953 days ago • Posted by William Ramstein

Small caps for the long-run against a backdrop of paltry US market returns

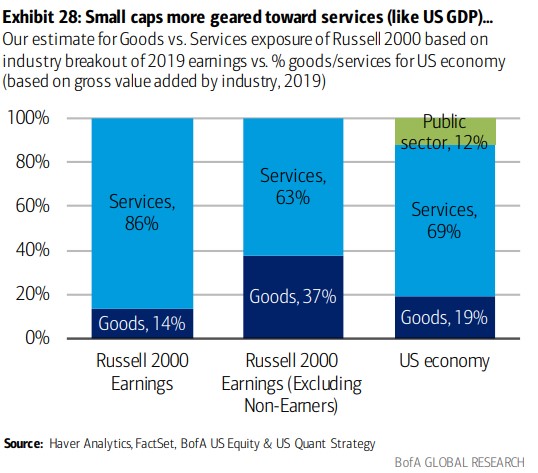

For long-term investors, could see more attractive return opportunities down the size spectrum. Small caps continue to trade at a steep historical discount to large caps on the majority of valuation measures tracked and are less stretched vs. their own history than large caps despite the US recovery so far. The historical relationship between forward P/E and returns suggests outperformance of small over large caps for the next decade, with potential for mid-single-digit annualized returns for the Russell 2000 – higher than de minimis annualized returns our valuation framework forecasts for large caps. @BoA