The Federal Reserve is choosing to go after inflation even at the risk of tilting the economy into a recession, a move that is weighing on oil prices, the only asset still up more than 40% year-to-date (27/06/2022). In this article, we will be discussing what the price of black gold is telling us and if there are opportunities to seize?

Despite all the recession headlines directing sentiment, fundamentally, nothing has changed. Energy markets remain underinvested, climate change commitments by essence are designed to push fossil fuel prices higher and in terms of growth, forward earnings estimates remain in an expansionary state. And if the war in Ukraine continues, the uncertainty about the outcome itself could support energy and in particular oil prices. This all together lets us believe that the likelihood for oil prices to remain above the USD100 mark is still very high.

Fighting inflation at any cost

Over the past two weeks, oil has been rapidly giving up early-year gains in what’s been a volatile second quarter. Investors are trying to predict the direction of the global economy and its impact on raw materials based on very hawkish central bank signals.

Federal Reserve Chairman Jerome Powell told lawmakers on 22 June that the central bank is determined to bring down inflation, even though he acknowledged a recession could happen. Following Powell’s comment, analysts revised their growth projection, attributing now as much as a 50% chance for the world economy to succumb to a recession over the next year. That number was between 20% and 30% two weeks ago.

Demand still rock solid

Interestingly, the decline in stocks so far has been mainly due to a contraction in price-to-earnings rather than to a drop in future earnings. Earnings growth for major indices and the world index (MSCI world) are still positive.

In addition to strong demand, oil prices are also likely to continue to benefit from an interminable demand-supply imbalance in the energy sector. The Russia-Ukraine situation and OPEC’s inability (or unwillingness) to increase output have meaningfully reduced supply in the face of insatiable demand for energy.

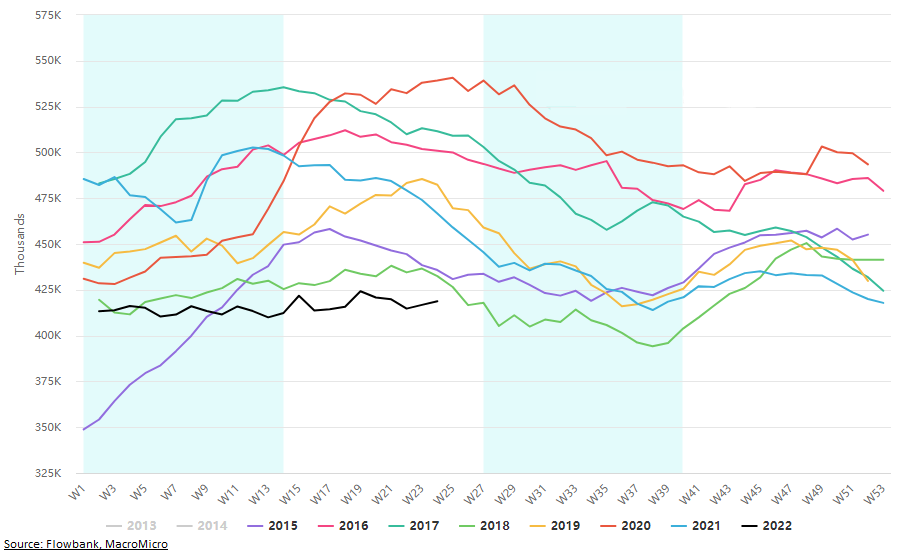

Current oil inventories are critically low in Europe and at their lowest level of the past decade in the US. And considering historical trends, the situation is set to worsen in the second half of the year, a period of intense energy consumption, as consumers head to the hot summer driving and holiday season.

As such, despite all growth fears, demand for oil still appears to be running ahead of supply. And as long as the uncertainty about the outcome of the war persists and West-Russia (one of the key energy exporters) relationships deteriorate, the imbalances in the energy market are set to endure.

