The Forex market stands out as the world's largest and most heavily traded financial market. It boasts an average daily turnover surpassing $5 trillion US dollars.

So, how exactly can you capitalize on these huge flows of money?

In the world of Forex trading, traders speculate on exchange rates and buy and sell currency pairs. It's akin to the familiar concept of trading stocks, except here, you trade currencies instead of shares.

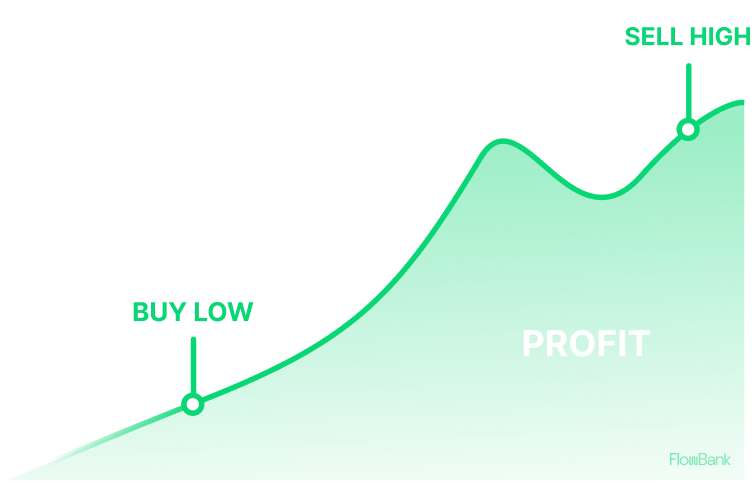

Imagine yourself using a Forex chart similar to the one below in your FlowBank trading account. This chart shows the fascinating journey of price fluctuations over time. By mastering the art of market timing, you can seize the right moment to...

Buy low and sell high (thereby generating profits)

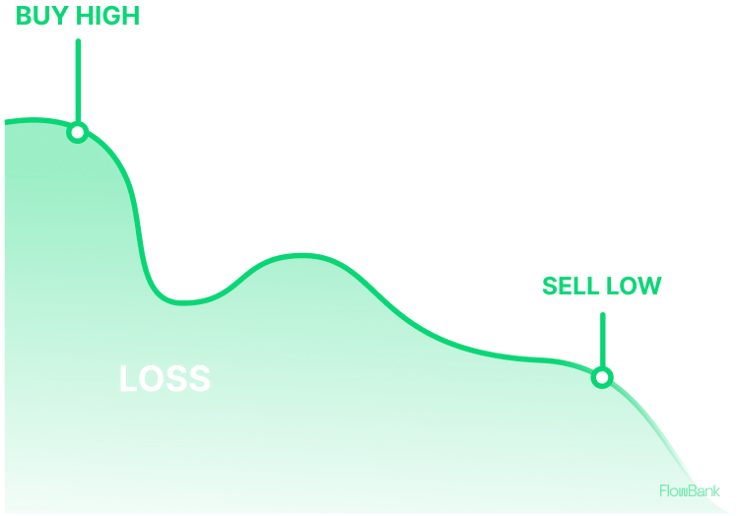

However, mistimed decisions can lead to losses if you end up buying when prices are high and selling when they dip lower.

Successful Forex trading requires knowledge of the markets and a number of skills and personal attributes. This guide provides a comprehensive overview of Forex trading, explaining its principles, functioning, and how you can participate.

Interested in understanding the dynamics of Forex trading? Learn more with Flowbank.

Overview: What is Forex Trading?

Forex, also known as foreign exchange trading, involves the buying and selling of currencies on a global market.The forex market is the global marketplace where individuals, corporations, and even central banks trade currencies. Whenever you travel abroad and exchange dollars for euros, pounds, or any other currency - that's a part of forex trading.

A good deal of foreign exchange trading takes place when people or companies need to exchange currencies for practical reasons, like international commerce. However, most forex trades are for speculation by forex traders.

We assume you are reading this guide as a prospective Forex trader!

Traders are individuals or institutions actively engaged in foreign exchange markets with the objective of turning a profit. The sheer volume of currency being exchanged on a daily basis causes currency values to fluctuate continuously. This price volatility presents opportunities for currency traders to potentially make a profit.

