1250 days ago • Posted by Charles-Henry Monchau

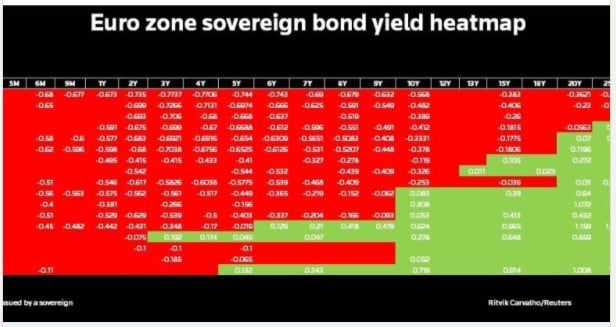

Europe’s pile of negative-yielding government bonds is at its highest ever and looks set to grow

Refinitiv data shows entire yield curves in Germany, the Netherlands and Finland once again below zero, meaning investors must pay those governments to hold their debt. What was seen in 2014 as a temporary side effect of unorthodox monetary policy, now seems firmly entrenched, given a growing belief that central bank stimulus will be in place long after a vaccine against the coronavirus is rolled out - source: cyprus-mail.com, Refinitiv