1141 days ago • Posted by William Ramstein

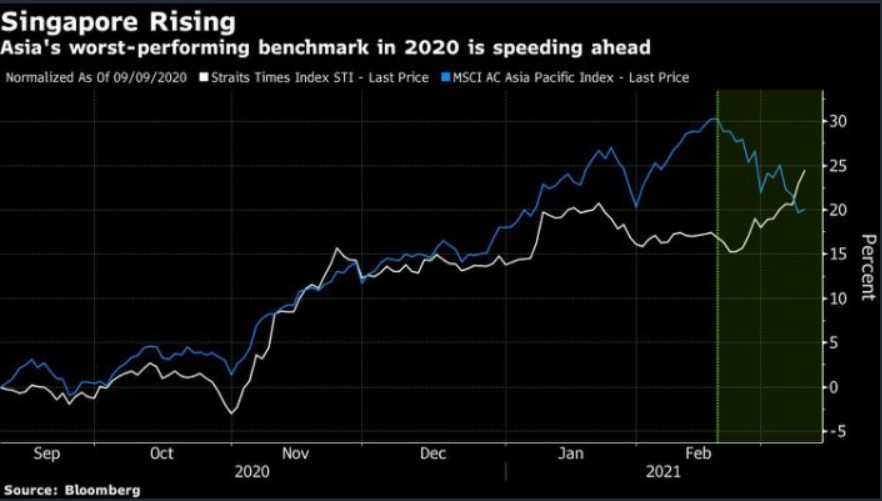

Singapore makes a comeback while MSCI Asia index falters

After becoming the region’s worst performer in 2020 following a 12% slump, the Straits Times Index has surged 9.1% to trounce all other major Asian benchmarks so far this year. Singapore’s market revival echoes the global trend of value investing as investors bet on an economic rebound. The island nation’s market is dominated by old economy shares. The Straits Times Index rose 1% on Tuesday to the highest in more than a year. The gauge is trading at 14.7 times 12-month forward earnings, behind most of its regional peers and the MSCI Asia Pacific Index’s 16.6 multiple, according to Bloomberg-compiled data. The Singapore gauge’s dividend yield is estimated at 3.8% for the next 12 months, higher than the regional benchmark’s 2.3%. Source: Bloomberg