At a critical moment

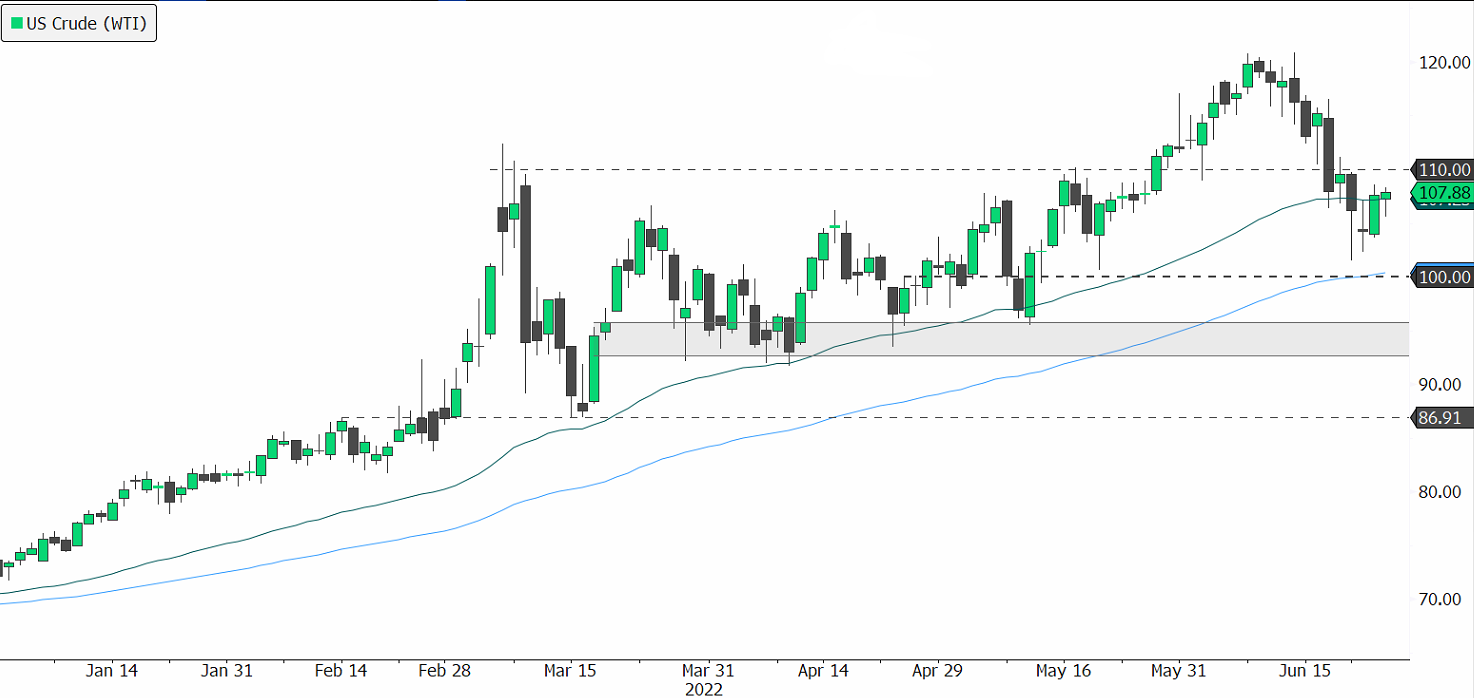

US Crude oil (WTI) plunged as much as 16% at one point over the past two weeks as sentiment was hurt by global growth concerns. Prices broke significantly below the 50-day EMA support for the first time since the beginning of the year, adding technical pressure to an already fragile market environment. But prices recovered sharply, bouncing from near 100-day EMA support as buyers jumped in.

Headline prices have been subject to outsized swings as futures holdings are at the lowest since 2016, and as the sentiment has deteriorated recently, prices are under profit-taking pressure. Meanwhile, fundamentals still point to upward risk; Super major Exxon Mobil warned this week that crude markets may remain tight for years, Vitol Group, the world’s largest independent oil trader, flagged rising fuel demand in China, and soaring margins are also offering refineries an incentive to buy every barrel of crude they can get.

Traders will be watching oil price action this week as it is likely to signal the trend for the coming weeks. In the best-case scenario for oil bulls, we see a material break above the 110 level as a key predeterminant for prices to resume their upward trend and claim back June highs of USD120. However, the 107-110 resistance levels shouldn’t be underestimated as the current weak sentiment is in favor of oil bears who see a retest of the 100 marks as a more plausible scenario. The OPEC’s outlook for global oil demand and whether it plans to boost production this week is also set to add some colour.

Conclusion

The macro backdrop still points to higher oil prices in the medium term as supply remains tight. Though short-term concerns about demand destruction and Biden’s upcoming trip to Saudi Arabia could weigh on prices. From a technical perspective, corrections of this magnitude after such a strong rally are often seen as healthy and positive, as such oil bulls don’t seem to have capitulated yet. Should the intense battle around the USD100 mark take prices lower, investors should consider adding back oil to their portfolio as upward pressure on prices remains high, unless a Ukraine deal is reached.