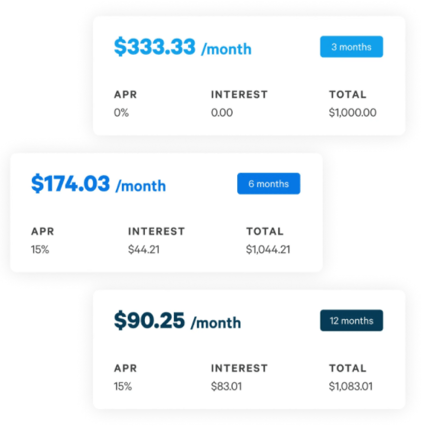

FinTech IPOs are becoming the norm with e-commerce and online payments booming from Covid-led consumer online demand. Affirm specializes in "buy now pay later" solutions. Its system enables consumers to get items today, but pay over time. APRs start at 0% for short 3 month terms and grow to incrementally higher rates with longer repayment terms.

Affirm IPO overview

Affirm is an online lending company founded in 2012 in San Francisco. They offer consumers the ability to pay for items in incremental payments. Instead of deploying $2,000 for the latest computer or Peloton bike, one can chose to pay in monthly increments like in the schedule shown below. Affirm has enabled companies of all types to capture a broader consumer demand essentially through optimized consumer price discrimination. What seemed like an impossible purchase has now become a quick buy for more people.

Before filing for its IPO, Affirm raised $1.7 billion for a post money valuation of $2.9 billion. The cash was raised in seven rounds and involved 22 investors including Ribbit Capital, the famous FinTech VC headed by Micky Malka backing firms like Coinbase, and Brex. The lead underwriters of this IPO are Morgan Stanley, GS, and Allen & Company. The opening price is planned around $33.00-38.00 with an IPO size of approximately $1 billion. If the IPO proves to be a success, the company's market cap will exceed $8.6 billion. The IPO is set to be launched tomorrow January 12th, 2021, but you can apply to trade Affirm before the day's end today.

We've been noticing a lot of M&A activity in companies that are about to IPO, and Affirm is one example of this. On Christmas eve, Affirm decided to treat itself to a little gift; PayBright. This Canadian firm provides installment payment plans for e-commerce and in-store purchases. This present cost Affirm $340M in cash and equity. The goal of this deal was to expand the diverse merchant network across North America, and in our opinion, to bolster balance sheet and increase pricing potential on their opening day later this morning.

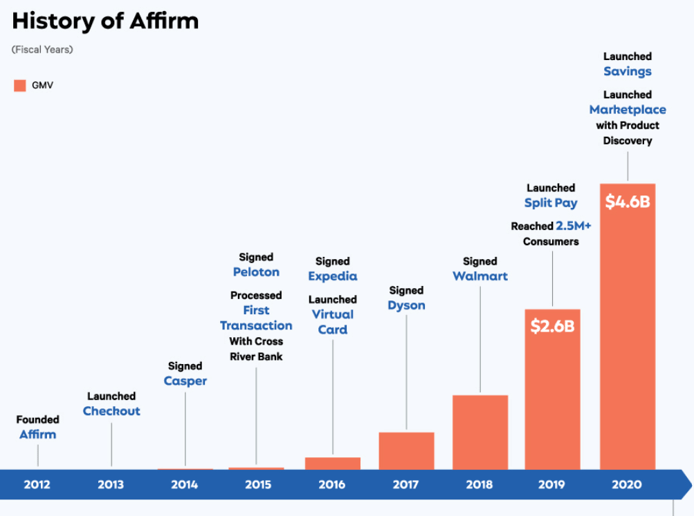

Here is a timeline of Affirm's milestones. Recent milestone include a new partnership with Shopify and a securitization deal.

*GMV = gross merchandise volume

Affirm's business operations and finances

IPO Outlook

In 2019, global online sales increased by 20% to $3.40 trillion and this rise is expected to keep going to upwards of $5 trillion by 2023. In the first six months of 2020, the e-commerce sales share in the US increased from 11.80% to 16.10% and according to Wordpay's Global payments 2020 report, the "buy now pay later" model is the fastest growing global payment method. In a couple of years the installments could account for 3% of online payments, and in EMEA it is already at 6% with expectations to rise above 10% in 2023. Online users are younger folks. Almost 70% of Millennials and Gen Zs prefer to shop online (learn more about Gen Z spending in our Megatrends article) and this implies that online sales will be growing alongside the purchasing power of this next generation.

