For investors interested in dividend stocks that promise a reliable income every year, the so-called 'Dividend Aristocrats' are the cream of the crop.

What is a Dividend Aristocrat?

A Dividend Aristocrat is a stock in the S&P 500 that has paid increased dividends each year for at least 25 years. Due to these reliable and growing dividend pay-outs, Dividend Aristocrats are some of the most interesting dividend stocks to own for an investor.

As of December 2020, the S&P 500 numbered 66 dividend aristocrats, which you can see on the table below:

| Company | Ticker symbol | Sector |

|---|---|---|

| 3M | MMM | Industrials |

| A.O. Smith | AOS | Industrials |

| Abbott Laboratories | ABT | Health Care |

| AbbVie | ABBV | Health Care |

| AFLAC | AFL | Financials |

| Air Products & Chemicals | APD | Materials |

| Albemarle Corporation | ALB | Materials |

| Amcor | AMCR | Materials |

| Archer-Daniels-Midland Co | ADM | Consumer Staples |

| AT&T Inc | T | Communications |

| Atmos Energy Corp | ATO | Utilities |

| Automatic Data Processing | ADP | Information Technology |

| Becton Dickinson & Co | BDX | Health Care |

| Brown–Forman B | BF.B | Consumer Staples |

| Cardinal Health Inc | CAH | Health Care |

| Caterpillar Inc | CAT | Industrials |

| Chevron Corp | CVX | Energy |

| Chubb Limited | CB | Financials |

| Church & Dwight | CHD | Consumer Staples |

| Cincinnati Financial Corp | CINF | Financials |

| Cintas Corp | CTAS | Industrials |

| Clorox | CLX | Consumer Staples |

| Coca-Cola Co | KO | Consumer Staples |

| Colgate-Palmolive | CL | Consumer Staples |

| Consolidated Edison Inc | ED | Utilities |

| Dover Corp | DOV | Industrials |

| Ecolab Inc | ECL | Materials |

| Emerson Electric | EMR | Industrials |

| Essex Property Trust | ESS | Real Estate |

| Expeditors International of Washington | EXPD | Industrials |

| Exxon Mobil Corp | XOM | Energy |

| Federal Realty Investment Trust | FRT | Real Estate |

| Franklin Resources Inc | BEN | Financials |

| General Dynamics | GD | Industrials |

| Genuine Parts Company | GPC | Consumer Discretionary |

| Hormel Foods Corp | HRL | Consumer Staples |

| Illinois Tool Works | ITW | Industrials |

| IBM | IBM | Information Technology |

| Johnson & Johnson | JNJ | Health Care |

| Kimberly-Clark | KMB | Consumer Staples |

| Leggett & Platt | LEG | Consumer Discretionary |

| Linde plc | LIN | Materials |

| Lowe's | LOW | Consumer Discretionary |

| McCormick & Company | MKC | Consumer Staples |

| McDonald's Corp | MCD | Consumer Discretionary |

| Medtronic plc | MDT | Health Care |

| Nucor Corp | NUE | Materials |

| Pentair | PNR | Industrials |

| People's United Financial | PBCT | Financials |

| PepsiCo | PEP | Consumer Staples |

| PPG Industries | PPG | Materials |

| Procter & Gamble | PG | Consumer Staples |

| Realty Income | O | Real Estate |

| Roper Technologies | ROP | Industrials |

| S&P Global Inc | SPGI | Financials |

| Sherwin-Williams | SHW | Materials |

| Stanley Black & Decker | SWK | Industrials |

| Sysco Corp | SYY | Consumer Staples |

| T Rowe Price Group Inc | TROW | Financials |

| Target Corp | TGT | Consumer Discretionary |

| United Technologies Corp | UTX | Industrials |

| VF Corporation | VFC | Consumer Discretionary |

| W. W. Grainger | GWW | Industrials |

| Walgreens Boots Alliance | WBA | Consumer Staples |

| Walmart Inc. | WMT | Consumer Staples |

| West Pharmaceutical Services Inc | WST | Health Care |

How are Dividend Aristocrats selected?

Respecting all the criteria makes the "Dividend Aristocrat" list a difficult club to get into. However, markets have shown that once a company makes it into the club, it is quite rare that it will be kicked out.

The criteria are as follows:

- To be a member of the S&P 500

- A per-share dividend increasing every year for at least 25 consecutive years

- A minimum market float-adjusted market capitalization of at least $3 billion

- An average of at least $5 million in daily share trading value for the three months prior

Some might wonder about the last two criteria regarding market cap and trading volume. After all, are dividends not all we are looking for in this list? This is to make sure that companies are large enough and that they can satisfy the needs of millions of potential investors. Indeed, it would be no use to add a company to the list if it does not have enough shares to sell. In addition, these strict requirements make sure that the company is solidly established and that it will stay in the list in the long term. If this was not the case, there would be too much a risk that the company may not be able to sustain this type of dividend pay-out and/or that the company gets acquired by a bigger firm.

Moreover, the S&P Dow Jones makes adjustments so that the index never falls under 40 stocks. If this happens, the index gives itself the right to reduce the threshold of consecutive dividend payments to 20 years to reach the 40 stocks target. If when applying this rule, more than one stock qualifies for the 40th position, the one with the highest dividend yield will prevail. Finally, every sector is limited to 30% of the index, in order that an industry may not dominate the index. If this comes to happen, adjustments will be made following the previously explained rules.

Do Dividend Aristocrats make a good investment?

As always, the answer remains the same: it depends what you are looking for. For investors looking to invest in dividend stocks, they offer almost everything one can dream of: a company not only paying a dividend, but also in a reliable way, with a 25 year track record of success. This calls for a greatly managed company with a certain competitive advantage and solid market position. Unsurprisingly, these company are often industry leaders with strong and reliable cashflows, generating more than decent annual returns.

