1108 days ago • Posted by Charles-Henry Monchau

Bitcoin futures yields are higher than all major currencies. JP Morgan believed that a Bitcoin ETF in the US would change its course.

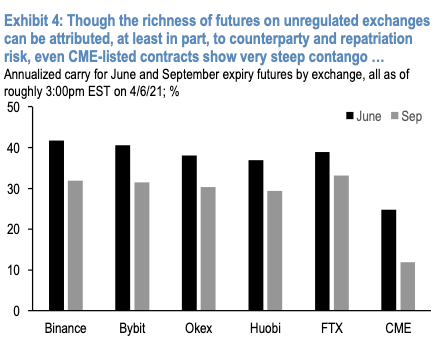

The chart below shows the annual carry for the June CME Bitcoin contract which currently offers around 25% annualized slide relative to spot. Looking at unregulated exchanges (e.g Binance), the carry can be as high as 40+%. This is substantially higher than all major currencies across developed and emerging markets.

Why such a carry? According to JPM, this can be explained by speculation, pricing error but first and foremost because it’s difficult for institutional investors to get access to Bitcoin on regulated markets. CME and the Grayscale Bitcoin Trust, a closed-end trust that manages close to $40 billion, are all investors really have.

So, what could bring the Bitcoin futures premium down? To JP Morgan, the listing of a Bitcoin ETF tracking spot exchange rates in the U.S would likely be a major catalyst. “It would also presumably be easier for prime brokers to take those securities as collateral,” said the JPM analysts.

For the time being, the US SEC has thrown out all applications for Bitcoin ETFs. You can thus enjoy the carry...

Source: decrypt, www.zerohedge.com, JPM