The world has begun moving towards more sustainable ways of producing energy and companies like Technip Energies are the enablers of a successful energy transition revolution.

Key Takeaways:

- The LNG market Technip Energy currently operates in has been identified as a €70 billion annual addressable market opportunity.

- The clean energy transition’s momentum is backed by major governments and institutional investors—governments plan to invest $98 trillion in energy systems over the coming three decades.

- In the more immediate future, up to 2030, cumulative investment in energy systems would reach approximately $57 trillion.

- Technip Energies 2021 growth estimates indicate that revenue figures could easily reach the $7 billion mark considering the on ramp of backlog projects already contracted for the coming years and 2020 $6 billion revenue figures.

What makes Technip Energies stand out?

Technip Energies is a Paris based clean energy engineering and technology company specialized in the Liquefied Natural Gas (LNG) space. The French company helps other energy companies make the move towards more sustainable business practices through modified plants that are engineered to optimize pollution levels. The firm delivers engineering expertise in LNG, but also hydrogen and ethylene projects and recently, the company indicated interest in exploring major growth markets in sustainable chemistry, carbon-free energy solutions and decarbonization projects in general.

The company has a very competitive offering to address the significant LNG market opportunity both for offshore and downstream projects. The LNG market Technip Energy currently operates in has been identified as a €70 billion annual addressable market opportunity and they want to be in the driver’s seat.

The company is interesting from an investment standpoint not only because of how in vogue sustainable engineering has become in the clean energy race, but because the firm spun off from its mother group TechnipFMC only recently. This provides the stock with a fresh start and an opportunity to ramp up in the energy transition space. The firm operates internationally in 34 regions, has 14,000 employees and 450 projects under execution.

The company is well positioned to become the much needed ''glue'' many large producers will call to as they build new plants and transition their current facilities to incorporate more sustainable infrastructures. Technip Energies is showing fast growth in their appreciating number of new hires, new projects, and profitability.

The mother company, TechnipFMC, remains involved in the spin-off, retaining about 50% equity in the new firm which will help Technip Energies stay liquid longer. The backlog seen on the balance sheet is truly impressive, with unearned revenues already penciled in for the next two years. Global energy companies already know and work with TE, and this network effect could be good news for the firm going forward.

A note on the energy transition...

There is a very strong case for energy transition stocks right now because there is a flurry of economic threads weaving a basket suited for clean energy stocks. This weaving is clearly seen in government involvement, and in the flow of funds seen in financial markets. There is a large push towards renewable energies, electrified transportation and green energy solutions.

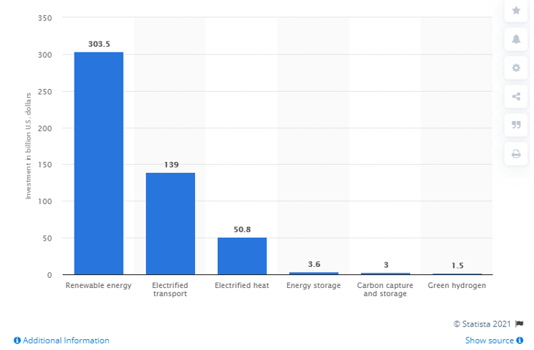

The graphic below indicates the global investment in energy transition in 2020. Right now, we are living the early-stage developments of what could grow into a major industry. An industry not only creating jobs, but backed by massive wallets like governments and institutional players.

Figure 1: Global investments in energy transition in 2020 (in $)

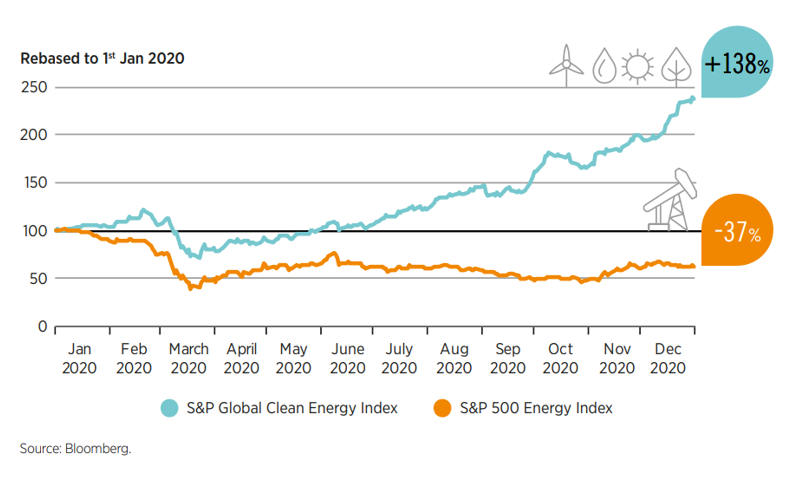

The energy transition is already underway however, and it is unstoppable (see figure 2). Over 170 countries have renewables targets and remarkable advances, enabled in part by foresighted policies, have made it economically viable for more countries to get involved.