So, how can this trading be done?

Using a Forex Platform to Trade

Forex trading is done on an app or online trading platform like FlowBank. On this platform, you can choose from many exchange rates, which are called currency pairs or forex pairs.When you want to buy or sell a currency pair, it's really simple on the trading platform. You just need to click on the buy or sell buttons.

Source: FlowBank app

Every currency has a specific code that represents how it is written.

The most commonly traded forex pair worldwide is EUR/USD. EUR represents the euro currency, and USD represents the US dollar. The currency exchange quote shows you the price of one euro in terms of dollars

Understanding How the Forex Market Works

Before you think about how to make money trading forex, you need first to get a grasp of what it is you dealing with. What is the forex market?The Forex Market Landscape

In the financial world, the Forex market holds a distinctive place. Unlike stock markets which are based in specific locations, the market for foreign currencies is decentralized and operates 24/5 across different time zones.

The trading happens directly between two parties in an over-the-counter (OTC) network. This network of global banks, brokers and financial institutions is spread across major Forex trading centres – London, New York, Sydney, and Tokyo. This unique feature offers the opportunity to respond to currency fluctuations caused by economic events at any time, day or night, though you can rest at the weekend when the forex market is closed!

Forex Market Types - Spot, Forwards, and Futures

The Forex market can be classified into three distinct segments - Spot, Forward, and Futures markets.The Spot Forex market is the most immediate, where currencies are bought and sold 'on the spot'. Trades in this market are settled at the current market price in standardized contracts. This is the domain of individual speculators, known as retail traders and the brokers that facilitate their trading, known as retail brokers - it is what we will focus on in this guide.

The Forwards and Forex Futures markets deal with the buying and selling of currencies at a predetermined price at a specified date in the future. Futures and forwards are preferred by large institutions because the contracts are more flexible and typically facilitated by large dealer banks instead of brokers.

The Forex Currency Pairs You Can Trade

Forex trading involves selling one currency to buy another, so it's conducted in pairs. Each pair consists of a base currency (the first one) and a quote currency (the second one). The pair's price indicates how much of the quote currency is needed to buy one unit of the base currency.Although this sounds complicated at first, it is the same idea as other financial markets. Think of it like this: instead of buying and selling 1 share of Apple (AAPL) stock, you are buying and selling 1 unit of a foreign currency.

Forex pairs are primarily classified into four categories:

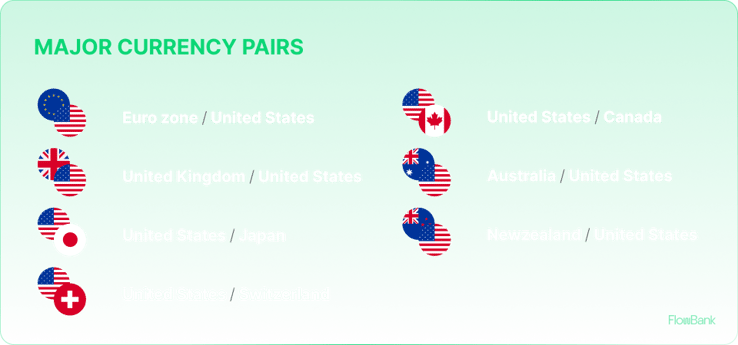

- Major pairs: Comprise 80% of global Forex trading, including pairs like EUR/USD, USD/JPY, GBP/USD, and USD/CHF.

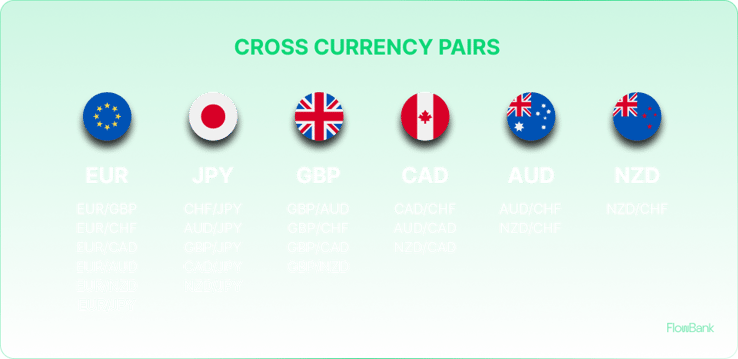

- Minor pairs: Less frequently traded, often featuring major currencies against each other instead of the US dollar. Includes pairs like EUR/GBP, EUR/CHF, and GBP/JPY.(these pairs are also known as Cross Currency Pairs).

