1078 days ago • Posted by Jasper Lawler

Bank of England tapers QE (but size of program unchanged..)

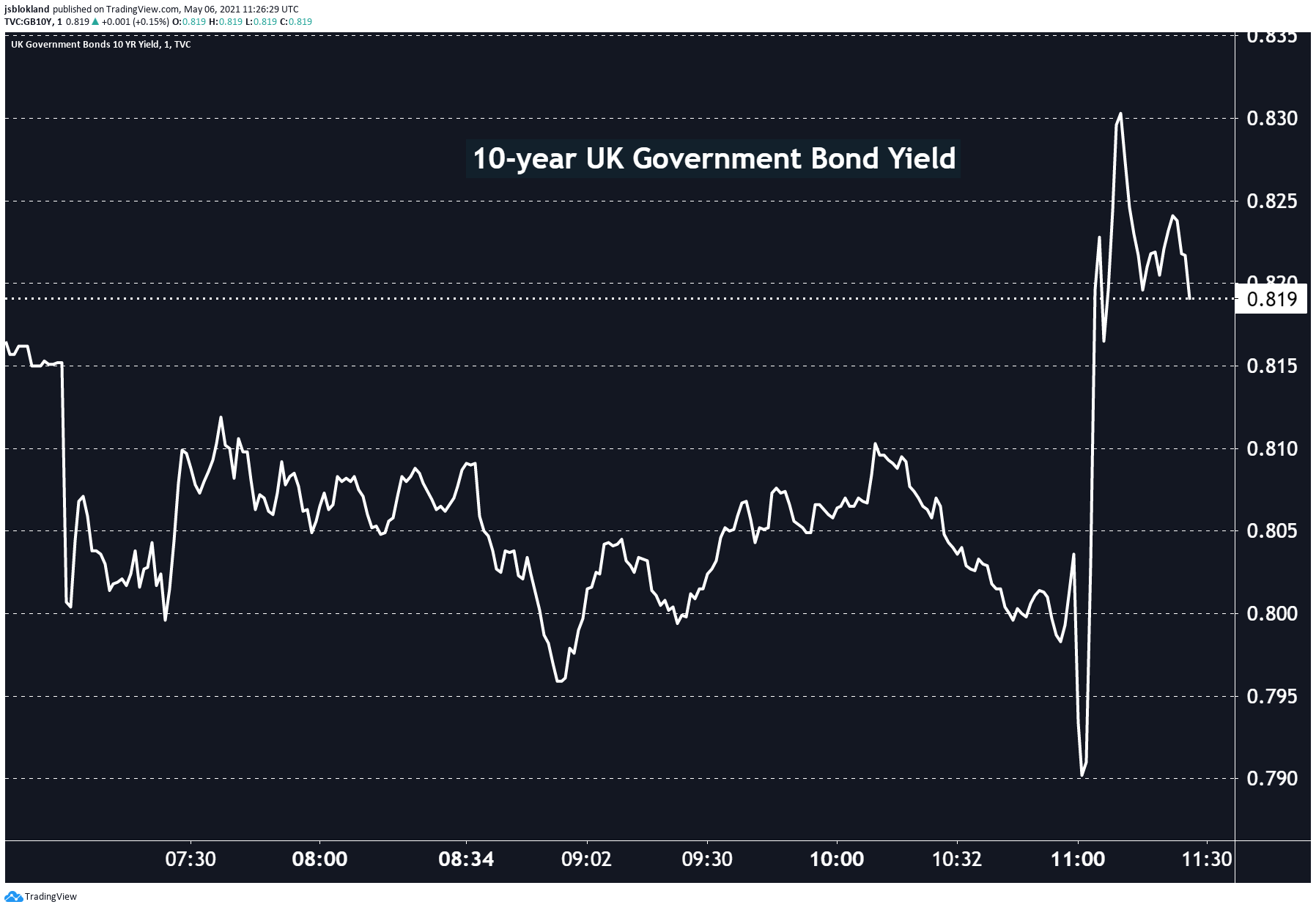

UK gilt yields jumped in response to the surprisingly hawkish policy change from the BOE.

First it was the Bank of Canada, now Bank of England has also joined the taper bandwagon, announcingthat it would cut its weekly bond buying (i.e. QE) from GBP4.44BN per week to 3.441BN, while keeping its overall rate and quantiative easing policy unchanged, in a 8-1 split vote with chief economist Andy Haldane voting to cut the BOE's Gilt purchases by GBP50BN to GBP825BN (however, since this is his last month at the BOE, his view is being discounted by the market).

The bank also drastically upgraded its GDP outlook and now sees 2021 growth at 7.25% and 5.75% in 2022, while predicting that the economy will return to pre-Covid levels over the course of this year, and that inflation will accelerate above target before easing to 2%.

Source: ZeroHedge

Chart source: @jsblokland