Bitcoin reached an all-time high of USD68’000 in 2021, paving the way for a generation of cryptocurrency enthusiasts and opening up a whole new asset class. However, it eventually dipped back to USD35'000 this year and has been lingering around USD40’000. What is driving the number one digital asset in early 2022?

Bitcoin continues to be pulled between opposing sides. Bears vs. Bulls. Crypto enthusiasts vs. environmental activists. Fundamentals vs Elon Musk’s tweets. And now that he is about to own Twitter, crypto markets and BTC are going to be even more volatile.

Bitcoin’s price action

Bitcoin was expected to breach the USD100’000 barrier before the crypto bear market took control.

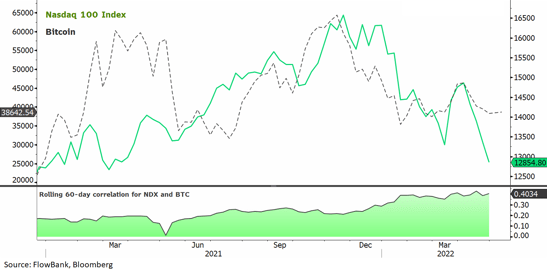

Technically speaking, Bitcoin’s price is showing encouraging signs so far in 2022 despite the downward pressure from the expected US rate hike cycle. Since mid-January, Bitcoin is slowly recovering, or at the very least, consolidating. However, after painting an ascending channel for roughly four months, making higher highs and higher lows, the price failed to break above the 200-day moving average resistance level, leading to early profit-taking and causing Bitcoin’s price to retest its February lows (USD38’000). But the good news is that while Bitcoin peaked at the same time as the Nasdaq and saw selling pressures push it lower by double digits, this year, it is showing resilience, outperforming the US tech-heavy by nearly 10% since the start of the year.

Mass adoption?

Bitcoin can be added to 401(k) plans. Fidelity Investments announced last week that it will allow investors to deposit Bitcoin into their 401(k) retirement plans, making it the first company to do so.

By the middle of 2022, the crypto product will be offered to 23’000 employers who use Fidelity to manage their retirement plans. Fidelity is the nation's largest retirement-plan provider, with USD11.3 trillion in assets under management, and its choice might help crypto become even more popular and mainstream.

Plan sponsors are increasingly interested in vehicles that allow them to give their workers access to digital assets through defined contribution plans, and individuals who want to include cryptocurrencies in their long-term investment strategies are following suit.

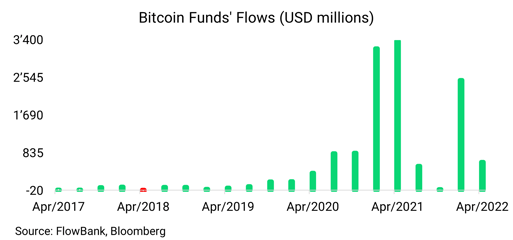

Rising institutional interest. While cryptocurrencies have recently experienced a drop in value, these drops follow massive rallies; Bitcoin and Ether are still 4 times and 10 times more valuable than they were just 18 months ago. There has been a meaningful uptick in interest from institutional investors toward gaining some exposure to Bitcoin and crypto over the past years. Traditional hedge funds have started to tiptoe into the space as opportunities have grown. According to PWC’s survey for 2020, 21% of traditional hedge fund respondents had some allocation to crypto (~3% of AUM on average), with most intending to deploy more capital at some point in the future.

Crypto-specific hedge funds are also starting to emerge, specializing in two main strategies. Some focus on higher-risk directional strategies while others favour more market-neutral strategies, such as high-frequency trading, market-making, and arbitrage, hence increasing market liquidity The biggest players in this field are investing more than USD1 billion in early-stage start-ups, the creation and adoption of which are improving crypto credibility, increasing crypto ownership, and providing support for the price of the digital gold.

Tesla to help mine Bitcoin

Elon Musk has long been a proponent of Bitcoin, and his company Tesla is partnering with Blockstream and Block (previously Square) to establish a Bitcoin mining farm, according to news reported by CNBC. Blockstream is a blockchain technology start-up run by co-founder Adam Back, and Block is a technology business founded by Jack Dorsey. The collaboration is meant to use Tesla's 3.8-megawatt solar PV array and 12 megawatt-hour Megapack battery energy storage devices to power the mining farm, enabling the mining of Bitcoin in an ecologically responsible manner and hence reducing Bitcoin's carbon footprint. a

Looking ahead

Traders will be watching how Bitcoin flows behave in a world with considerably less liquidity and rising real yields. For now, the price is likely to continue to fluctuate around current levels (USD40’000). From a trading perspective, it may be too late to cut positions given how much the price has already fallen (40% from its highs of USD69’000 in November). On the contrary, for crypto enthusiasts who missed the 2020/2021 rally, the time seems right to start allocating a bit of portfolio as the potential to the upside is likely to be larger than further weakness. We're keeping a close eye on whether institutional investors increase their Bitcoin holdings as growing adoption could provide a real boost to sentiment. Ultimately, what matters the most is momentum, something that Bitcoin is critically lacking lately.