Traders can use a CFD (contract for difference) to trade multiple markets including forex, indices, shares, commodities from a single account.

CFD meaning (What CFD stands for)

CFD stands for Contract for Difference.

CFDs are simply a type of contract that allows investors to speculate on the markets, without taking ownership of the underlying asset.

CFD Trading Explained

When trading CFDs, a trader will open a position in a specific market. For example, buying gold.

If the gold price rises, the trader can close the position to turn a profit. However, if the gold price falls, when the trade is closed it will be for a loss.

CFDs are quoted in the same currency and typically have the same trading hours as the underlying market. For example, oil CFDs are traded in US dollars with 24-hour trading available - just like oil futures contracts. The CFD is designed to replicate the underlying asset - be it Tesla stock or a forex pair like EUR/USD - as closely as possible.

Why trade CFDs?

It is possible to buy and hold CFDs but they are typically used for short term trading or day trading.

A CFD online trading platform allows a trader to buy and sell almost instantly, many times per day - something that tends to take longer in traditional share trading accounts. This speed and flexibility of CFDs tends to attract those interested in short term trading opportunities. That said, CFD traders come in all shapes and sizes - while some traders are in and out of a trade for minutes, others hold on for days or weeks. Ensure that you know everything there is to know about these trading platforms as many traders end up losing money rapidly with retail investor accounts.

What is the benefit of trading CFDs?

The principal advantages of trading CFDs are the following five points, which we discuss in more detail next.

- Ability to trade rising and falling markets and predict closing price fluctuations

- Trade using leverage

- Trade multiple asset classes from one account

- Low transactions costs AND

- Potential tax advantages *

Trade rising and falling markets

One benefit of CFD trading is the ability to speculate on both rising and falling markets.

There are many reasons to want to go short a market, either to speculate on falling prices or to hedge a portfolio.

If for example, a trader thinks the price of the Swiss Market Index (SMI) is expected to fall, they can sell or go short an SMI CFD. If the price falls, the trader stands to benefit, while if the price rises the trader will lose out.

Do you pay tax on CFDs?

CFDs often receive preferable tax treatment but remember taxes vary according to jurisdiction and individual circumstances. In many regions, there is no stamp duty (a transaction tax of around 0.5% of the value of the investment) on CFD trades. However, any CFD trading profits will almost always be subject to capital gains tax.

Trading with leverage

Using leverage to trade on margin, traders can open CFD positions with a smaller initial investment. This makes CFDs one of the more cost-effective ways to trade because the spare capital can be deployed into other trades.

However, trading on margin also adds risk. It amplifies the effect of price changes on the trader’s account balance. For inexperienced traders, this means an increased risk of losing the entire balance. To help you mitigate the risks of using leverage, we explain in more detail how it works below.

Trade multiple asset classes in one account

Typically a separate trading account would be needed for separate asset classes. For example, traders will have one account for stocks and shares, one account for options trading and other account for futures trading. With CFDs, one account balance can be used to cover positions in multiple global markets from forex to gold to a naked call option.

Low transaction costs (competitive spreads)

CFD trades normally have no commission cost because all transactions fees are incorporated into the bid/ask spread. The spread is the difference between the buy and sell price and measured in points (or pips in forex). What each point (pip) is worth depends on the size of the position. The exception to this rule tends to be equity CFDs, which trade with the same bid/ask spread as the underlying share price on the exchange so a small commission is added on top by the CFD provider.

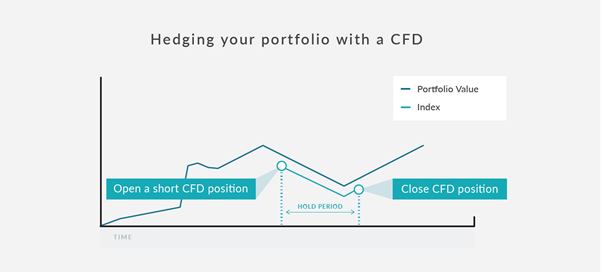

Hedging using a CFD

If you invest in the stock market or in other market like futures or options, it can sometimes be easier and more cost-effective to hedge those positions with a CFD.

What is Hedging? Hedging is taking an opposite position to an open trade with the hope of offsetting an potential loss.

For example, if you hold a portfolio of Swiss stocks on the SMI but are concerned about a possible bear market - or even a market correction - you can go short an SMI CFD. The result would be that if the market did turn lower, some or all of the portfolio losses would be hedge by gains on the CFD short trade.

What markets can I trade as CFDs?

CFDs are typically split up by asset class

Popular individual markets include:

What are the costs of CFD trading?

There are two costs associated with CFD trading: a spread and a funding charge.

CFD spreads

The first is the spread, which is the difference between the price available to buy and sell. (see the list above). The spread is given as an amount in points. To understand the actual cost in currency, you need to understand the cost per point of the CFD that you are trading.

