If Chinese billionaire Jack Ma already broke the record for the biggest IPO with Alibaba - $25 billion in 2014 – he could very well surpass it yet again with Ant Group’s IPO.

Key background

Founded in 2011, Ant Group is an affiliate company of the Chinese Group Alibaba and dominates the Chinese payment market. In 2014, Alipay was renamed Ant Financial and raised $4.5 billion.

Today, Ant Group is the world’s highest-valued fintech, with a valuation of $150 billion. The company operates Alipay, largest mobile and payment platform in the world, as well as Yu’e Bao, the world’s largest money-market fund, and various other daughter companies in different industries.

In order to understand the DNA of this giant colony, let’s explore their main participants one by one:

The $17 trillion giant: Alipay

Alipay was founded by the e-commerce giant Alibaba as a new method of payment for the platform. The service was well adopted and quickly expanded to other platforms. So much so that in 2009, the mobile version held no less than 75 of the market, before being pushed back to 55% after the rise of WeChat Pay, who’s also performing really well in China.

Today, the company has no less than 1.3 billion active users who buy any sort of products, from the morning coffee to cars, and even real estate properties. The app generated no less than $17 trillion in the last 12 months.

The master loaners: Huabei and Jiebei

Don’t have any money to spend with Alipay? Did you really think that it meant you could not buy things? Of course not. Huabei and Jiebei are services offering unsecured loans: the former focuses on little spending (phone, computer, couch) and the latter finances larger spending such as travel, education and cars.

Although Ant uses some of its own cash reserve for lending, most of the money comes from banks, with the platform only acting as the connector. Goldman Sachs predicts that the amount of their loans could reach 2 trillion by 2021.

The cash-making machine: Yu’ebao

Capitalizing on the enormous inflows of cash coming in Alipay, Yu’ebao is a money market funds which lets user earn money from the cash they parked on the platform. They recently partnered with Vanguard Group to offer the service of a robot advisor in addition to their 20 asset managers.

Yu’ebao is acclaimed as a “fund for the masses” because it removed the entry barriers which stopped most small investors from getting returns higher than bank deposits. Indeed, you can invest as little as one yuan. Yu’ebao Money Market Fund now has $173 billion in assets, making it the world’s largest of its kind.

The judge: Zhima Credit

Strong with an enormous amount of data based on their various lending and payments activities, Ant launched a credit scoring service called Zhima Credit. Founded in 2015, it is able to judge the credit worthiness of Ant’s customers with a laser precision. Not only does the algorithm analyze your expenses and the payment of your bills, it also takes into account your school degrees and the credit score of your friends.

Companies can use the service in exchange of a certain fees, and customers with a sufficiently high score can pass on paying deposits for renting good or staying in hotels.

The Insurer: Xianghubao

In 2019, the company decided to enter the insurance market. The idea is rather simple: clients spay a small monthly fee that is pooled to cover treatment for diseases such as cancer, Alzheimer’s or Ebola. The company also proposes insurance premiums from other companies and takes a cut on price.

With a fee as small as US$4 a year, the company attracted 150 million users in two years, who can benefit from a coverage of up to US$42’000.

Will the Giant leave China?

As you might guess, this enormous growth will soon be too much for one country only, even if the country is China. Ant had to delay its expansion to the U.S. because of recent tensions between the two powers. In 2018, Jack Ma had promised to create a million jobs in the U.S., but sadly, he could not deliver.

In the meantime, the group is consolidating his presence in Asia, partnering with different payment startups (Paytm, Gcash) as well as delivery platforms and other marketplaces in order to address an even larger pool of customers.

Potential tensions ahead

Such an expansion can of course not go unnoticed. China’s regulators are all looking closely at Ant’s development and operations, not always with a good eye. The Chinese central bank is also working on a new project to control the stability of payment systems which could be very harmful to Ant: a digital Yuan.

Ant also remains concerned with the tensions between the U.S. and China, as further bans, restrictions and tensions between the two powers could be very harmful to their expansion plans.

The largest IPO the world has ever seen

After its $30 billion IPO, the Ant could be valued at around $225 billion, making it the world’s fourth-largest financial company.

It is also said that the company is planning on raising more funds on the Shanghai’s STAR Market and has approached many institutional investors.

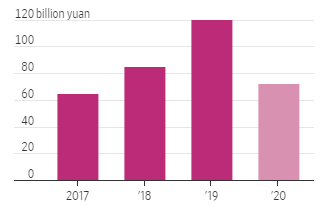

An interesting information for investors is that Ant reported a profit 21.9 billion yuan (US$3.2 billion) on a total revenue of 72.5 billion yuan (US$10.6 billion) for only the first half of 2020. That’s no less than a 1000% year-on-year profit – 2019 numbers were 1.9 billion yuan (US$278 million) in profit, and a revenue of 52.5 billion yuan (US$7.7 billion). That is some growth is it not?

Total revenue per year (source: Wall Street Journal)

.png?width=322&name=hhh%20(2).png)

Total profit per year (source: Wall Street Journal)

To quote Citibank: “Ant Financial is building an Empire of Services”. And this could not summarize things better. Tackling payment, insurance, loan and credit scoring at the same time is a dauting task. We can only imagine how far the company will go.

Sources:

https://edition.cnn.com/2020/08/26/tech/ant-group-ipo-hnk-intl/index.html

Read our next article: The Pentagon decided to award the JEDI contract to Microsoft. Again.