Xavier Niel, Mathieu Pigasse and Moez-Alexandre Zouari, decided to raise 300m euros for a blank-cheque company and establish a vertically integrated player in the organic industry.

The project: 2MX ORGANIC

The trio wants to offer a differentiated consumer investment opportunity. The company has been incorporated as a SPAC and aims to operate one or more acquisition in the consumers good industry. The one thing they will keep in mind: sustainability.

Ultimately, the goal is to create a new European player to face the other continents. The plan is to raise around 300 million euros, and the SPAC will be listed on the Euronext exchange in Paris.

They want to create a vertically integrated giant, with investment in both retail and production. “We want to build a European champion in organic food,” said Zouari in an interview. “People want to consume differently nowadays, not only for their health and wellbeing but for that of the planet.”

Organic food market

The Food market in Europe is undoubtedly growing, but it remains fragmented. Their goal is to consolidate it and help everyone to work in the same direction, as well as capitalize on the momentum shared by both investors and consumers who are looking more and more for ESG (environmental, social and governance) investments.

“Consumers are looking for quality, sustainability and traceability. Many now pay particular attention to the means of production and sourcing of the goods they consume,” said the company in a statement.

From 2010 to 2019, the European organic yearly consumption per capita grew 120% to 81 euros. Europe has now over 16 million acres of organic farmland.

The company holds the firm belief that a vertical integration along with economies of scale will be the driver for more affordable organic products. This should make happy the 71% of French people using organic products once a week and even more happy the 14% that use them on a daily basis. This data is from 2019, so it is likely that the rate is even higher with COVID-19 now that people made an effort to consume more locally.

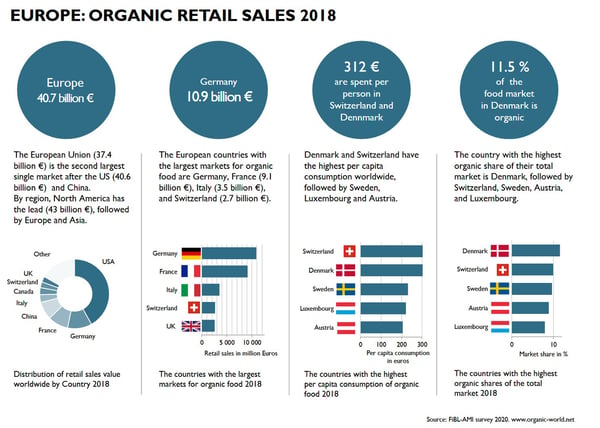

European Organic Retail Sales as of 2018 (Source: FiBL)

The financial details

The bookbuilding will be carried out by Deutsche Bank and Société Générale, with a target of 25m shares for 10 euros each, which should start trading around mid-December.

There will also be an extension clause in case of high demand, which would make the total number of shares go up to 30 million. The offer is available as of November 30th and will be until December 7th.

Investments will be reserved to qualified investors, with a minimum investment of 1 million euros

Its IPO should be one of the biggest of the year in Paris, and the three founders should hold a little less than 30% of the capital.

The company will have 24 months after reception of the funds to make an acquisition. If it doesn’t buy anything till then, assets will be returned to investors. However, the team told the press that their goal was to buy as soon as possible in 2021 and that they had already four or five targets in mind. All we know is that the first target they are aiming could be worth as much as 2 billion euros.

The Team

The team is composed of:

- Xavier Neal - a technology entrepreneur who owns 70% of Iliad group, parent company of Free. At age 25, he started WorldNet, which was France's first internet provider. He funded Station F, one of the biggest French start-up accelerators. He is also the one who bought Orange Switzerland and renamed it "Salt".

- Mathieu Pigasse - French investment banker, and the CEO of Lazard France as well as the global head for M&A. He's also co-owner of "Le Monde" (along with Neal) and "l'OBS" as well a couple other magazines and newspapers. He's also heavily involved in the music industry, being chairman of "les Eurockéennes de Belfort" and owner of "les Inrockuptibles".

- Moez-Alexandre Zouari - is the trio member with expertise in the food industry. He owns 44% of Picard Surgelés as well as a few hundred food stores.

Maybe by now, you understood 2MX Organic: 2 Ms for Mathieu and Moez, one X for Xavier, and Organic for the mission.

This is not the first time that Neal and Pigasse work together, as they had already raised 250 million euros in 2015 for a SPAC company focused on becoming one of the largest media content and entertainment platforms in Europe. As they say in French: "on ne change pas une équipe qui gagne" (One does not switch up a winning team).

Bringing a SPAC to Europe

Short for "Special-purpose-acquisition", a SPAC is a way to make a company public without going through over complicated valuations for a company with an activity. The SPAC just goes public with an accelerated process (after all, they only have cash and a mission) and they then acquire one or more company, making them instantly public. You are then raising money on the basis that managers will make an acquisition, and the money is returned if nothing happens.

The method is incredibly popular in the US and has quickly become one of the hottest trends. This year only, SPACs have raised $64 billion in the US vs. only $786 million in Europe.

Sources:

#253 Xavier Niel, in Forbes

Xavier Niel-backed Spac looks to build organic food ‘champion’, in the Financial Times

Capital-Investissement : X. Niel, M. Pigasse et M.A Zouari lèvent 250 à 300 ME pour lancer 2MX Organic, in Boursier

Eir boss backs plan for organic food ‘champion’, in the Irish Times

Durable et bio : le nouveau projet de Xavier Niel et Matthieu Pigasse dans la distribution, in Capital

Avec 2MX Organic, Xavier Niel fait le pari de la consommation durable, in Maddyness

Niel, Pigasse Seek as Much as $360 Million for Consumer SPAC, in Bloomberg

The World of Agriculture: Statistics and Emerging Trends 2020, by FiBL and IFOAM