So you might be curious to know how bitcoin mining works, or are considering becoming a bitcoin miner yourself ? Or perhaps you are looking for bitcoin mining public companies to invest in ? Read on.

Bitcoin Mining

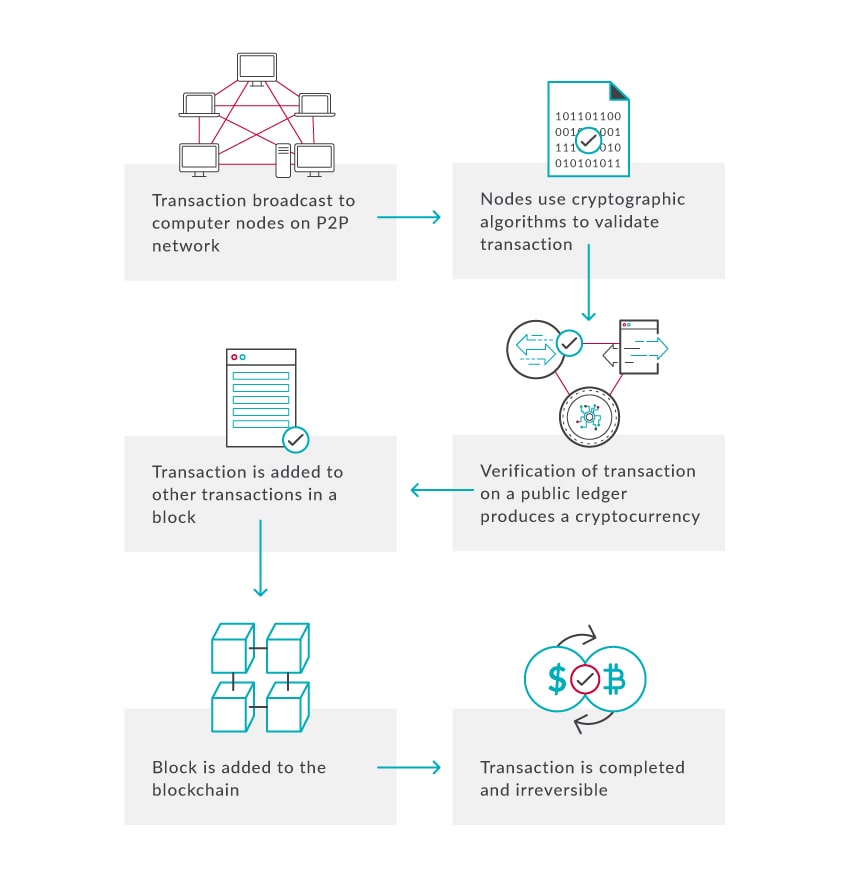

As you've read in our Coinbase article, crypto assets such as Bitcoin are obtained through what is called mining. The goal behind mining is to earn actual Bitcoins in return for your mining efforts where 1 BTC = $34,000 at the time of writing. In 2009, mining one 'block' earned you 50 BTC, in 2012, 25 BTC in 2016 12.5 BTC, and in 2020 6.25 BTC. In other words, the miner's reward for a successful block is halved every four years, or every 210,000 blocks. What are these blocks you may ask ? Let's see the diagram below to show you more broadly the process of mining; from the mines, to the exchanges. Simply put, mining computer networks join to solve cryptographic math problems that serve as a verification process which in turn generates a cryptocurrency. A block is then added to the underlying blockchain technology which serves as a bedrock for the whole bitcoin enterprise.

In fact, miners are more like auditors of a currency than diggers. They use their computing power to verify the legitimacy of transactions by checking 1MB worth of transactions and then having enough luck to be the first one to find the right answer to a target hash number. A hash or 'hashing' requires lots of processing data to solve, and the basic idea is to be as close as possible to finding the mathematical solution to a random string of numbers. Once solved, the hash adds a block to the blockchain and the miner is rewarded (though not always) with a transaction fee, or actual BTC. You need to guess massive amounts of numbers to be successful at mining a BTC and use massive loads of computing power which is costly.

Miners are not only auditors but also 'minters' which means they are printing digital money (which creates inflation). In aggregate, there has been a total of 18.5 million total bitcoins mined. There is a fixed supply of coins at 21 million bitcoins but the final bitcoin won't be found until 2140. Since mining bitcoin is very difficult to do with only one computer one can join a miner's union called ''mining pools'' which enable miners to operate with a network of miners thus increasing ones probability of solving the hash problem and adding a block on the blockchain.

The crypto mining industry has this 'labor structure' appeal which goes back to the decentralization and individual sovereignty concept of cryptos. Visualize this image on actual gold mining: You are a gold miner, you are paid hourly wages to work in a mine. You mine all day, you mine all night and after a week you gather a kilo of gold (worth $62,891 right now) and instead of keeping it for you and your team, you bring it back to the big boss who then sells it. You then leave for your weekend fishing trip with $850 instead of a couple ounces of gold. Bitcoin mining differs in that you don't have a boss, you keep exactly what you labored for and you mine when you want to mine. It is a decentralized labor market.

Sounds appealing ? Click here.

Firms mining bitcoin

Bitcoin mining firms compete on a variety of things but the main ingredient to success is the ability to hash out bitcoin. As we've seen above this ability boils down to solving hash quickly. Therefore, having a high hash rate is a top priority (putting operational costs aside for a moment). The hash rate is the number of calculations a miner can perform in one second as it works to solve the BTC ''code''.