- Exotics: Pairings of a major currency against one from a small or emerging economy. Examples include USD/PLN, GBP/MXN, and EUR/CZK.

- Regional pairs: Pairs classified by region, such as Scandinavia or Australasia. Includes pairs like EUR/NOK, AUD/NZD, and AUD/SGD.

What Causes Currency Movements in Forex Trading?

The primary driver of currency movements is the fundamental economic principle of supply and demand. When demand for a currency exceeds the supply of that currency, the price (its exchange rate) tends to rise. Likewise, when supply outstrips demand, the price of the currency relative to other currencies falls.

Central banks control the demand and supply of currencies by using interest rates and open market operations. By raising interest rates, they can decrease currency demand, while lowering interest rates stimulates demand. Through open market operations, central banks can increase the money supply by buying securities, leading to decreased currency value, or reduce the money supply by selling securities, causing increased currency value.

Over the longer term, currency values are often determined by government policy as well as the country’s economic health.

Traders speculate about the direction of interest rates and other fundamental factors by following economic data, including Gross Domestic Product (GDP), unemployment rates and inflation statistics like the Consumer Price Index (CPI). ![]()

By understanding these key factors, traders can make informed predictions about currency price movements and develop effective trading strategies.

How Forex Trading Practically Works

Perhaps you’re getting an idea of which forex pairs you might want to trade. Now how do you go about placing the trade? What do you buy? How much should you buy? and How much does it cost?There is some terminology to get familiar with.

Definition of a Pip in Forex

A pip, short for "price interest point," is the smallest unit used to measure changes in exchange rates. It helps to understand the precise fractional movements in currency prices. When thinking about how much a forex price might change, traders think in terms of pips rather than dollars, euros, Swiss francs etcFor major currencies, a pip is usually the fourth decimal point, like in EUR/USD = 1.3001 (where the pip is the '1'). However, with certain currencies like the Japanese yen, the pip is the second decimal point, such as in USD/JPY = 104.32 (where the pip is the '2').

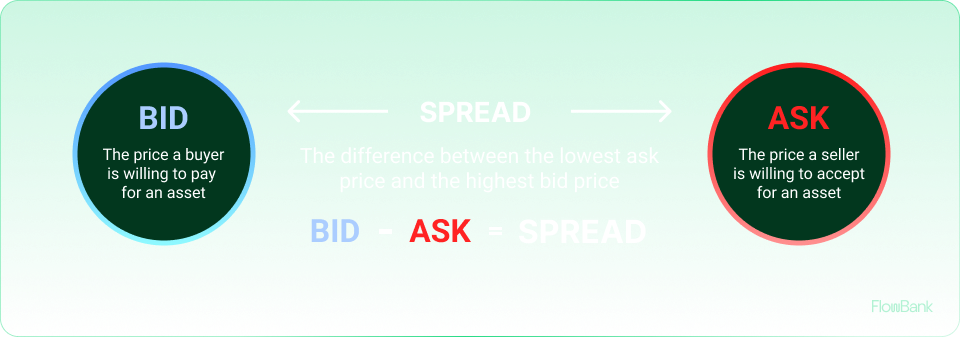

Buy and Sell (Bid/Ask) Prices

In forex trading, the bid/ask prices are essential components in determining the value of a currency pair. Here's what they represent:

The bid price is the highest price a buyer is willing to pay for a particular currency pair at a specific moment. Traders who want to sell a currency pair receive the bid price. It is the price at which you can sell the base currency (the first currency in the pair) and buy the quote currency (the second currency in the pair).

The ask price (also known as the offer price) is the lowest price at which a seller is willing to sell a currency pair. Traders who want to buy a currency pair would typically pay the ask price. It is the price at which you can buy the base currency and sell the quote currency.

Your broker will quote the bid/ask prices simultaneously for each currency pair, and the difference between the two is called the spread.

