1148 days ago • Posted by Jasper Lawler

DB's Jim Reid looks at credit spreads, raises alarm on real yields

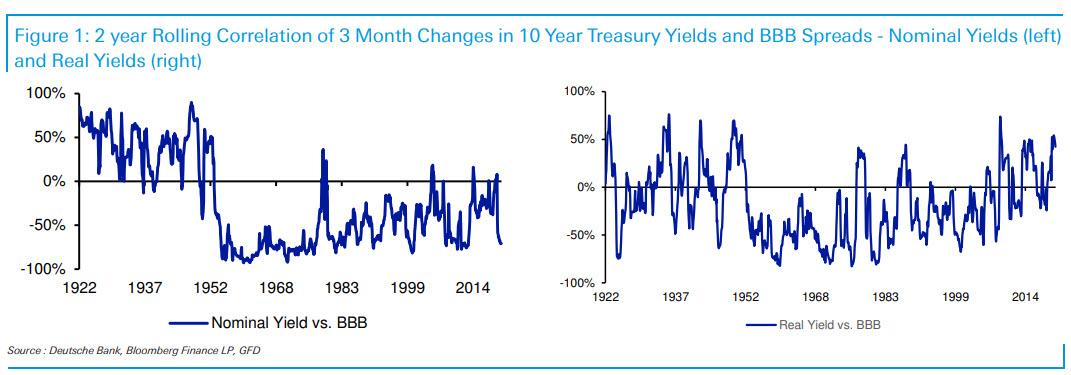

The spread of Real 10-year Treasury yields vs. BBB rated credit is inching up

Jim Reid notes:

"with such a heavily indebted financial system, real yields probably matter more than nominal ones. If nominal yields rise but inflation rises more (i.e. lower real yields), this would no doubt cause some volatility but it should help those with high debts (e.g. corporates) assuming the economy wasn't suffering."

"if real yields rise notably from here, then all risk assets will likely suffer given the debt load the financial system has. So the correlation between real yields and credit will likely be strong going forward."