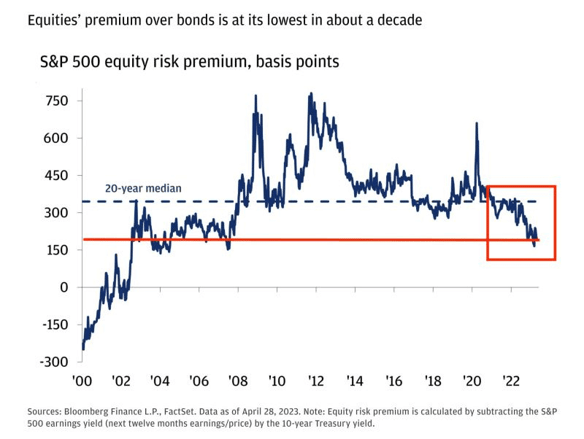

US equity risk premium has reached its lowest point in a decade, reminiscent of the period just before the Global Financial Crisis. That doesn’t sound good, but are things different this time?

The concept of the Equity Risk Premium (ERP) has long been regarded as a crucial indicator in assessing the attractiveness of the stock market. It represents the excess return that investors can expect to receive by holding stocks over risk-free assets such as government bonds.

Historically, the equity risk premium has served as a valuable tool for predicting future stock market returns.

This article delves into the significance of the equity risk premium, its historical usefulness in predicting stock market returns, the current factors that have contributed to the declining equity risk premium in the US, and whether the calculation still works in today’s market environment.

Understanding the equity risk premium

The Equity Risk Premium is calculated as the difference between the consensus earnings yield (earnings divided by share price) and the risk-free rate.

It provides a measure of the expected additional return investors can potentially earn by holding stocks instead of risk-free assets like government bonds.

A higher equity risk premium indicates greater potential rewards for assuming the higher risk associated with equity investments. Conversely, a lower equity risk premium can indicate a less attractive market environment where investors are not adequately compensated for the risks associated with equity investments.

Put another way, a low equity risk premium suggests equities are not as ‘worth the risk’ when compared to safer investments in the bond market.

The most commonly watched interpretation for US markets is comparing the consensus earnings yield for the S&P 500 index with the yield on the US 10-year Treasury bond.

As the chart above demonstrates, it is now at its lowest in a decade and at a level not seen since 2007. 2007 marked the low point on that occasion because equity risk premiums spiked through 2008 as earnings expectations tumbled. Since then, risk premiums have oscillated but generally remained elevated, supported by historically low-interest rates. So even as earnings expectations fell periodically, stock markets were underpinned by especially low-interest rates that kept stocks relatively more favorable to bonds.

Current concerns

In the present US equity market, the declining equity risk premium has raised concerns among market participants. A combination of factors has contributed to this decline. Firstly, higher interest rates have increased the yield on risk-free assets, thereby narrowing the spread between the return on government bonds and stocks.

Additionally, elevated equity valuations have increased the price investors must pay for stocks relative to their earnings, further reducing the potential excess return. Moreover, there are concerns about declining earnings growth and the possibility of an impending recession, which has added to the caution surrounding the equity market.

Implications for capital allocation

The diminishing equity risk premium has implications for capital allocation decisions. Money managers and investors may become less inclined to allocate their capital to US equities due to the relatively lower risk-reward profile. If the potential rewards of investing in stocks do not adequately compensate for the additional risks, investors may opt for alternative assets or seek opportunities in other markets with more attractive risk premiums.

But are things different this time?

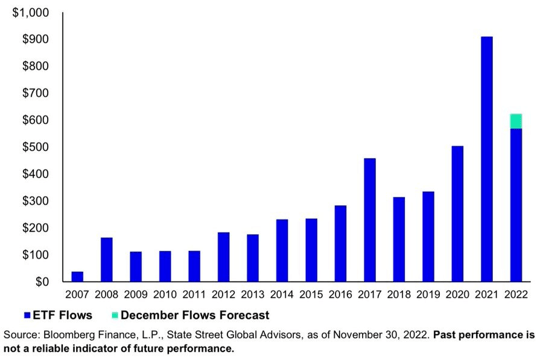

We might also take into account two influential factors: passive flow from exchange-traded funds (ETFs) and corporate stock buybacks. These elements have introduced price-agnostic buyers into the market, potentially altering the relationship between equity risk premiums and stock market returns.

As investors flock to ETFs, these funds indiscriminately purchase stocks based on their inclusion in the underlying index, regardless of their valuation. This constant inflow of passive investments creates consistent demand, driving stock prices upward. Consequently, the traditional relationship between declining equity risk premiums and stock market returns may be disrupted by this ongoing passive flow.

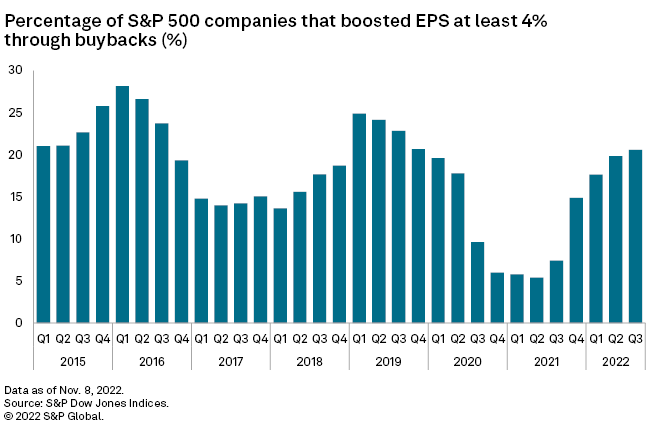

Corporate stock buybacks, another significant market force, have been prevalent in recent years. Companies utilize cash reserves to repurchase their own shares, effectively reducing the supply of publicly traded stocks. Similar to passive flow, buybacks occur irrespective of valuation. By reducing shares outstanding, buybacks boost earnings per share and can drive stock prices higher.

However, while passive flow and stock buybacks bolster the market, they also introduce vulnerabilities. Reliance on passive investments can lead to herding behaviour, amplifying market swings during volatility. Excessive stock buybacks may divert resources from productive investments, limiting future growth opportunities.

The role of artificial intelligence

Interestingly, the rise of artificial intelligence (AI) has played a significant role in driving up the valuations of mega-cap tech stocks and pushing the index higher. However, it is important to note that a considerable portion of the positive performance in the index has been driven by multiple expansions rather than organic earnings growth. This reliance on multiple expansions raises concerns about the sustainability of the market rally, especially when considering the high valuations, declining earnings, and the potential economic downturn.

Conclusion

The US equity market's declining equity risk premium raises cautionary flags for investors and money managers alike. With the equity risk premium at its lowest point in a decade, it suggests that investors may not be adequately compensated for the additional risks associated with equity investments. This, coupled with concerns over high valuations, declining earnings, and the potential for an economic recession, warrants a cautious approach to the US equity market. As market participants navigate this challenging environment, it becomes crucial to closely monitor developments and adjust investment strategies accordingly while seeking more attractive risk-reward opportunities in other markets or asset classes.