A well-defined Forex trading money management system is crucial to becoming a successful trader. It's not just about having a good forex trading strategy, but also understanding the intricate aspects of the trading world. Topics such as Understanding Forex Trading Psychology delve into the mental and emotional resilience needed to navigate the volatile Forex market. The effective management of Leverage and Margin in Forex Trading is a critical skill that can significantly increase your profits while reducing risks. The Role of a Forex Broker is also pivotal in money management, as their guidance can help you make informed investment decisions. Selecting the Best Forex Strategy for effective money management can be a game changer, and using the right Forex Trading Tools can provide valuable insights to manage your funds effectively. Lastly, the importance of Emotional Control and Patience in Forex money management cannot be understated, as they are essential traits for all successful traders.

Content Table:

- What is Forex money management?

- How do I stop losing money in forex?

- Understanding Forex Trading Psychology

- Top Forex money management rules to follow

- 1. Defining risk per trade using position sizing

- 2. Set a maximum account drawdown across all trades

- 3. Assign a risk: reward ratio to every trade

- 4. Use a stop loss and take profit order to plan trade exit

- 5. Only trade with funds you can afford to lose

- Effectively Managing Leverage and Margin in Forex Trading

- Can I trade forex with $100?

- The Role of a Forex Broker in Money Management

- How to Choose the Best Forex Strategy for Effective Money Management

- Forex Trading Tools for Better Money Management

- Emotional Control and Patience in Forex Money Management

What is Forex money management?

Forex money management is a set of processes that a forex trader will use to manage the money in their forex trading account.

The underlying principle of forex money management is to PRESERVE TRADING CAPITAL. That doesn’t mean never having losing trades in forex because that is impossible. Forex money management aims to minimise trading losses so that they are ‘manageable’. That means when a trade turns to a loss, it does not prevent the trader from winning other trades.

The idea of money management is closely linked to risk management because when trading, all the risks portend to your money. However, the definitions are slightly different. Risk management is about preparing for and managing all identifiable risks - that can include things as arbitrary as having a backup computer or internet connection. Whereas money management for forex traders relates entirely on how to use your money to grow your account balance without putting it at undue risk.

How do I stop losing money in forex?

This is the question that forex money management will help to answer. Since we are all human and tend to have similar traits (good and bad) there are common mistakes to avoid in forex trading. Successful traders tend to think of trading as a business. The aim of your forex trading business is to make money, not lose it so steps should be taken to avoid losing it.

Can you lose all your money in forex? Yes, you can lose all your money in any investment where your funds are put at risk. So it is your job as an investor to minimize the chance that happens.

There are ways to fine-tune a trading strategy to win more and lose less, but that is not normally the main reason people lose money in forex. The main reason tends to be having no specific money management rules to follow. So we will go through those rules now.

Understanding Forex Trading Psychology

Forex trading, like any other form of investment, involves a high degree of psychological preparation. Traders must have the ability to manage their emotions, be disciplined, and maintain a clear mind. Understanding Forex trading psychology is essential for successful trading and effective money management.

Key aspects of Forex trading psychology include:

- Emotional stability: Traders must learn to manage their emotions to avoid making impulsive decisions based on fear or greed.

- Discipline: Successful traders stick to a well-planned strategy, even in the face of short-term losses. They don't allow temporary setbacks to derail their long-term plans.

- Patience: Forex trading often involves waiting for the right opportunities to come along. Traders must be patient and avoid rushing into trades.

Top Forex money management rules to follow

If you get these five money management rules right, your odds of forex trading success will improve greatly. These rules can be tailored to your own trading system but some version of these five forex money management rules should be written down and read before every single trade is placed.

1. Defining risk per trade using position sizing

The idea is that a trader should risk only a small percentage of their account on any one trade. Trading mentors often preach the ‘2% rule’ where a trader should risk 2% of their account on every trade.

For example, with a 100,000 CHF trading account, the trader would risk 2,000 CHF per trade.

Some traders will vary the size of each trade, depending on recent trading performance. For example, the anti-martingale money management method halves the size of the trade each time there is a trading loss and doubles it every time there is a gain.

