1081 days ago • Posted by Jasper Lawler

Goldman still believes in FAAMG stocks - Here's why...

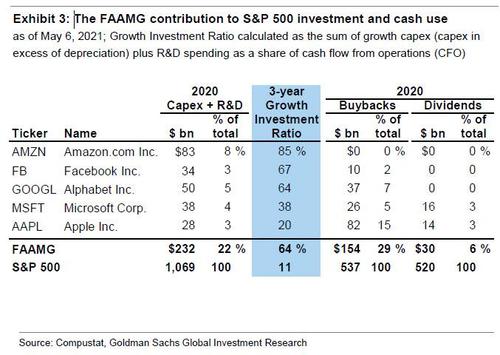

According to Goldman it's not the topline growth that is the most distinguishing aspect of the FAAMG business models, but the amount and share of operating cash flow they devote to driving growth. During 2020, the five FAAMG stocks, spent $128 billion in R&D and another $104 billion on capex, accounting for 22% of the S&P 500 total. FAAMG posted a growth investment ratio of 64% over the last three years vs. 11% for the typical stock. As Goldman puts it, "they are investing their way to superior growth."

Source: Goldman Sachs / Zero Hedge