In forex trading, every trader aims at maximizing their profits and mitigating their losses. A highly effective tool that can be strategically used to limit these losses, especially for beginner traders, is the stop loss order. This crucial trading mechanism plays a significant role in Contract for Difference (CFD) trading, which is characterized by its high risk and high reward nature. The stop loss order can effectively protect traders from severe market downswings.

However, like all trading tools, appropriate knowledge and understanding of its application, benefits, drawbacks, and its interaction with market variables such as volatility are fundamental. One critical part of this learning curve includes understanding the concept of Rejection Candles, a popular price action method used in technical analysis. These candles can provide valuable insights into market sentiment and potentially forecast a price reversal. In the volatile environment of CFD trading, navigating these variables and understanding the role of leverage adds an extra layer of complexity. Yet, when effectively managed and understood, it can significantly optimize your trading strategy, offering the potential for higher returns.

Hence, with the right knowledge and strategic application, stop loss orders and price action tactics like Rejection Candles can be powerful tools in any trader's arsenal, allowing for the maximization of gains in CFD trading.

Contents: Price Action CFD Trading Strategy: Rejection Candles

- What is a stop loss?

- Stop loss forex example

- How a stop order works

- Is stop loss a good idea?

- How to set a stop loss in forex trading

- Applying stop loss in CFD trading

- Stop loss calculator

- Role of leverage in CFD trading

- What is a guaranteed stop?

- Why a stop loss is important in Forex

- Effect of market volatility on stop loss

- Pros and cons of using stop loss in trading

What is a stop loss?

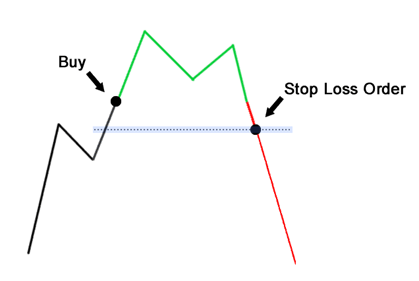

A stop loss is an order type used in forex trading designed to limit losses from a trade. It is also known as a ‘stop order’ or ‘stop-market order’.

The order will trigger a trade to be closed at a loss. Specifically, it is an order from the trader to their trading company or broker to execute a trade when the market price is at a specific price level, which is a less favourable price than the trader’s entry price.

No forex trader desires a loss but since some losing trades are inevitable in trading, it is better to keep the losses small and reduce risk exposure.

Stop loss forex example

We will offer two examples, one for a trade that is long the forex market and one for a trade that is short the forex market.

Stop loss on a long forex position

Market order is placed to BUY 5 lots of EUR/USD at 1.1750

Stop loss order is placed to SELL 5 lots of EUR/USD at 1.1730

The stop price is 1.1730 and the stop loss is worth 20 pips.

On a trade of 5 lots (500,000) - each pip is worth $50 - so the stop loss is worth 20pips x $50 = $1000

Stop loss on short forex position

Market order is placed to SELL 1 lot of USD/JPY at 109.70

Stop loss order is placed to BUY 1 lot of USD/JPY at 110

The stop price is at 110 and the stop loss is 30-pips wide.

On one lot of USD/JPY, each pip is worth $9 so the stop loss is worth $270

How a stop order works

It’s important to understand that a stop loss order is an order type known as a ‘stop order’. The way a stop or executes is different other order types like a limit order, which is used in a take profit order. Where as limit orders execute at the limit-price or better, a stop order executes at the next best available market price after the stop order is triggered.

For example: You buy GBP/USD at 1.3110 and set a stop loss at 1.3100. If there is nobody willing to accept your sell trade at 1.3100 - perhaps because the market is gapping after an economic news release - then your stop will not be triggered at 1.3100. It will be triggered at the end of the price cap at the next market price.

Is stop loss a good idea?

The best forex traders will decide before buying a currency pair, where they will sell it in case the trade becomes a loss. Equally, they know where they would buy it back at a loss if they went short a forex pair.

Using a stop loss is just an automated way of making sure you exit the trade as you planned. The same argument can be made for ‘take profit’ limit orders, which make sure you exit a winning trade as planned.

The major benefit of a stop loss is knowing that you have an order sitting, ready and waiting to cut your losses, without you needing to monitor the price movement all day long. This is especially helpful for part-time traders, which most new traders tend to start as.

