895 days ago

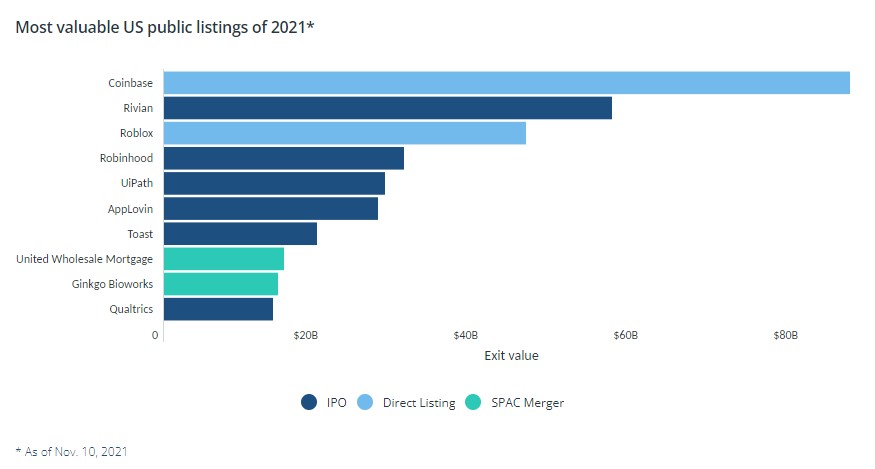

The value of all companies going #public on #US exchanges has passed a record $1 trillion this year across 981 deals, after #Rivian's upsized #IPO added nearly $56 billion in #exit value.

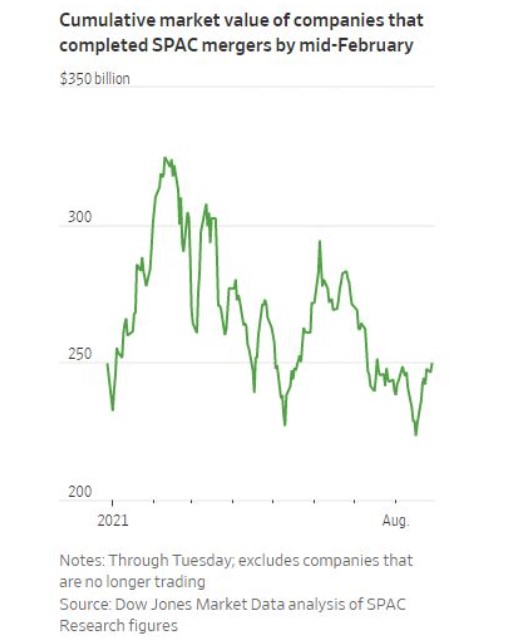

Nearly 17% of the year's total #exit value, or #$166.9 billion, has come from companies that merged with #SPACs. #VC-backed #startups comprised more than half of the total exit value at $618 billion. The value of all companies going public on US exchanges has passed a record $1 trillion this year across 981 deals, after Rivian's upsized IPO added nearly $56 billion in exit value. Those with private equity backing accounted for 28% of the total. A company's exit value is its valuation on the day it goes public, not counting the new funds raised or dilutive shares.