Do you still believe in the long term growth of the companies you are invested in BUT want to save yourself from some potential short-term pain when the stocks drop?

Yes? How about hedging your portfolio?

First- What is an ETF?

An exchange-traded fund is an investment fund traded on stock exchanges, much like stocks. An ETF holds assets such as stocks, commodities, or bonds and generally operates with an arbitrage mechanism designed to keep it trading close to its net asset value, although deviations can occasionally occur - Wikipedia

Hedging Against Falling Shares

Again, if you want to try and avoid short term losses in your portfolio but still want to hang on for the potential long term gains, hedging is worth some consideration.

What is Hedging?

To buy (or sell) something that will offset the falling price of the shares you own.

NOTE: You only want to hedge when share prices are falling (or you think they might be about to). Once the shares are rising again, you do not want to hedge the profits!

Example of Hedging

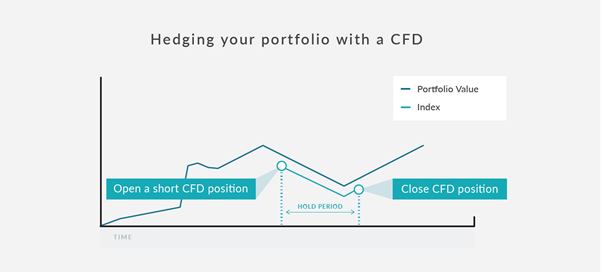

In the below example, you as an investor sees the value of your shares falling and think more losses could come.

STEP 1

To protect your portfolio you sell or ‘Go Short’ an index ETF or a collection of shares that best mimic your portfolio. As the value of your portfolio drops, the value of the ETF rises.

Sometime later-- you see the value of your portfolio start to rise.

STEP 2

You no longer want to hedge your portfolio, so you close the close the short position in the ETF(s) hopefully at a profit.

STEP 3

Wait for your portfolio to recover or reinstate the hedge if the portfolio starts to fall again.

The same concept can be achieved using a CFD (contract for difference)

Pros and Cons

Remember that timing the market is difficult and so when to enter and exit your hedge will never be perfect. If the hedge is entered and exited too late, the hedge position is more likely to incur a loss. Some investors use options contract to hedge, which if unused involve losing the cost of the premium. Keep in mind, the main point of the hedge is to protect your portfolio from exposure to bigger market declines.

Read our next article: How to invest into distance learning stocks