1183 days ago • Posted by William Ramstein

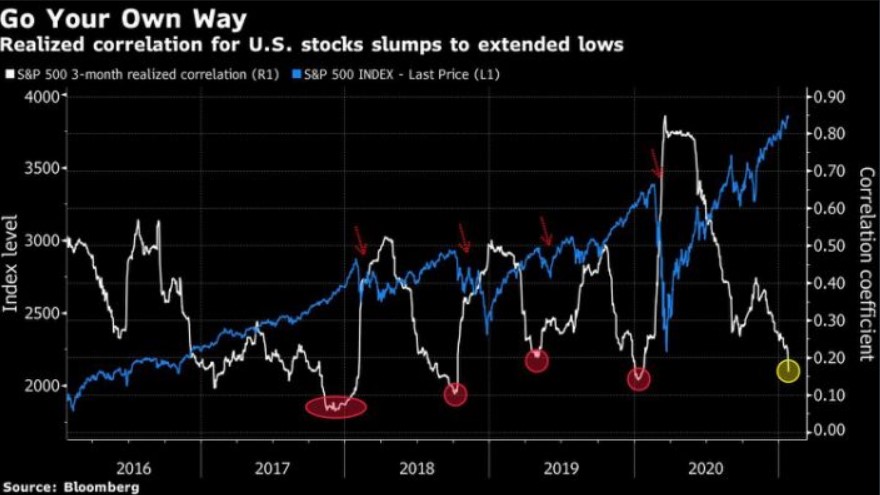

Low equity correlations in US stocks offer chance to beat index

The S&P 500 Index’s 3-month realized correlation -- a gauge of how closely its top stocks move relative to one another -- fell to 0.16. This is its lowest correlation in a year, and an extreme level relative to history. A maximum possible correlation of 1.0 would signify all the shares are moving in perfect unison. Low correlations are good if one is looking to beat indexes through stock picking because if most equities are moving in the same direction, it becomes more difficult to choose one that stands out from the crowd. Source: Bloomberg