This scalability is encouraging and can present more business opportunities in things like decarbonized power systems, electrification of end-use sectors, synthesized fuels and feedstocks, green hydrogen—many such projects Technip Energies happens to be involved with—and more.

Figure 2: S&P clean energy index versus S&P 500 energy index

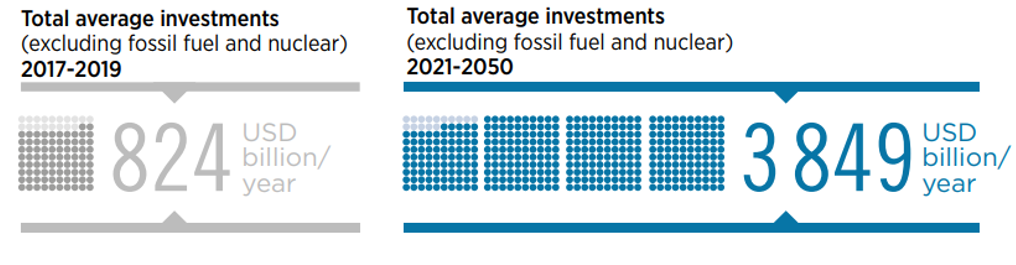

According to the International Renewable Energy Agency, governments plan to invest $98 trillion in energy systems over the coming three decades. The current economic packages seen in the US now would direct $4.6 trillion into energy transition sub-sectors and in the more immediate future, up to 2030, cumulative investment in energy systems would reach approximately $57 trillion. Needless to say, this world-project will not see a shortage of funds to start or run companies like Technip Energies.

Figure 3: Graphic shows the increasing average investments flowing into energy transition

Technip Energy’s commercial activity...

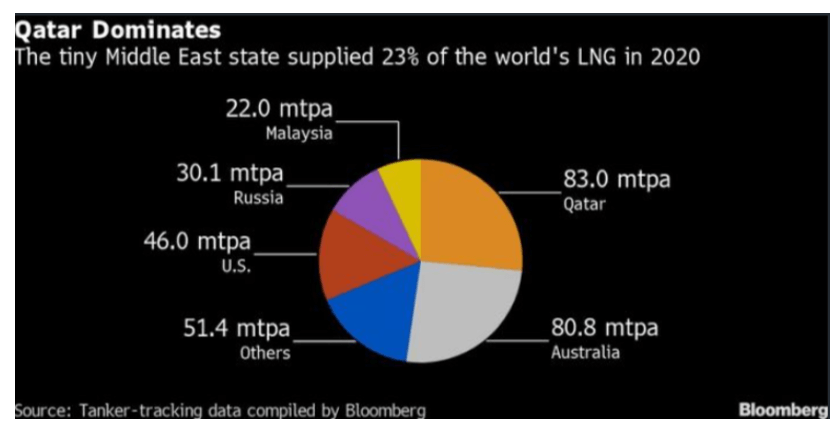

Technip Energy and their partner Chiyoda were awarded a major contract worth $13 billion with Qatar Petroleum to build and improve the onshore facilities of their North Field East Project. This project involves building four mega trains each with a capacity of 8 million tons of LNG per year. LNG trains are facilities that help compress and purify the liquified gas. Qatar is the leading market for LNG, and has supplied one quarter of the world with LNG in 2020. The project is said to lead to more than 25% reductions in greenhouse gas emissions from efficiencies generated by Technip’s facility engineering.

Figure 4: Qatar dominates the LNG supplier market.

The firm also works with Sanofi and was contracted by them to build their latest greenfield facility in Algeria. The facility enables the production of 100 million drug units per year and represents 80% of Sanofi’s output in Algeria. Technip Energies continues to be contracted project after project because of the quality of their engineering procurement, according to their CEO.

Figure 5: Technip Energies constructs 22,000 square meter plant for Sanofi in Algeria

In fact, this week, TE made its way to Russia, a major LNG and energy producer, in a joint project with Nipigas to begin sustainable projects under the joint venture company, Nova Energies. Through this venture, TE will reinforce its energy transition positioning, leveraging its engineering expertise and making more of name for itself across the world.

Financial overview of Technip Energies...

With all these projects and many more that we omitted, TE has seen a 9% change in revenues in 2020 ending the year with $6 billion up from $5.5 billion in 2019. Net profit grew 78% from 2019 hitting $220 million as general expenses fell 10% and R&D expenses tumbled 9%. 2021 growth estimates indicate that revenue figures could easily reach the $7 billion mark considering the on ramp of backlog projects already contracted for the coming years.

The company has identified an annual addressable opportunity in this upside market of more than $15 billion with medium-term growth potential of 5-15% per year. The stock is currently trading at EUR 12.54 with a PE ratio of 11X, a PB ratio of 1.24 and an EPS of $1.15. The firm shows decent debt coverage and healthy prospects for more contracts going forward.