1146 days ago • Posted by Charles-Henry Monchau

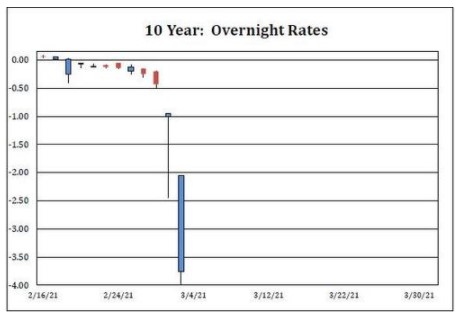

US Repo market insanity: Bearish bond bets send US 10-year rates to MINUS 4 per cent in REPO ahead of massive short squeeze

Some interest rates in the U.S. repurchase agreement (repo) market turned negative overnight as traders stepped up bets that U.S. Treasuries yields would rise as macro data point to an improving economy. In the repo market, banks and Wall Street firms raise cash from investors to fund loans and trades by pledging a security as collateral. When the repo rate turns negative, the lender pays the bank or Wall Street firm to own the security.

So what is happening? A significant amount of shorts rolled forward and now short-demand has overwhelmed the available supply. The issue traded as low as -4.00% today and already traded at -3.05% for tomorrow. Both of those rates are lower than Fail Charge, which is the equivalent of -3.00%. A rate of -3.00% is usually considered the equivalent of extremely hard to borrow. Even so, never before have we encountered a 10Y trading so special it was BELOW the fails charge. Trading below the Fail Charge implies a real deep short-base."

Source: www.zerohedge.com