680 days ago • Posted by Paul de La Baume

Green signals for #stocks #Inditex #Vix #economy #trading #S&P500 #technicals #Nasdaq #inflation

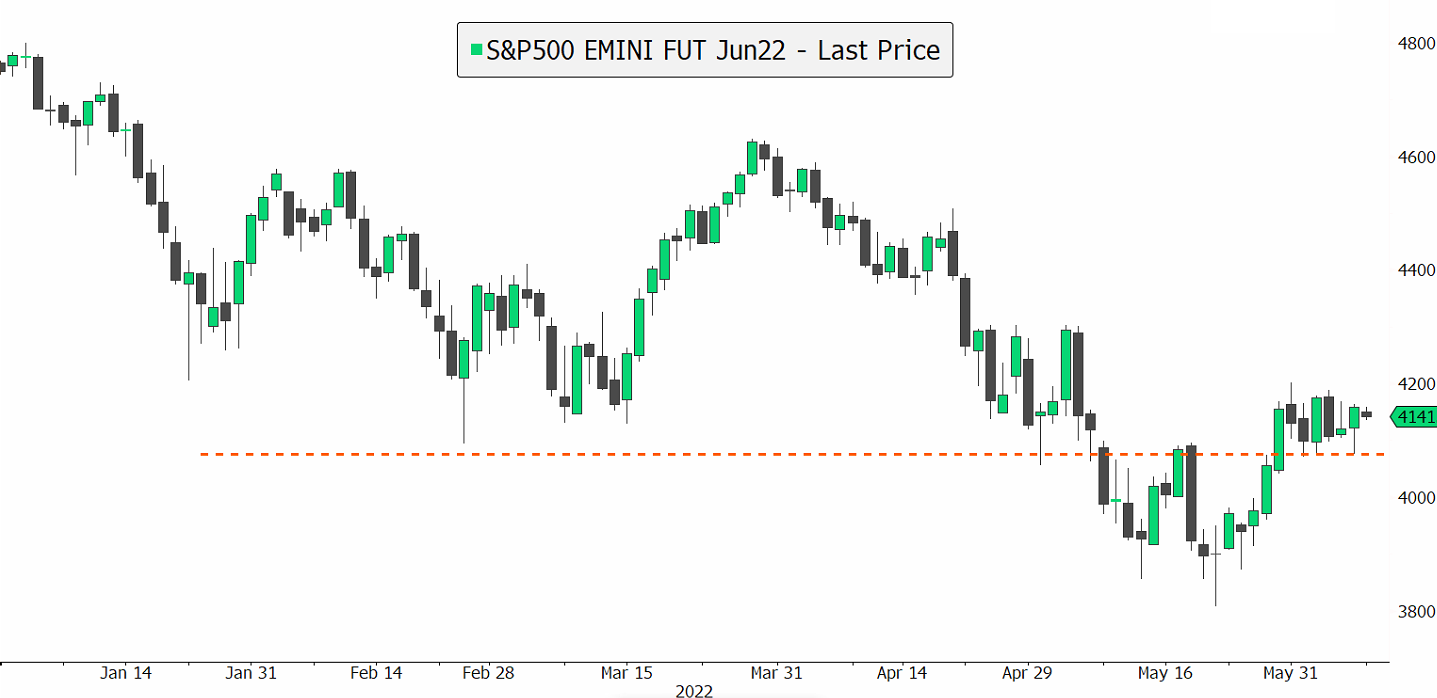

It is difficult not to be affected by the negative headline news calling for severe deterioration in markets or the economy. However, investors continue to buy dips in the markets, and volatility (VIX) has come down to 24.4, from a May 9 high of 35, but still significantly up from where it entered the year at 16.6. Near-term risks continue to be inflation data, with a key US CPI report on Friday. But just how bad is the economy? Well, earnings from Zara's owner Inditex may surprise some. Net profit surged 80% as sales surpassed pre-pandemic levels, up 36% from a year ago. Encouraging signs from China lifting restrictions could also boost sentiment and reassure investors about global growth perspectives. But inflation needs to come down, as higher yields simply pressure valuation multiples, and the yield on the US 10-year still seats at 3%, from entering the year at just 1.6%. On a technical picture, the short-term trend remains positive for the S&P500, as long as it is able to hold above its support level at 4'076. A break above 4'189 to target 4'220 would be encouraging.