1123 days ago • Posted by Charles-Henry Monchau

US Media and Chinese education stocks nose dived due to Archegos Capital Fund massive fire sale.

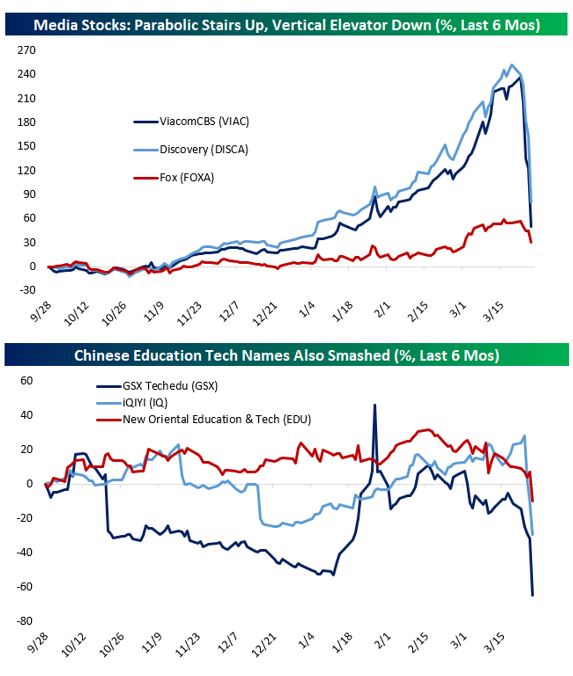

Legacy media stocks like ViacomCBS (VIAC) and Discovery (DISCA) went parabolic since November. Fox (FOXA) also benefited, though to a much smaller degree. VIAC and DISCA both tripled in just a few months as hopes of a robust economic recovery boosting ad revenue and, more importantly, the potential for streaming riches similar to Disney (DIS) and its Disney+ platform helped fuel gains. But over the last four days, most of those gains have been incinerated. The catalyst appears to have been a secondary offering from VIAC a few days ago. But there have also been rumors of a big, leveraged position by an unnamed fund having its portfolio seized and liquidated by its prime brokers. There have also been huge blocks of stock reported at dealers, with Goldman Sachs (GS) reportedly getting tapped to sell a block equivalent to more than 6% of VIAC's free float and a second block equivalent to more than 12% of DISCA's free float. Another similar collapse has been playing out in Chinese education technology stocks listed in the US as ADRs. We heard on Sunday that Archegos Capital was behind the massive $10.5 billion in block trades executed on Friday by Goldman Sachs Group. Chart source: Bespoke