1042 days ago • Posted by William Ramstein

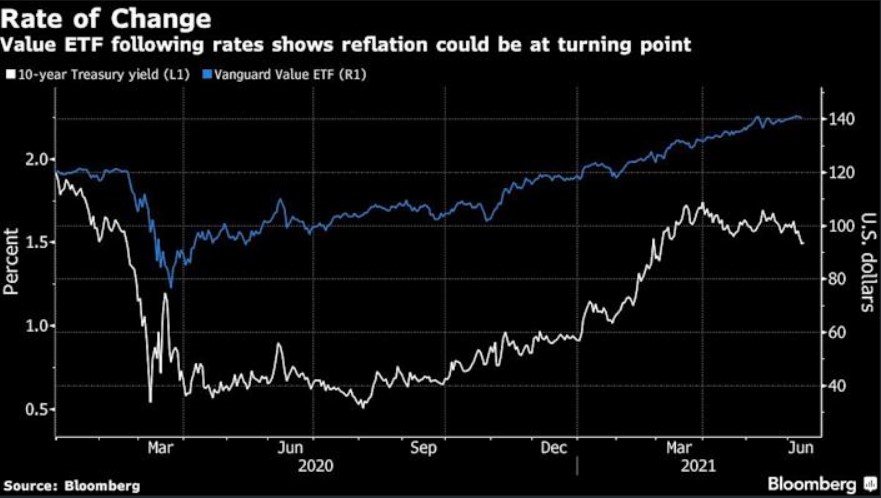

Value ETF following rates shows reflation could slowing down

In stocks, flows to ETFs tracking small and value stocks have slowed since their March peak. The $45 billion Financial Select Sector SPDR Fund (ticker XLF), whose assets tend to benefit from a rising rate regime, saw the biggest exit since April on Wednesday. Despite three days of solid inflows, the $70 billion iShares Russell 2000 ETF (IWM) is still showing outflows for June. “The reflation trade has held up so well since the 10-year peaked on March 31, and sectors like financials have clearly been telling a different story than bonds,” said Adam Phillips, managing director of portfolio strategy at EP Wealth Advisors. “Given this deviation, it wouldn’t surprise me to see the reflation trade take a bit of a breather here.”

Source: Yahoo/Bloomberg