Riot Blockchain (ticker: RIOT) is a publicly listed bitcoin mining company which houses massive amounts of hardware to increase its hash rate. The firm recently reached the $1B market cap. They pivoted business models from biotech in 2017 to bitcoin mining when their value was closer to $50 million. They didn't know about Covid-19 or the crypto surge so we call bluffs on this pivot.

RIOT's hash rate for 2021 is expected to be around 1,446 PH/s with a fleet of 15,040 miners. In terms of energy usage we're looking at 46 MW of energy by may 2021. A typical coal plant is about 600 MW in size. 50 MW is comparable to a wind farm project. In other words, RIOT needs an entire wind farm to sustain its business. Mining firms are the renewable energy sector's dream customer.

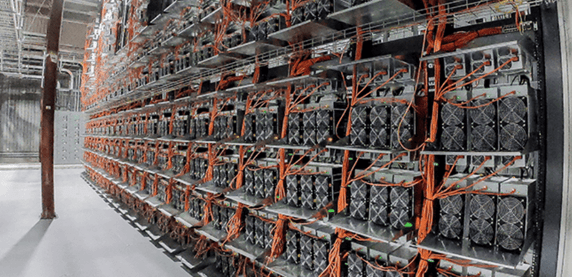

Commercial bitcoin miners like RIOT compete on hash rate since this is the closest measure of their return on work rate, the return being Bitcoins. With Bitcoin skyrocketing, RIOT could represent a buying opportunity even though the largest gains were made early in 2020. RIOT is priced at $18.41 with a 52 week low of $0.51, see their warehouse and stock growth below:

Marathon patent group (ticker: MARA) is well known in the cryptocurrencies space since 2010. MARA operates a data center with a maximum capacity of 105 MW (twice that of RIOT) and over 21,500 miners. The company recently completed a successful $200 million shelf offering ending the 2020 fiscal year with $217.6 million in cash. The cash will be used to buy more mining rigs and grow the firm. Reading their last 10-Q, MARA showed a cryptocurrency mining revenue that varies quite a bit over the last four years with Q3 showing $835,184 in revenues a rise from same time last year. This is also accompanied by a net operational loss of $1.99 million.

With the price of bitcoin being subject to an increase they could sell some of their coins to bulk up their income statement in order to buy up more competitors into the next year, but considering their recent cash raise to pay for computers, they probably will hold that cash and invest in working capital solutions while they sit on the cryptomania surge. This is what their facility looks like just imagine more aisles:

And this is their projected hash rate:

Their stock:

Argo Blockchain (LON: ARB) is the leading cryptocurrency miner listed on the LSE for £77. Its reported revenues have climbed 23% in November. Over the last month, Argo mined 115 BTC and 2,369 BTC year to date worth around $45.7 million. The company holds 178 bitcoins in reserve. They operate 16,000 mining rigs with a 645 PH/s hash rate and its active mining power is 31 MW. Argo prides itself on being one of the most efficient miners out there. In November they reported an average monthly mining margin of 57% compared to 40% a month earlier with revenues rising to £1.48 million. Here is a look inside their facilities:

Their stock;

HIVE Blockchain Technologies (HIVE) the Canadian company has recently purchased their next generation of miners pushing their aggregate operating hash power to double to 653 PH/s. Their goal is to reach 1,000 PH/s by the end of 2021 all funded through operational cashflows. HIVE is the leading Ethereum producer sourcing green energy from Facilities in Sweden.

They boast that ETH has outperformed BTC this year and they say they have produced 22,000 coins in the last quarter of 2020. They also have a BTC production in Canada that increased to 160 BTC in the last quarter. They say covid has slowed their orders of miners from China. Their net income was $9.3M after a loss of $11.5M the same time last year and they sold $1.7M of their digital currency. Their stock price and chart is next:

Becoming a bitcoin miner

- Get a bitcoin mining rig. More specifically called an ASIC i.e. Application Specific Integrated Circuit chips which are specialized for cryptographic algorithms. They use less energy and mine BTC faster. This is what enables you to solve the hash 'codes'. You have different parameters to look for like performance of hash rate, consumption of electric energy, and the price. You can actually place your mining machine into a professional data center and can thus profit from a lower price of energy, cooled areas, and monitoring.

- get a Bitcoin wallet. It will have a public address like an IBAN number you can transfer through and a private number for you to hide. Your private number is the one used to send out transactions and if you lose it you lose your BTC forever. There are software and hardware wallets with different sets of pros and cons.

- Join a mining pool. Like the pie chart shows above, there are plenty of pools to join. Don't mine alone as you will lose the numbers game. You'll have to pay a fee to enter the pool. You'll offer up your computing power to the group and receive a proportion of the BTC earnings based off that power. Small but steady earnings over time.

- Get a mining program. This connects you to the blockchain and bitcoin network. The best program is NiceHash Miner.

- Good luck!

Sources:

http://www.globenewswire.com/NewsRoom/AttachmentNg/2fb70d7a-d61d-464e-88e5-e9cac15d361c/en

https://www.coindesk.com/riot-blockchain-1-billion-market-capitalization

https://www.buybitcoinworldwide.com/bitcoin-clock/

https://www.masterdc.com/blog/how-to-mine-bitcoin-beginners-guide-to-mining/