The Spread in Forex Trading

The spread refers to the difference between the buy price and sell price of a currency pair, measured in pips. The bid/ask spread represents the transaction cost or the broker fee for executing the trade. The bid and ask prices are constantly changing as market conditions fluctuate, reflecting the supply and demand dynamics of the currency pair.Put another way, the spread is the main cost of entering a trade.

For example, GBP/USD might have a bid price of 1.4035 and an ask price of 1.4037, resulting in a 2-pip bid/ask spread (7-5 = 2).

Standard, Mini and Micro Lots in Forex

In forex trading, currencies are traded in blocks called "lots." The standard lot size any broker will offer is 100,000 units. FlowBank also offers smaller lot sizes, such as mini lots (10,000 units) and micro lots (1,000 units).Currencies are traded in specific contract sizes to make trading more efficient. A buyer wishing to buy 10,000 can always be matched with a seller looking to sell 10,000. Additionally, transacting in smaller amounts of currency would not be worthwhile. While currencies fluctuate all the time, they do not usually move by as much as stocks. While single stocks regularly rise and fall by 20% in a day, this is almost unheard of in forex. To take advantage of these relatively smaller price movements, larger contract sizes are needed.

Example: If USD/CHF is quoted as 0.9325, one lot of $100,000 in Swiss francs would be equal to 100,000 * 0.9325 = 93,250 CHF.

The value of a pip can be calculated based on the lot size, e.g., a spread of 2 pips would be 0.0002 * $100,000 = $20.

Trading with Leverage

Leverage allows traders to participate in forex trading with smaller amounts of invested capital. It is expressed as a ratio and represents the required funds in your account compared to the value of the trade.A broker offering leverage enables trading with larger positions than what the available capital would otherwise allow.

For example, a leverage ratio of 30:1 means you need $1 in your account to trade $30 worth of currency.

Using Margin in Forex

Margin refers to the funds required in your trading account to open a trade. If the leverage is 30:1, it means you need $1 in your account to trade $30. However, a trade size of $30 may be too small for practical purposes.To trade three standard lots worth $300,000, you would need ($300,000 / 30) = $10,000 in your account. Margin requirements ensure that traders have sufficient funds to cover potential losses.

Forex Order types

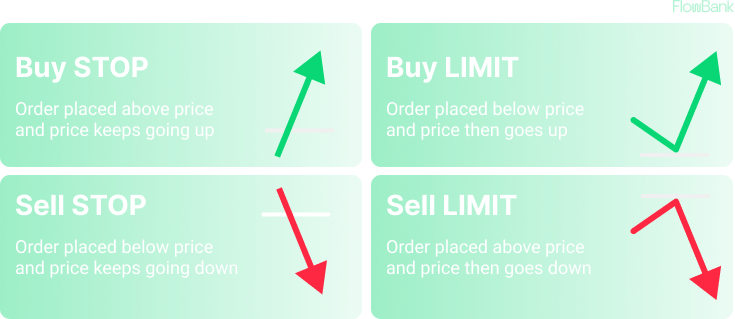

In forex trading, an order is a request to buy or sell a currency pair at a specified price. It is the instruction a trader (you) gives to execute a trade in the forex market with your broker (FlowBank).The main forex order types are:

- Market Order: Buy or sell at the current market price.

- Limit Order: Buy or sell at a specified price or better.

- Stop Order: Buy or sell when the price reaches a specified level.

- Stop-Limit Order: Buy or sell at a specific price after a stop price is reached.

Going Long and Short

In Forex trading, going long refers to buying a currency pair with the expectation that its value will rise. Traders taking long positions aim to profit from the currency's appreciation. By purchasing the base currency and selling the quote currency, they participate in the market's upward movement.Conversely, going short involves selling a currency pair in anticipation of its value declining. Traders taking short positions aim to profit from the currency's depreciation. They sell the base currency and buy the quote currency, benefiting from the market's downward movement.

Both long and short positions enable traders to speculate on currency movements and profit from market fluctuations.