A top trading strategy and sound risk management plan should help a trader make money over time, but you can never be sure what will happen in the next trade or even the next 10 trades. To mitigate the risk of the next trade being a loss, the forex trader should keep the trade size relatively small compared to the size of the trading account.

Then taking this same principal and extending it, the trader should also protect themselves against several losing trades in a row by making the amount risked so small that even ten losing trades in a row will be something they can quickly recover from.

2. Set a maximum account drawdown across all trades

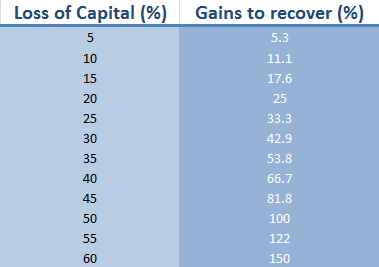

What is a drawdown in forex? A drawdown is the difference in account value from the highest the account has been over a certain period and the account value after some losing trades. For example, if a trader has 10,000 CHF in their account, and then loses 500 CHF, that is a 5% drawdown. (500 is 5% of 10,000). The larger the drawdown, the harder it is to recover the account balance with winning trades.

Source: trade-leader.com

Traders will set a max drawdown level that is acceptable according to their trading strategy backtesting. For example, if a trader tests their strategy over 50 trades and only ever experienced a 6% drawdown, then the trader might set 6 or 7% as the max drawdown. If when trading a live account, all the open trades put the account down by over 7%, the trader would have a money management rule to close some or all the trades to put the account back into good order.

3. Assign a risk: reward ratio to every trade

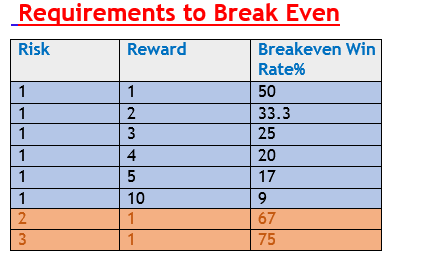

Is 2:1 risk reward the best? The rule of thumb taught in trading textbooks is that a trader should aim to have winning trades that are on average twice as big as the losing trades. With this risk-reward ratio, the trader needs to win only a third of their trades to breakeven.

In actual fact, the most important thing is to be consistent in the risk: reward ratios chosen. If a trader chooses a risk: reward ratio of 1:1, then the trader must win a higher number of trades (at least 6 out 10) trades to be profitable. If the trader chooses a risk: reward ratio of 3:1, then they need to win fewer trades (1 in every 4 trades) to break even.

Source: freeforexcoach.com

How to be a consistent forex trader… To achieve long-term profitable forex trading, a trader must have some idea of what to expect from his or her trading strategy. Two important and complementary components of that are the win: loss ratio and risk: reward ratio.

4. Use a stop loss and take profit order to plan trade exit

Using a stop loss locks in the maximum amount a trader can lose in any one trade, while using a take profit order locks in the maximum amount the trader can win. Using these forex order types the trader can make sure that he/she is not unexpectedly in a position that loses more money than planned.

source: Pennystocks.com

Of course there are some disadvantages to using stop losses, the most frustrating of which is seeing a stop loss triggered, only for the trade turn around and hit the take profit level. But as annoying as that experience might be, it is worth keeping a stop loss to avoid those occasions when the price does not turn around quickly and leaves the account with an unmanageable loss.

5. Only trade with funds you can afford to lose

Last but not least; successful trading is only possible when the trader can make unemotional decisions about what do with a trading opportunity. If the trader ‘needs’ the trade to win because the money is required for other purposes, the trader is liable to make bad decisions and increase the odds of losing money. “Hope for the best and plan for the worse” by trading with funds that would not hurt your lifestyle if you lost them.

Effectively Managing Leverage and Margin in Forex Trading

Leverage and margin are critical concepts in Forex trading. Leverage allows traders to control large positions with a small amount of capital, while margin is the deposit required to open and maintain a leveraged position. Proper management of leverage and margin is essential for successful Forex trading.

Key considerations for managing leverage and margin include:

- Understanding the risks: While leverage can amplify profits, it can also magnify losses. Traders need to be aware of the potential risks before using leverage.

