1093 days ago • Posted by Charles-Henry Monchau

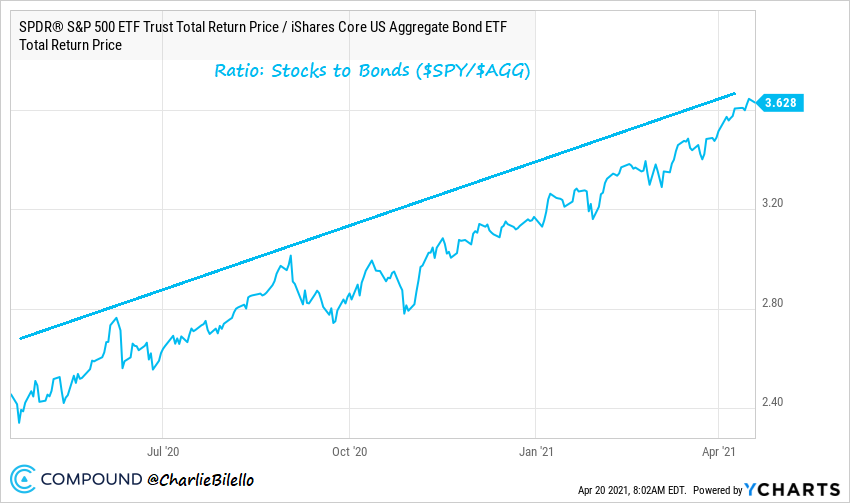

Ratio of stocks to bonds continues to hit new highs. Will the trend persist?

3 major aggregate are rising: DEMAND, INFLATION and EARNINGS – this explains the relative strength of equities vs. bonds. Can this trend persist? POSITIVES (for equities)- While there are still countries in lock-down and some delays in vaccine, the end game is vaccine to be rolled-out effectively at a global scale. In the US, 40% of adults have already received a first shot. The re-opening thesis should have legs; - The upcoming transition from recovery to expansion implies that we remain in the favorable part of the business and market cycles; - Market breadth remains (% of stocks participating to the upside) remains exceptionally strong; - Consumer balance sheet are in great shape. NEGATIVES / RISKS - Sentiment looks too optimistic + some signs of speculation (bad from a contrarian perspective); - Valuations; - US Fiscal cliff in 2022; - Lack of organic drivers of growth to carry the expansion beyond its pent-up demand-fed, stimulus-backed, liquidity-driven surge; - Equity returns tend to disappoint when PMI peaks and Q2 could very well be the PEAK in terms of RATE of growth. >WHAT's YOUR VIEW? Chart source: Charlie Bilello