How to set a stop loss in forex trading

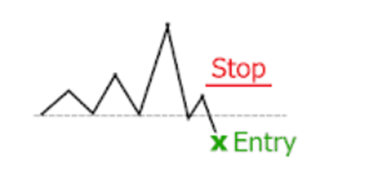

How to place a stop loss order when trading is one of the most common questions asked by a novice trader. The size of your stop loss comes down to risk management and position sizing. Here is a step-by-step guide to finding the best stop loss strategy for any trading system.

- Determine what price would mean your trade idea is wrong - Set the stop loss order (SL) here

- Determine what price level the market could move to if you are right - set the take profit order (TP) here

- Choose an entry price that makes sure the reward of hitting the TP level is worth the risk of hitting the SL. Trading books often cite a 2:1 risk to reward ratio.

- The number of pips you are risking is the difference between your entry and stop loss

- Choose a trade size that means you are risking 2% or less of your account on the trade. If you can afford to risk $500 and your stop loss is 50 pips, you can place a trade for 5 lots.

It is quite possible to use a very simple stop loss system like using a 10 pip stop loss for every trade. However, this makes the trade less able to adjust trading parameters according to volatility.

Applying Stop Loss in CFD Trading

Implementing a stop loss is a crucial risk management strategy in CFD trading. A stop loss is an order set to close a trading position if the price reaches a predetermined level, minimizing potential losses. Here's how to apply it:

- Determine the stop loss level: This can be based on a trader's risk tolerance, the asset's volatility, or a technical analysis level.

- Set the stop loss order: Once the level has been determined, the order can be set on the trading platform.

- Monitor and adjust: Depending on market conditions and the performance of the trade, stop loss levels might need to be adjusted.

Stop loss calculator

It’s not typically necessary to use a stop loss calculator to calculate the stop-loss price or stop-loss value because modern online trading platform will have it integrated. However when researching and first getting familiar with using a stop loss, a stop loss calculator like this example on babypips.com can be very handy.

Role of Leverage in CFD Trading

One of the key features of Contract for Difference (CFD) trading is the use of leverage. Leverage allows traders to open positions significantly larger than their initial investment, potentially magnifying profits. However, this also means that losses can be amplified.

When you trade CFDs, you're essentially borrowing to increase the size of your position. This gives you the opportunity to potentially increase your returns. However, it's important to remember that leverage works both ways — while it can magnify profits, it can also magnify losses, sometimes even exceeding your initial investment. Therefore, it's crucial to manage risk when trading CFDs with leverage.

What is a guaranteed stop?

A guaranteed stop loss is a type of stop loss order where a trader will arrange with their broker, often for a fee, to guarantee the stop loss will be triggered at the pre-agreed price. Using a guaranteed stop loss to some degree mitigates the risk that the stop order will be triggered at an undesirable price in volatile market conditions.

Why a stop loss is important in forex

A common argument against stop losses is that it means you a prematurely taken out of a trade. New traders will recite an experience of seeing a price drop 2 pips past their stop loss and reversing back to whether they would have taken profits. Clearly this is a frustrating experience - but there are three better answers to not using a stop loss.

A) It might be where you are placing the stop loss is the issue, rather than using the stop loss.

B) Narrowly missing out is easily worth avoiding the inevitable experience of a much bigger loss when eventually the price does not quickly reverse from near your stop-price.

C) You can close out your position using stop orders in parts using an average method stop loss- meaning some of your position could remain open to take advantage in case the trend quickly changes.

To kickstart your journey, explore our comprehensive guide on Introduction to Forex Trading. This resource will furnish you with essential insights, strategies, and the necessary groundwork to begin your forex trading endeavors.

Effect of Market Volatility on Stop Loss

Market volatility refers to the rate at which the price of an asset increases or decreases for a set of returns. Volatility is measured by calculating the standard deviation of the annualized returns over a given period of time. It shows the range to which the price of a security may increase or decrease.

In times of high market volatility, stop loss orders may not be executed at the predetermined level, resulting in slippage. Slippage is when the price at which your order is executed does not match the price at which it was set. This could lead to larger than expected losses. Therefore, it's important to use a strategy that accounts for volatility when setting stop loss levels.

Pros and Cons of Using Stop Loss in Trading

- Pros:

Stop loss orders can protect against significant losses by automatically closing out a position once it reaches a predetermined level. They can also help to manage risk and take the emotion out of trading decisions.

- Cons:

Stop loss orders may not always be executed at the predetermined level, particularly in volatile markets. This could result in larger than expected losses. Additionally, stop loss orders could be triggered by short-term price fluctuations, potentially resulting in premature exits.