ownership of the piece of art – be it physical or digital – cannot be copied or falsified.

For artists, this way of selling online let's them have a much broader exposure and sell on scale. Any artist can be seen from anywhere in the world, and there is no hassle regarding delivery. This let's them expose and sell whatever they want, on any platform. There is no need to go through art galleries – who usually grab 50-60% of the selling price as a fee – or to undergo a long auction – which, as you guessed already, also take a big fee from artists. It could prove to be a new source of income for struggling artists, and already made millions for some, as we will see in the next section.

A practical example: NFTs generate $3.5m to artist Beeple

Are you still doubtful about the success of crypto art and NFTs? Let us take a practical case to convince you of the validity of the technology.

Mike Winkelmann a.k.a. "Beeple" is a digital artist who executed its second "NFT drop" – fancy crypto name for "online auction" – on the platform NiftyGateway. He released small illustrations backed by physical copies to be sent to users. What he proposed was: 100 $1 editions, 3 open editions for 5 minutes and 21 1/1 auctions over the course of 2 days.

One of the three open editions backed by a physical copy and a hair sample (Source: Beeple)

It worked wonders. The $1 pieces sold out instantly. The 3 open editions sold 580 times over the 5 minutes of availability. At almost $1,000 a piece, that is more than half a million in 5 minutes.

Most $1 works went up in the few thousands in the secondary market with the lowest price being $5,000, and the top reaching $11,000. All 21 for auction were raised to bids of $6,666 by an investor named Pablo. 10 of them were sold in the end, generating almost a million altogether. The #4 "into the ether", originally sold for $1,000, was resold for $100,000 on the secondary market.

More crazy bidding occurred, which I will recall in detail here, but you should know that the final amount of the primary market sale was $3.5M.

The 21 works sold for auction, all sold at least $6'666 (source: Beeple)

The Passion of Elon (source: Beeple)

The Passion of Elon (source: Beeple)

The market of NFTs

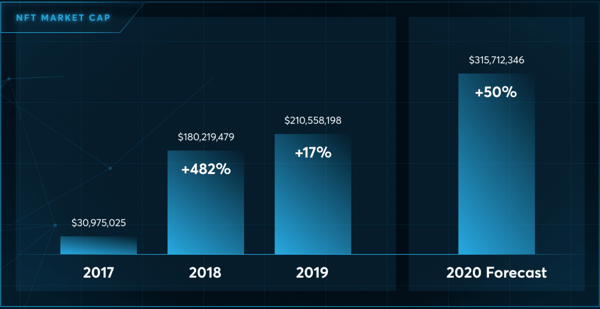

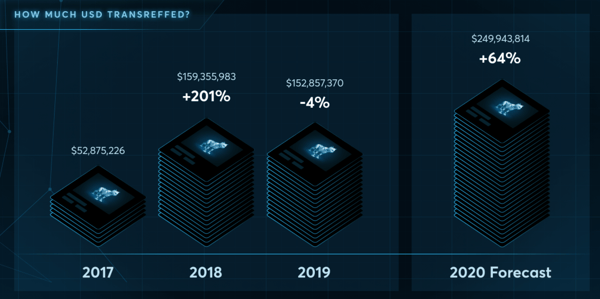

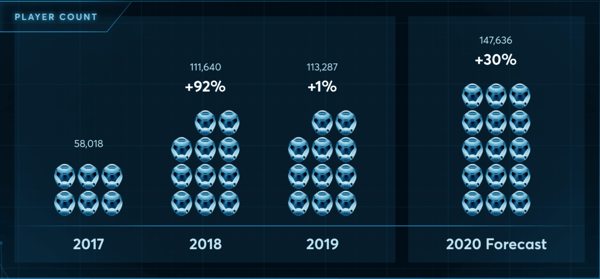

Non-Fungible-Tokens are relatively new, but they are seeing a considerable growth, as you may see on the graphs below:

NFT Market Cap: 2017-2020 (Source: Coin Telegraph)

Amount of USD transferred through NFTs: 2017-2020 (Source: Coin Telegraph)

Number of players in the NFT market: 2017-2020 (Source: Coin Telegraph)

Number of players in the NFT market: 2017-2020 (Source: Coin Telegraph)

We can only see that the growth heavily died down in 2019, which is in part due to the extreme hype that crypto markets saw in early 2018. However, forecasts for 2020 are rather optimistic as crypto assets are gaining more popularity and trust from investors.

As of now, the leading NFT platforms are Decentralized with over $38 million in total sales, Cryptokitties with the same amount, Axie Infinity and SupeRare with around $7 million in total sales.

As you can see, the market is growing and some creators are starting to become popular, and thus, valuable. Is it a trend to jump in early on? That is for you to decide.

Sources:

The Proof of NFTs — $3.5M Beeple Drop., in Medium

The Crypto Art World ?, in Medium

Non-Fungible Tokens: The Quick Guide, in CoinTelegraph

Musician Sells NFT Token Bringing Royalty Rights for $26K in Crypto, in Coindesk