Popular markets for options trading include Forex options trading, indices options trading, and shares options trading. Below we explain how to trade options.

What is an option?

An option is a financial derivative representing a contract wherein a buyer is given the right, but not the obligation, to buy or sell a financial instrument at an agreed-upon price and on a specified date in the future. If the period ends, the option expires and no longer exists according to the rules of the options disclosure document.

Options trading terminology

While a registered investment adviser knows all terminology associated with trading and can give investment advice, you might not understand everything from the beginning. Before attempting any options trading strategies, investors should ensure they are familiar with the terms involved in FX options trading and that of other assets including:

Option Holder: refers to the buyer of an options contract

Option Writer: refers to the seller of an options contract

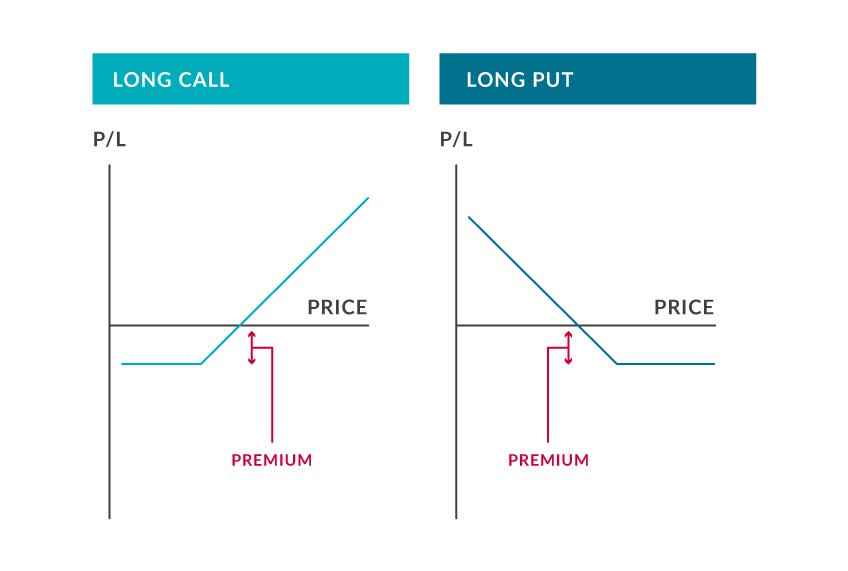

Call: refers to the act of buying an option

Put: refers to the act of selling an option

Strike Price: refers to the agreed upon specified price of the asset to be bought or sold in an options contract

Exercise Date: refers to the specific date upon which an options contract comes into effect

Option's premium: the cost of buying or selling an options contract. This is composed of the time value and intrinsic value

Why do investors use options?

Options trade strategies are usually used by investors to:

Speculate on Financial Markets

Similar to other forms of derivatives trading, options trading is used by investors to speculate on whether the stock price or value of a financial instrument will rise or fall.

If an asset’s price is expected to rise, a call option can be placed, allowing the option holder to purchase the asset at a lower price and sell it for a profit once the price has risen. Conversely, a put option can be placed if an instrument is expected to fall in price, allowing the option holder to buy the instrument once the price has fallen and sell it at the agreed upon higher price to earn a profit.

Hedge Against Other Market Positions

Options trading strategies are also used to hedge against other investments traders have made in the markets. For example, an investor may use Forex options trading to hedge against an open position on the Forex market.

So, if an investor has placed a long trade on the EUR/USD currency pair, they may also place a put option on the pair as a means of hedging their position. Thus, if the pair rises in value, the long trade will be profitable and the options contract will not be exercised, meaning only the premium has to be paid. On the other hand, if EUR/USD falls in price, the long trade can be closed and the put option will produce a profit.

Options strategies

There are various options trading strategies that experienced investors use to attempt to profit from the financial markets. The strategy a trader will rake is based on factors including the underlying security price direction, the time, and how long it will take for the trade to work. Regardless of these factors, millions of options contracts are traded daily. There are different that can be used to help protect an existing position and pursue potential profit. There are strategies including:

Straddles

One of the popular options trading strategies, a straddle involves an investor holding both a call and put option on an asset, with the same strike price and expiration date, while paying both premiums. This is usually used by investors when a significant market movement is expected, but the direction of the movement is unclear. Adopting a straddle options strategy allows an investor to profit regardless of the direction the market moves in, as long as the price movement is large enough to move past either of the strike prices and cover the cost of the two premiums.

Strangles

A strangle strategy involves an investor holding both a call and put option on an asset as per an option contract, with the same exercise date but using different strike prices. Similar to a straddle strategy, this is best used when a significant market movement is expected. Although the direction of the movement may not be 100% clear, there may be a hint as to where the price will move, which is why a strangle strategy uses different strike prices. This would allow an investor to profit from the impending market movement and would be cheaper than using a straddle strategy, while still providing some protection in case the price was to move the other way.

Bull Call Spreads

Another of the popular options trading strategies, a bull call spread involves buying a call option on a particular stock or asset at a specific strike price, while concurrently selling a call option on the same asset, with the same exercise date, but at a higher strike price. The bull call spread strategy is used when an investor expects a small rise in the price of the instrument being traded. The maximum profit for such a move is calculated by finding the difference between the strike prices and subtracting the cost of the options. The strategy the trad

Bear Call Spreads

A bear call spread strategy involves buying a call option on an asset such as an exchange-traded fund at a specific strike price, while concurrently selling a call option on the same asset, with the same exercise date, but at a lower strike price. This strategy is adopted when a trader expects the price of an asset to fall moderately. Like the bull call spread strategy, the maximum profit is calculated by finding the difference between the strike prices and subtracting the cost of the options.

Other calls such as the collar strategy help protect underlying stock from price decrease as the trader combines a long put and covered call.

Read our next article: Financial events of the week