Technology and ecosystem

Affirm's technology is a modern cloud infrastructure connected to a data management server which serves as an engine to their machine learning and economic models. Those models orchestrate their trading platform to maximize consumer trend behaviors, API integrations, and gain insight into the online payment space. With this technology, Affirm has been able to exploit the economic benefits of price discrimination (price discriminations means that you capture the entire consumer surplus because you charge different consumers different optimal prices, prices that are defined by unique consumer budget lines).

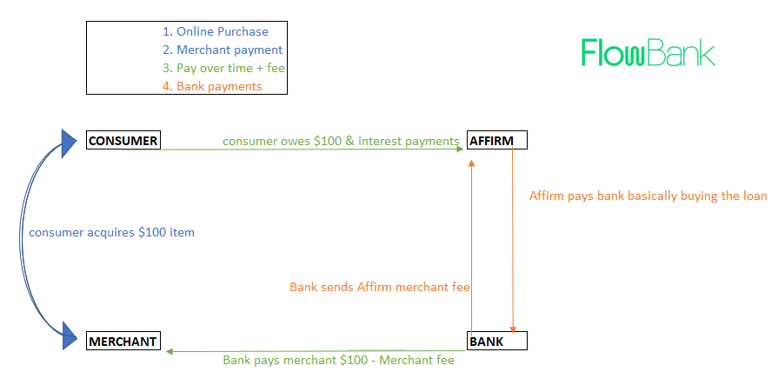

You are probably wondering how the money machine works? A consumer purchases a product on Peloton's website, Peloton offers the consumer the option to pay through Affirm's system, she choses to buy now and pay later (which is a loan that they will pay back over time). At this point, the consumer gets her item and her wallet becomes interest income to Affirm. At the same time, Cross River Bank pays the merchant the price of the item minus the Affirm merchant fee (see revenue segments below to see that this is where Affirm capitalizes). Later on, Affirm goes knocking on Cross River Bank's door, buys the unsecured consumer loan (thus paying back the bank for having paid the merchant) and receives its fee.

Affirm revenues

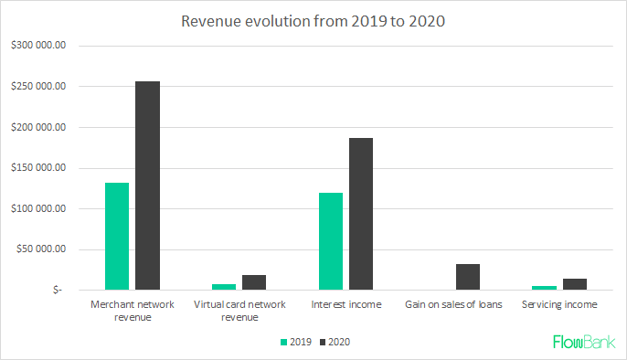

Let's look at the revenues from fiscal year ended in June of 2020, alongside percentage change growth factors. What we notice in the first graph is a clear improvement in revenues. Obviously without discussing expenses this means very little on its own but with young growth companies like Affirm it is always fun to see the stark improvement from one year to the next. In addition, what this graph helps us notice is where most of the money comes from which is essential in understanding a business model. Merchant network revenues are first, followed by interest income from their payment solutions.