Strategies for Forex Trading

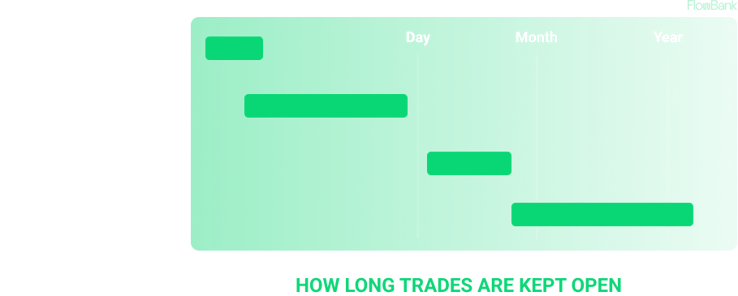

Success in Forex trading doesn't happen overnight. It requires a well-thought-out strategy that considers several variables, including the trader's risk tolerance, capital availability, and ultimate trading goals.Popular Forex trading strategies include day trading, swing trading, position trading, and scalping.

Day trading is where traders open and close positions within the same trading day. They aim to take advantage of short-term price fluctuations in the market.

Swing trading is a short-term strategy that aims to capture larger price movements over a period of several days to weeks.

Position trading is a long-term trading strategy where traders hold positions for an extended period, ranging from weeks to months or even years.

Scalping is an ultra-short-term trading strategy where traders aim to make quick profits from small price movements. Scalpers often execute multiple trades within a few seconds or minutes.

Example Forex Trades

Let's look at an example of a forex trade using the euro and the Swiss franc.Currency Pair: EUR/CHF

Price: 1.1103 / 1.1106 (3-pip spread)

Trade Setup:

You decide to go long (buy) €20,000 at the ask price of 1.1106.

Leverage Ratio: 30:1 (Margin Rate: 3.34%)

Margin Requirement: (0.034 x 20,000) = 680 EUR (or 755 CHF)

Example of a Winning Trade:

The price moves in your favor, reaching 1.1153 / 1.1156.

You close the trade at the bid price of 1.1153.

The difference between your entry and exit is 47 pips.

You earn a profit of 47 pips, including all fees.

Example of a Losing Trade:

The price moves against your prediction, dropping to 1.1053 / 1.1056.

You close the trade at the bid price of 1.1053.

The difference between your entry and exit is 53 pips.

You incur a loss of 53 pips, including all fees.

In both cases, the forex market moved 50 pips, but a spread of 3 pips was deducted from the profit and added to the loss.

The Advantages of Forex Trading

Forex trading offers several key advantages that make it an attractive option for traders:- 24-Hour Market: The Forex market operates 24 hours a day, five days a week, allowing traders to participate at their convenience.

- High Liquidity: With a daily trading volume exceeding $5 trillion, the Forex market is highly liquid, ensuring ease of transaction execution.

- Profit Potential: Forex trading provides opportunities for profit in both rising and falling markets, enabling traders to capitalize on market trends.

- Leverage: Forex trading allows for leverage, meaning traders can control larger positions with a smaller initial investment. It amplifies potential gains, but also carries increased risk.

- Low Transaction Costs: Compared to other financial markets, Forex trading typically incurs lower transaction costs, making it a cost-effective option.

The 2 Types of Forex Market Analysis

Forex market analysis is essential for successful trading. It involves assessing economic, political, and social factors (fundamental analysis) as well as analyzing historical price data (technical analysis).- Fundamental Analysis: Evaluate economic indicators, interest rates, geopolitical events, and central bank policies to understand the fundamental health of economies and predict currency movements.

- Technical Analysis: Analyze charts, patterns, and indicators to identify trends, support and resistance levels, and potential entry and exit points. It helps gauge market sentiment and make informed trading decisions.

By combining both approaches, you'll gain a comprehensive understanding of the forex market and make more informed trading decisions. Regularly update your analysis based on new information and market developments.

Start enhancing your trading skills by incorporating market analysis into your strategy. Stay informed, practice regularly, and refine your analytical skills for success.

Forex Trading Key Takeaways

Let’s summarise some of the key ideas you can takeaway today about forex.- Forex trading involves buying and selling currencies in the global market.

- It offers opportunities to profit from currency price fluctuations.

- The forex market operates 24 hours a day, providing flexibility for traders.

- Market analysis, including fundamental and technical analysis, is crucial for making informed trading decisions.

- Getting started with forex trading on Flowbank is easy and straightforward.