CFD Funding charge

The second is called the funding charge, which is an adjustment to your P&L based on interest rates for holding the trade overnight. It is essentially the cost of ‘borrowing’ the extra amount traded with leverage that is effectively loaned to you by the broker.

The amount of these costs varies with each trade but is clearly displayed on the trading platform before placing the trade. A full PDF pricing list for FlowBank is available on the website.

Leverage in CFD Trading

Using leverage in CFD trading is standard practise and is one of the features of CFDs that attracts traders. However, misunderstanding how leverage works is a common pitfall for rookie traders.

Leverage is expressed as a ratio. It is a ratio between the funds you need in your account to place a trade and the value of the trade.

Margin Trading with a CFD

The margin requirement is the amount of funds needed in your account to place a CFD trade.

If the leverage ratio is 10:1, then you need $1 in your account to trade $10. However, $10 is too little an amount to place a trade with. CFDs are traded in standardised contracts.

The information for which is added inside the FlowBank trading platform.

You can learn more about margin utilization here.

Lot size in CFDs

Sometimes one CFD will equal one of the underlying asset, however this is quite often not the case. So part of the homework for getting to know CFDs is understanding the size of the contract you are trading. Knowing this is essential to plan your trade and what to expect as fat as profit potential as well as risk.

For example, in this table it can be seen that one spot gold CFD is worth $100

Example CFD trade

XYZ company is trading at $390 (bid) / $394 (ask

You buy 100 stock CFDs because your signal service tells you the price will go up.

The value of the trade is $39’400

XYZ has a margin requirement of 10%

So you deposit $3’940 (10% of 100 shares @ $394 (buy price)

Example of profitable CFD trade

The trade works! The price rises to $430 (bid) $434 (ask) within the next day.

You close your position at the sell price of $430.

The price went up $36 ($430 (sell price) - $394 (buy price)).

Gross profit = $36 x 100 = $3’600.

Minus the commission for buying and selling:

100 (CFDs bought) x $394 x 0.12% = $47.28

100 (CFDs sold) x $430 x 0.12% = $51.6

Net profit becomes $3’600 – ($47.28 + $51.6) = $3’501.12

Example of a losing CFD trade

Not this time! The stock CFD fell to $345 (bid) / $350 (ask)

The price dropped by $49 ($345 (sell price) - $394 (buy price)).

Gross loss is price difference x number of CFDs you acquired = $49 x 100 = $4’900.

Even on losing trades, a commission must be paid too.

100 (CFDs bought) x $394 x 0.12% = $47.28

100 (CFDs sold) x $345 x 0.12% = $41.4

The net profit becomes $4’900 + ($47.28 + $41.4) = - $4’988

Note the loss is larger than the funds invested. This is something traders can usually avoid with a properly planned out trade with good money management.

Common CFD FAQs

Do CFDs have Expiry Dates?

There are two types of CFD, one that is based on the spot price and one that is based on the futures price. Futures and options trading contracts have expiry dates, so by default all CFDs on futures and options will have an expiry. However it is possible to trade ‘spot’ versions of many of the more popular futures like WTI crude oil, Brent crude oil or copper. The spot versions do not expire, they are ‘rolled over’ just like spot forex but the CFDs based on the future price have an expiry date. This is listed on the platform and its worth checking before placing a trade.

Is CFD trading legal?

CFD trading is not illegal, it is a legitimate form of investing. However, the financial regulators in some countries do not recognize CFDs, making it impossible to trade with a regulated broker in those countries. For example CFD trading is not regulated in the United States by regulators like the SEC or CFTC but they are regulated north of the border in Canada. CFD trading is possible in most of the world but it is worth checking regulations in your region.

Is CFD trading safe?

Here it is important to separate two risks to your money when trading CFDs. One is the risk of losing money in financial markets and two is losing money if your CFD provider gets in trouble. By trading with a regulated broker like FlowBank, full regulated in Switzerland- you can negate the second risk. However, taking risks in the market is necessary to earn profits and part of the trading process, whether it be in CFDs or any other investment. The leverage involved does create additional risk and traders should get comfortable trading CFDs with margin trading on a demo account before going live.

Do day traders use CFDs?

Yes, CFDs are a favourite instrument for day trading. Day trading is often associated with individual stocks, but the true definition is buying and selling within the same day on any market. Some countries put financial restrictions on who qualifies as being able to buy and sell stocks in the same day. No such restriction exists for CFDs, which are well suited to short term day trading.

CFD Trading app / Best CFD trading platform

The most effective way to understand the way CFDs function is by spending time on a demo trading account in a risk-free environment before trading live.

If you haven’t already done so, make sure to register for a FlowBank trading account.

CFDs are leveraged products. CFD trading may not be suitable for everyone and can result in losses that exceed your deposits, so please consider our Risk Disclosure Notice and ensure that you fully understand the risks involved.