1105 days ago • Posted by Jasper Lawler

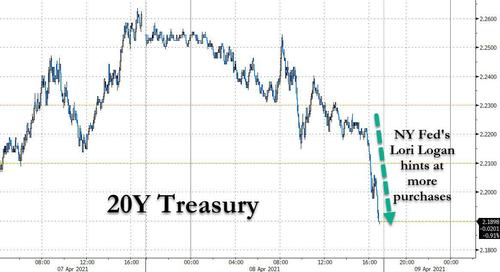

20Y Treasury yields plunge after NY Fed VP hints at extra purchases

In a speech discussing the role of Primary Dealers in "The New Normal", Logan said that the Treasury’s introduction of the 20-year Treasury bond in May of last year had "increased amounts outstanding around the 20-year maturity point." She also said that since "the pace of increase in TIPS issuance has been slower relative to nominal coupon securities" and with "net issuance expected to remain high in the near term, we anticipate that the composition of outstanding supply will continue to evolve."

But it was the punchline from Logan that led to the buying stampede:

"as a result, we plan to make minor technical adjustments to our purchase sectors and increase the frequency at which we update purchase allocations to remain roughly proportional to the outstanding supply of nominal coupon securities and TIPS. We expect to announce these as a part of a normal purchase calendar release in coming months."

Source: Zerohedge / Bloomberg