- Keeping leverage at a manageable level: It's crucial to use leverage sensibly and maintain a level that suits your risk tolerance and trading style.

- Monitoring margin levels: Traders must keep a close eye on their margin levels to avoid a margin call, which could result in the closing of positions.

Can I trade forex with $100?

Let’s finish this forex trading presentation by answering this common question from newbie traders, particularly younger investors who have a small amount of money but would like to get started trading forex anyway.

Yes, it is possible to trade with $100 but it will be harder and a solid money management approach becomes even more important. In this instance, the trader should use ‘micro lots’ where each trade is worth around $1000 and each pip is worth around $0.10. Then the trader must have a maximum stop loss of 20 pips, worth $2 to keep to the 2% rule for positioning sizing. If you have more money to trade, it provides you with more room to manoeuvre in your trades and adds flexibility to your money management rules that increase the odds of being a profitable trader.

Finally, you can explore our comprehensive guide and unlock the secrets of the forex market for a successful trading experience. Learn more about Your Guide to the Forex Market today.

The Role of a Forex Broker in Money Management

A Forex broker plays a crucial role in money management. They provide trading platforms, offer leverage, provide market information, and may also offer tools for money management. It is important to select a broker who offers reliable services and competitive pricing.

Key roles of a Forex broker in money management include:

- Providing trading platforms: A good broker provides a reliable trading platform with accurate price feeds, fast execution, and minimal slippage.

- Offering leverage: Brokers offer leverage to traders, allowing them to control large positions with a small amount of capital.

- Supplying market information: Brokers may provide market analysis, news updates, and economic calendars to help traders make informed decisions.

How to Choose the Best Forex Strategy for Effective Money Management

Choosing the right strategy for managing your money in forex trading is imperative. Financial discipline is a key principle in money management, and having a strategy in place helps maintain this discipline. Strategies may vary depending on a trader's risk tolerance, financial goals, and trading style. Some traders may prefer strategies that involve higher risk but potentially higher returns, while others may prefer safer, more conservative strategies.

Choosing the right strategy also involves understanding and managing the risks involved in forex trading. This includes being prepared for potential losses and knowing when to cut losses to protect your trading capital. Moreover, it's crucial to ensure that the potential profit outweighs the risks involved in each trade.

Here are some steps to choose the best forex strategy for effective money management:

- Understand your financial goals: This includes both short-term and long-term goals. Are you looking to make a quick profit, or are you investing for the long haul? Understanding your goals will help you choose a strategy that aligns with them.

- Assess your risk tolerance: How much risk are you willing to take in your trades? Your risk tolerance will dictate the type of strategies that are best suited for you.

- Research and learn about different strategies: There are numerous forex strategies available, each with its own advantages and disadvantages. Take the time to learn about different strategies and understand how they work.

- Test your chosen strategy: Once you've chosen a strategy, test it out with a demo account before using it in live trading. This will help you understand how the strategy performs under different market conditions.

Forex Trading Tools for Better Money Management

In addition to a solid strategy, traders also use a variety of tools to better manage their money in forex trading. These tools can help traders make more informed decisions on when to enter or exit a trade, manage risks, and optimize profits.

Here are some essential forex trading tools for better money management:

- Trading platforms: These provide traders with access to the forex market and offer various tools for trading, such as real-time charts, technical analysis tools, and news feeds.

- Forex calculators: These tools help traders calculate various aspects of their trades, such as their profit or loss, margin requirements, and pip value.

- Risk management tools: These include tools such as stop-loss orders, which automatically close a trade at a predetermined level to limit losses, and take-profit orders, which close a trade once it reaches a certain profit level.

Emotional Control and Patience in Forex Money Management

Emotions can greatly affect a trader's performance in the forex market. Trading based on emotions, such as fear or greed, can lead to poor decisions and potential losses. Therefore, it's crucial for traders to maintain emotional control and patience in forex money management.

Emotional control involves not letting emotions dictate trading decisions. Instead, decisions should be based on careful analysis and strategies. Patience, on the other hand, involves waiting for the right opportunities to enter or exit a trade, rather than acting impulsively.

Developing emotional control and patience can take time and practice. It involves consistent risk management, self-awareness, and discipline.