1269 days ago • Posted by Charles-Henry Monchau

U.S earnings season has been stronger than ever but share-price reactions to earnings haven't been as strong as beat rates

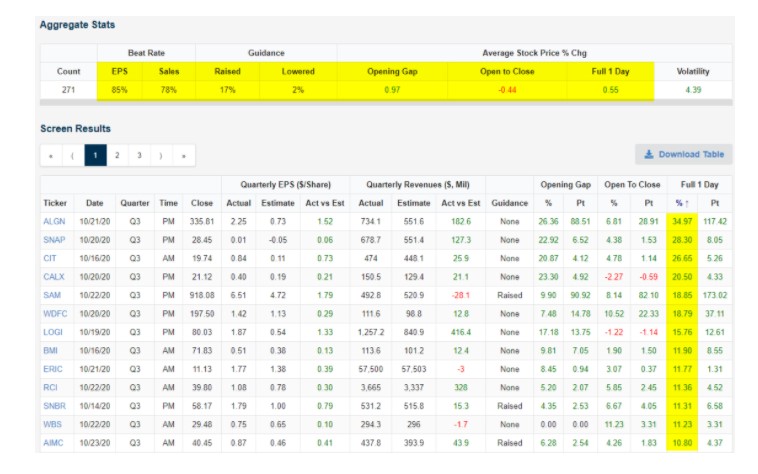

"The results so far this U.S earnings season have been stronger than ever. Through last Friday, 85% of the 271 companies that had reported Q3 results beat consensus bottom-line expectations. That's more than 25 percentage points above the average beat rate of ~60% seen over the last twenty years. The top-line beat rate for revenues has been almost as strong at 78%, while the percentage of companies raising guidance (17%) is higher than we've ever seen. Share-price reactions to earnings haven't been as strong as beat rates, but the numbers are still positive. So far this season, the average stock that has reported has gained 0.55% on its earnings reaction day (the first full day of trading after the earnings release). To get to that +0.55% full-day gain, the average stock has actually opened higher by 0.97% and then sold off by 0.44% from the open to the close of trading. So while we're seeing stocks gain in reaction to earnings, underneath the surface we've seen a stronger initial reaction to the news and then some intraday selling. Of the 271 stocks that have reported, 13 have gained more than 10% on their earnings reaction days. These 13 stocks are listed below. As a final note, when it comes to forward guidance, we're seeing the same extraordinary trend when it comes to what companies are saying about their future prospects". - source: Bespoke