1230 days ago • Posted by Charles-Henry Monchau

A $1.1 Trillion Boost: Why JP Morgan sees global stocks rising as much as 25% next year

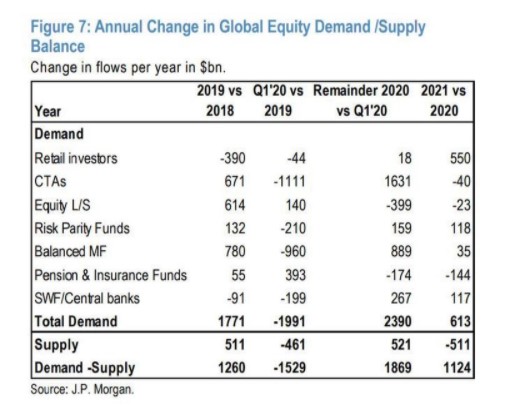

in the latest note from JPMorgan's Nick Panigirtzoglou the bulls got yet another "justification" to keep buying stocks at all time highs. The reason: according to the JP Morgan quant analyst, 2021 will see a net improvement in stock demand/supply to the tune of $1.1 trillion, which of course should - in theory - lead to higher prices. According to his goalseeked analysis, Panigirtzoglou writes that "for 2021 we see an overall improvement in equity demand of around $600bn relative to this year." This projected improvement will be driven by incremental demand from retail investors as well as Sovereign Wealth Funds and Risk Parity funds. At the same time, JPMorgan also expects that "global net equity supply will return next year to the very low levels of 2016-2018, i.e. a decline of $500bn relative to this year, as share buyback/LBO activities normalize and the need for equity raising subsides." - source: www.zerohedge.com