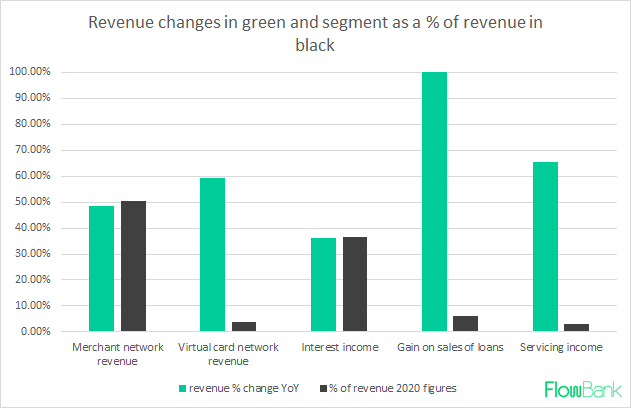

This graph next matters for two reasons: firstly, revenue percentage change shows us how the business allocates its revenue streams. The green bars below shows us that from 2019 to 2020 the biggest re-allocation so to speak, was in the sales gains on loans. Meaning Affirm made gains from selling the loans they originated via Cross River Bank to institutional investors. Notice how above we highlighted merchant banks and interest income as the two top streams? Well notice here how little those two segments have moved compared to their servicing income and virtual card network revenues. This shows us that Affirm has put energy into improving weak points in its business and showing positive results in improving weak points is a sign of good management. Secondly, the graph shows in the gray bars, the weight that each segment has on aggregate revenue. What we see mirrors the revenue growth seen above in that merchant network and interest income revenue represent the largest revenue streams.

- Merchant network revenue: as seen in the flow of funds diagram above, merchants are charged a merchant fee as negotiated with Affirm at the onset of a contract. The vast majority of revenues for Affirm come from such fees as seen in the graphs above. The merchant is paid by the originating bank (Cross River Bank) and that merchant recognizes their revenue directly when the product is purchased through the Affirm system.

- Virtual card network revenue: Customers can checkout at retail stores using the Affirm debit card. This card also works online and customers can apply for it on Affirm.com. Merchants are charged interchange fees when these cards are used and the card issuers get a cut of the merchant fee during such a transaction. This is a small portion of Affirm's revenue.

- Interest income: this is the second largest source of income for Affirm, they receive interest from consumers, and from the loans they buy back from their originating bank partner.

- Servicing income: Affirm collects servicing fees to manage the loan portfolio of third party capital markets investors. This is 2% of total revenue.

- Loan sales and trading: Affirm will sell some of the loans it bought back from its originating bank partner to institutional investors through its capital markets teams. Affirm is increasingly selling more loans and generating gains through this division.

Risks involved with Affirm

- If Affirm is unable to attract additional merchants and retain past relationships their revenue could be hindered. A big chunk of their revenue comes from merchant network fees and transaction volumes on the platform need to keep growing in order to gain further momentum. Here are some of the current Merchants working with Affirm:

- If the company cannot attract new consumers and retain or grow relationships with existing consumers. Some reasons for consumers to stop wanting to utilize Affirm at checkout involve things like lack of variety of merchants on the platform, mixture of available products, consumer satisfaction with the checkout experience and the reputation of the brand. On the other hand, the gross merchandise volume basically doubled in 2020, and active users went from 2 million to 3.6 million YoY. However, the number of transactions per active users remained around 2 per year which is fairly low compared to an Amazon. But, it is not bad considering products bought on Affirm are usually more expensive on average.

- A large percentage of Affirm revenues are concentrated on a single merchant partner namely, Peloton. Peloton represented 1 / 3 of Affirm's revenue streams in 2020 so if Peloton goes down or choses to stop working with Affirm, Affirm would be handicapped. Affirm needs to diversify its reliance through more attractive merchants, in the luxury business for example.

- Direct competition involves Afterpay and Klarna, other players like card issuing banks, VISA, PayPal which are substantially larger than Affirm with much more operational experience, market share and reputations.

- Affirm relies heavily on Cross River Bank to originate a substantial number of loans facilitated through their platform. Cross River Bank could stop working with Affirm for any reason, could make working with Affirm cost-prohibitive, or could enter into an exclusive or more favorable partnership with competitors.

Sources:

S&P Global Market Intelligence

Blogposts, newsletters, podcasts and any other content published by FlowBank SA (hereinafter “FlowBank”) reflect the opinions of the authors only and do not reflect the views of Flowbank or any of its subsidiaries or affiliates. These contents are meant for informational purposes only and aim to offer new ideas and perspectives. They are not intended to serve as a recommendation to buy or sell any type of financial instrument, whether that be through a Flowbank account or any other trading account. They are not to be considered as research reports and are not intended to form the basis of any investment decision. Any third-party opinion expressed, and information provided therein do not reflect the views of Flowbank or of any of its subsidiaries or affiliates. We emphasize that all investments involve risk, and past results are not a guarantee of future performance. While diversification does help to lower and spread the risk, it does not ensure a protection against loss. Investing in securities or other financial products always involve a risk of losing money. Prices fluctuate with the market in sometimes unpredictable ways, and investors should be aware that their losses might exceed their initial deposit. Flowbank SA, a FINMA regulated company.