Trading CFDs is a popular way to trade stocks and shares including popular companies like UBS and Facebook listed on global stock exchanges.

These include well known names such as UBS, BMW, Facebook, Netflix, Barclays as well as lesser known names, and stocks from a broad range of sectors.

How to trade CFDs?

CFD trading is speculating on the price movement of a market. In this case, stocks. If you think the value of the stock will increase, you buy, this is also known as going long. For every point that the share price moves in your favour, the trade makes a profit. If the value of the stock drops, the position would incur a loss for every point that it falls against you. It is worth knowing that one CFD is equivalent to one stock.

All stocks are quoted with a sell and buy price. This is also known as the bid and the offer price. The difference between the bid and offer is called the spread.

Example trade

HSBC is trading at 646.5p and 647.7p. You think the price of HSBC will rise so you place a buy trade of 5000 CFD’s at the buy price of 647.7p.

The price of HSBC increases to 697.7p to sell, an increase of 50 points. You close the trade by selling to close. The profit (excluding some charges) is calculated as:

(Trade close price – trade open price) x stake

(697.7p – 647.7p ) x 5000 = 250,000p or £2,500

Should the price of HSBC decline then your position would lose for every point that HSBC went against you. For example, if HSBC dropped to 607.7p and you sold to close at this price, your position will have lost 40 points

(647.7 p – 407.7p ) x 5000 = 200,000p or £2000.

