1175 days ago • Posted by Charles-Henry Monchau

US Mint warns it can't meet "surging demand" for Silver & Gold. The last time it happened was in June 2010

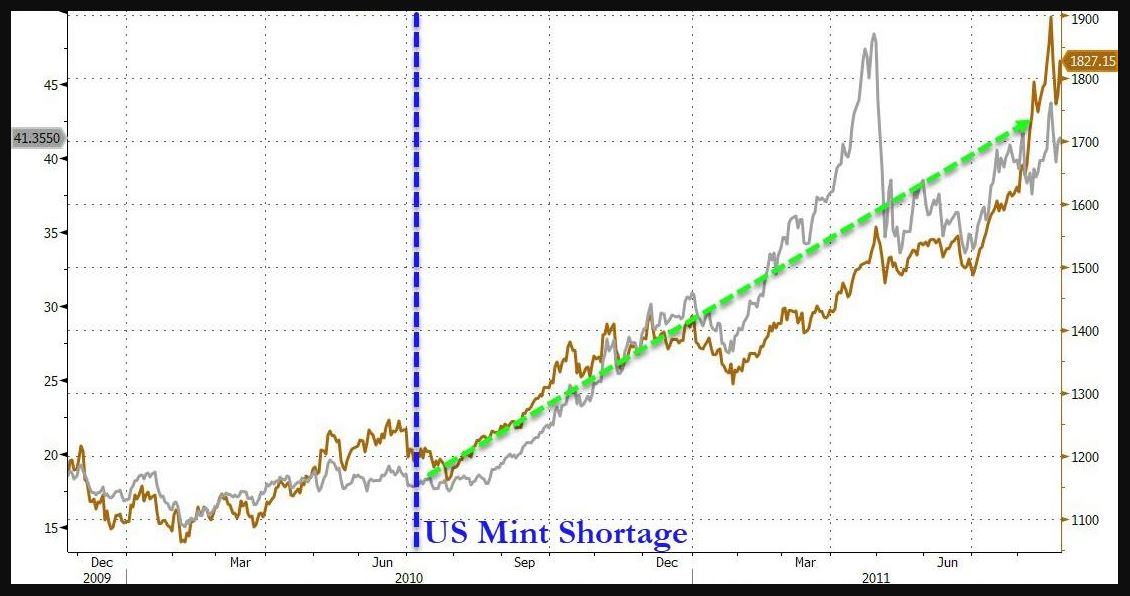

Sales of U.S. gold bullion coins rose 258% in 2020 while silver coin demand was up 28%, the U.S. Mint said Tuesday. This has led to bullion dealers running dry of stock and physical premium to paper silver prices soaring to record highs. And with Reddit-Raiders taking aim at Silver, demand for silver (and gold coins) has exploded...The US Mint is limiting distribution of its gold, silver and platinum coins to specific dealers because of heavy demand, and a limited number of suppliers of metals, it said in a statement. The United States Mint said on Tuesday it was unable to meet surging demand for its gold and silver bullion coins in 2020 and through January, due partly to pandemic-driven demand and plant capacity issues... Heavy buying has continued in 2021, it said, squeezing supplies, which had already been tight as the coronavirus affected production. The last time the US Mint 'admitted' its inability to meet demand was in June 2010. The reaction in precious metals is summarized on the chart below (Gold in brown and Silver in grey) - source: www.zerohedge.com