1147 days ago • Posted by William Ramstein

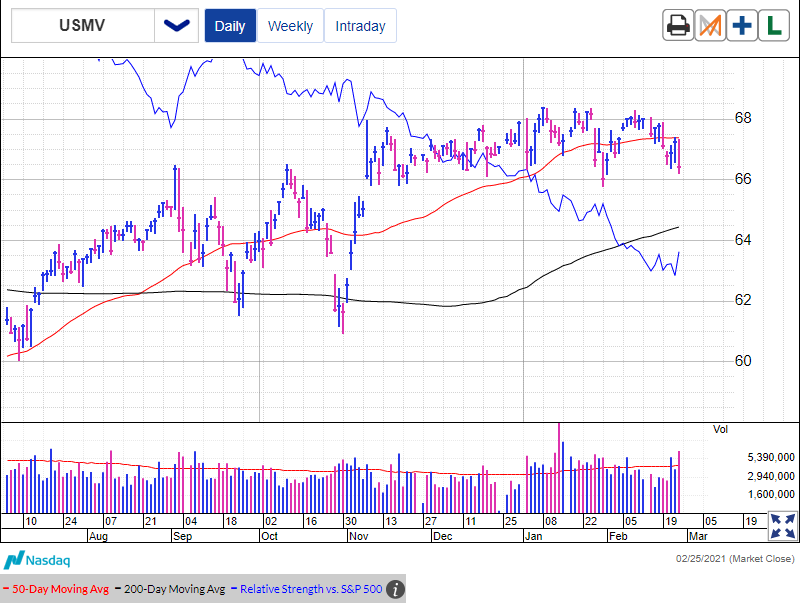

Low Vol ETF can protect from volatility:

Low volatility ETFs also modify holdings to try to tamp down drama. The largest low-volatility ETF, iShares MSCI USA Min Vol Factor with $29 billion in assets, spreads its portfolio across a wider range of industries than Invesco S&P Low Volatility, Rosenbluth says. It does this by holding the least volatile stocks in a sector, even if the sector itself is volatile. Microsoft (MSFT) is its top holding at 1.7%. Source: investors.com