1128 days ago • Posted by Jasper Lawler

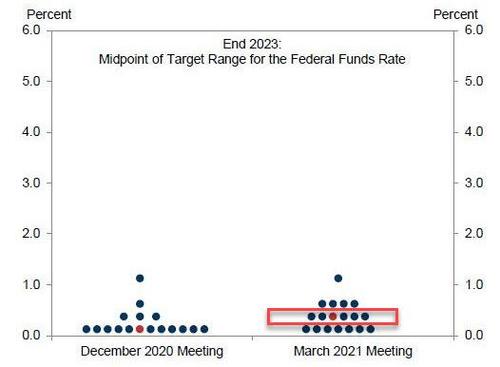

Fate of the market rests with the Fed's dots!

What happens to the 2023 dot plot could determine near term market moves.

The market is increasingly pricing in a 2023 rate lift-off from the current zero-bound. The Fed could confirm this today in their dot plot but to do so would weaken their dovish forward guidance, which has been the main policy tool since the drop to ZIRP.

If +25bp is signalled for 2023, that could see yields jump and stocks sink, while a continuation of the last forecasts could prompt a relief rally in equities.

chart source: Nomura / Zerohedge