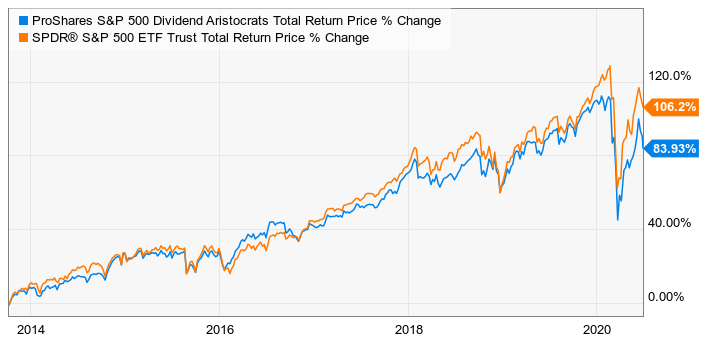

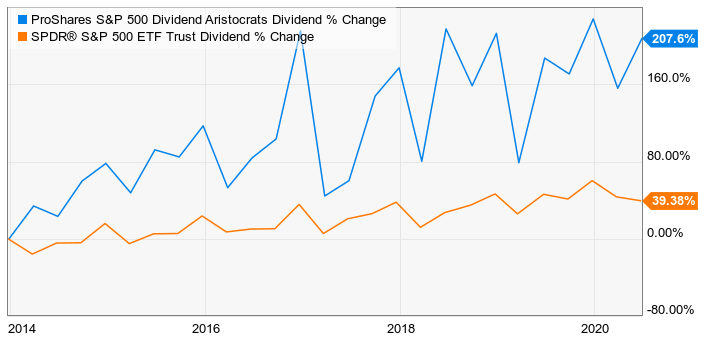

Although Dividend Aristocrats underperformed the S&P in terms of total returns, their dividend yields are usually much higher:

ProShares S&P 500 Dividend Aristocrats vs. S&P 500 Return Price % Change (Source: The Motley Fool, Ycharts)

ProShares S&P 500 Dividend Aristocrats vs. S&P 500 Dividend % Change (Source: The Motley Fool, Ycharts)

Between 2014 and 2020, the dividends of Dividend Aristocrats increased five times faster than that of the S&P 500. If you are looking for growth, those well-established companies will not be of much help to you, but if you are chasing dividends, they're definitely the way to go.

5 interesting Dividend Aristocrats to consider in your asset portfolio this year

The Motley Fool recommends these three health stocks, both for their established business models and solid financials:

- Johnson & Johnson (NYSE: JNJ): The massive healthcare giant is not just a simple Dividend Aristocrat. In fact, it deserves the name of Dividend King. The company delivered an increased dividend for 58 consecutive years, a dividend which currently yields 2.5%. For this reason, Johnson & Johnson has remained one of the favorites of dividend investors. Their business model is as stable as it is diversified, being active in consumer health, medical devices, and pharmaceutical industries.

- Abbott Labs (SWX: ABT): The company increased its dividend in December 2020 by 25%, and it is the 49th year in a row that they increase it. Unlike other dividend aristocrats, Abbott Labs can also show off an impressive growth with stocks surging 26% last year. They market no less than 8 Covid-19 tests, the sales of which totaled $881 million in the last reported quarter. Their dividend yield is 1.6%

- AbbVie (NYSE:ABBV): it used to be part of Abbott Labs, before spinning off on its own in 2013. Their dividend is far more appealing at 4.8%. Of course, their dividend track mirrors that of its parent company. Analysts expects the company to deliver an average annual earnings growth of 11%, an estimate which would be even higher if they did not face so much competition for the sale of their top selling product Humira, which will begin in 2023. However, the company has two autoimmune disease drugs ready to grow sales if Humira fails to do so. The combined sales of these drugs should reach $15 billion by 2024.

Following these popular health stocks, US Money News put the following two stocks in their top 9. One is one of the most solid American conglomerate, while the second is the example of a company that everybody knows well, but did you know it was a Dividend Aristocrat too?

- 3M Company (NYSE:MMM): With 62 consecutive years, they are among the champions of dividend aristocrats. 3M is the classic slow and steady dividend giver. The chemical company has been around since 1902, with a wide diversification in safety, electronics, transportation, and healthcare. This great diversification combined with large scale operations that have been in place for more than a century make for a very solid dividend stock. Their current dividend yield is 3.54%.

- Coca-Cola Corporation (NYSE:KO): Is there really a more established brand than the soft drinks giant Coca-Cola? This is a massive beverage conglomerate worth over $200 billion and sold in almost every country in the world. Although some consumers are turning away from the once most popular drink because of sugar, the company has many more cards in its hand, such as Smartwater, Minute Maid juices, Powerade and many other alternatives. Strong sales are insured for the years to come and the company has increased its dividend for 58 consecutive years. Current dividend yield is of 3.3%

Finally, if you have a hard time picking your favorite Dividend Aristocrat stock, the Motley Fool also suggests the option of buying the ProShares S&P 500 Dividend Aristocrats ETF, a low-cost fund which tracks the entire list of Dividend Aristocrats.

Not only does it capture the interesting returns of the basket, but it is also much less volatile than if you were to buy singular stocks. However, lower volatility does not mean an immunity to loss, but studying previous years, these companies held solid for decades, so they should show more resilience in the future.

Sources:

Dividend Aristocrats, in the Motley Fool

9 Dividend Aristocrats to Buy Now, in US News Money

3 Dividend Aristocrats to Buy Right Now, in the Motley Fool