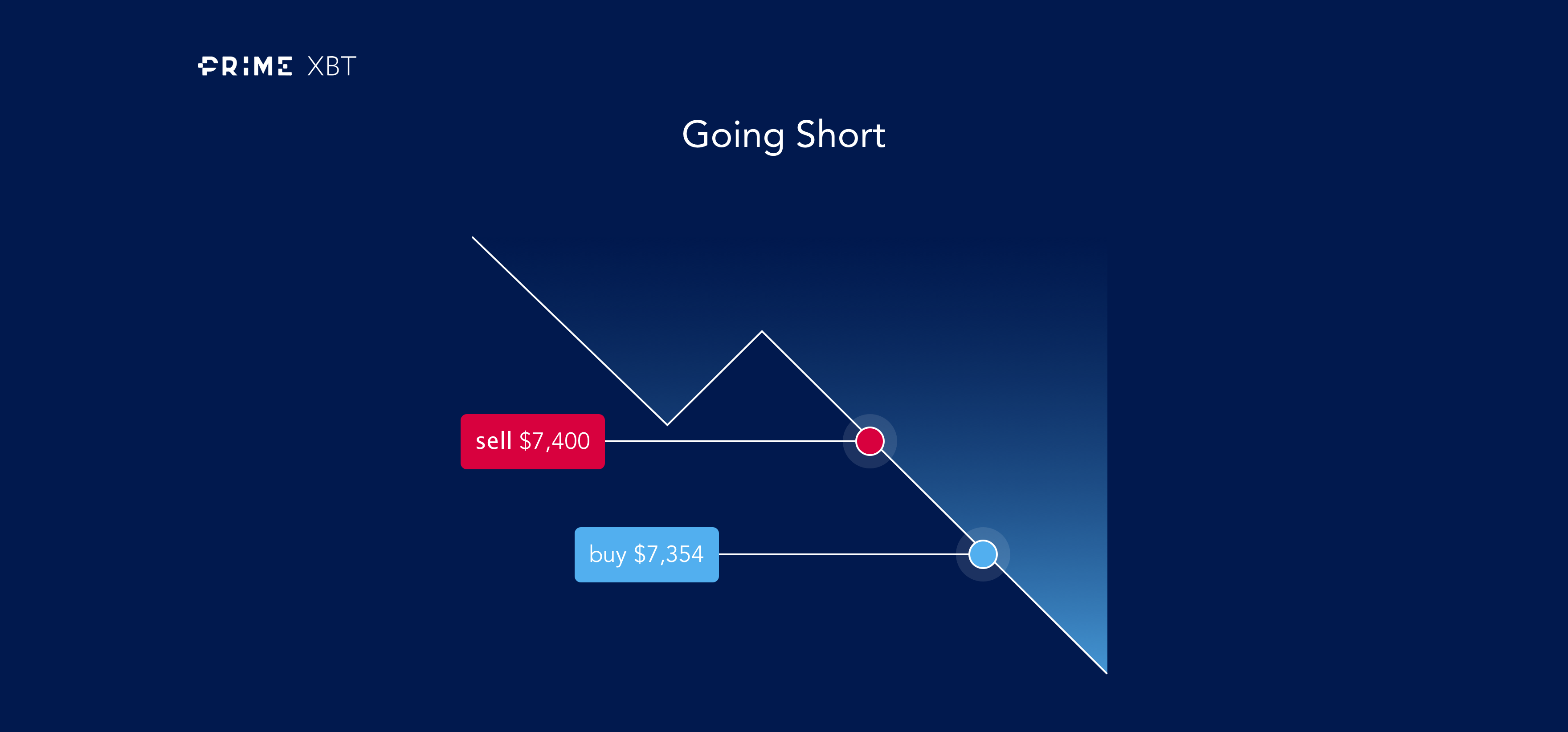

Profit from a falling market

Source: PrimeXBT / medium.com)

With CFD’s you don’t own the underlying asset as you do with share dealing. In CFD trading you are speculating on the price movement of an asset. This means that it is possible to make money from a falling market as well as a market that is increasing in value.

If you think that the value of a stock will decline, you sell to open. This is called going short. For every point that the share value decreases your trade profits. However, for every point that the market rises you would make a loss.

For example, you go short 5000 HSBC CFD’S the sell price of 646.5p to open. The price of HSBC drops to 596.5p, you buy back at this level to close. The profit of you trade is calculated as the difference between the close price and the open price multiplied by your stake.

(646.5p – 596.5p) x 5000 = 250,000p or £2,500.

If you hold a short position and the market rises you will make a loss for each point that the trade moves against you.

Trading on margin

CFD’s are a leveraged product. This means that rather than putting forward the full value of the trade to open it, you only need to put a small percentage of the value of the trade forward as an initial deposit. This is known as the margin.

For example, Swiss shares have a margin requirement of 20%. Suppose you want to go long CHF 10,000 worth of UBS shares, the margin required would be 20% of CHF 10,000 = CHF 2000.

If you were to buy CHF 10,000 pounds worth of UBS stock through a ordinary stock broker you would need to stump up the full CHF 10,000.

From this example we can see that trading on leverage means that with a smaller initial outlay you can have control of a larger position. It is advantageous because it you can then put your money to work elsewhere, such as for another trade.

Whilst profits are magnified through trading on leverage, so are losses. We therefore recommend that you adopt a sensible risk management strategy whilst trading CFD’s. This might include using a stop loss order.

Hedging with CFD’s

As it is possible to short the market with CFD’s and make a profit from a falling market, some traders like to use CFD’s to hedge a position that they have in physical stock. By going short a stock CFD, for example, that you have in your portfolio of ordinary stocks, the trade can act as an insurance, offsetting some or all losses in the physical position.

Physical Facebook shares / Facebook CFD position

For example, you hold 5000 shares in Facebook, and you believe they will drop in the short term. You short 5000 Facebook CFD’s. Suppose Facebook drop 5% in value, the losses that you experience on the share dealing account will be offset by the profit which will be sitting on your CFD account. You can protect your shares without having to close out the position. Hedging can be particularly useful when you believe that longer term the price of the share will increase.

Trading costs

When trading stock CFD’s the spread is the main charge. The spread varies depending on where the shares that you are trading are listed.

Aside from the spread there is also a financing charge. This is calculated as a small percentage of the value of the trade, divided by 365 and charged each night that the position is held open. Financing charges apply to both long and short positions.

Taxes

CFD’s are a tax efficient way of trading. This means that from a tax point of view CFDs are a cheaper product through which to trade stocks than via a traditional stock broker. *

Trading hours

When trading stocks through CFDs, it can be done during the same hours that the exchange is open. For example, Swiss stocks can be traded during Zurich trading hours (8am - 16:00 CET). UK shares can be traded during the hours that the London Stock Exchange is open (8am – 16:30 GMT). US shares can be traded the hours that the US stock exchange trades (14:30-21:00 GMT).

* Tax laws depend on individual circumstances