Data suggests that bitcoin is beginning to play a role of an inflation hedge. Could it be that bitcoin is maturing into a 'real asset'?

Key takeaways:

- Inflation hit a 40 year high in the US in December 2021

- Data suggests that bitcoin is beginning to fulfil this inflation hedge role. Observing bitcoin’s price changes relative to changes in inflation shows that this relationship is becoming statistically significant.

- We remain unsure as to what will happen to inflation in the coming 5 years, but we see adding “real assets” as a prudent measure to protect portfolios from the tail-risk that inflation runs out of control.

“Transitory”

After months of debate surrounding “transitory” inflation, the Federal Reserve finally dropped the term that was giving it such a headache, though it still believes inflation should abate over the coming months. Still, with Omicron likely extending supply chain disruptions, inflation could remain higher for longer – and some believe we are at the beginning of an inflationary spiral.

In addition, wages appear to be creeping higher, though this should prove temporary. While wage growth was unusually high during the pandemic, this has been distorted by lower paid workers being laid off. As these workers regain employment, it is most likely to push down wage growth in the coming months, rather than increase it.

It is therefore very difficult to determine if higher inflation really is just round the corner. There are some supply bottlenecks caused by the disruption in global shipping, broader supply chain issues and inventory challenges increasing short-term inflation, but this does not necessarily mean it will lead to longer-term inflationary problems. It remains too difficult to say exactly what will happen to inflation. However, whether inflation proves persistent or temporary, plenty of investors will remain concerned with the erosion of capital and will look for hedges.

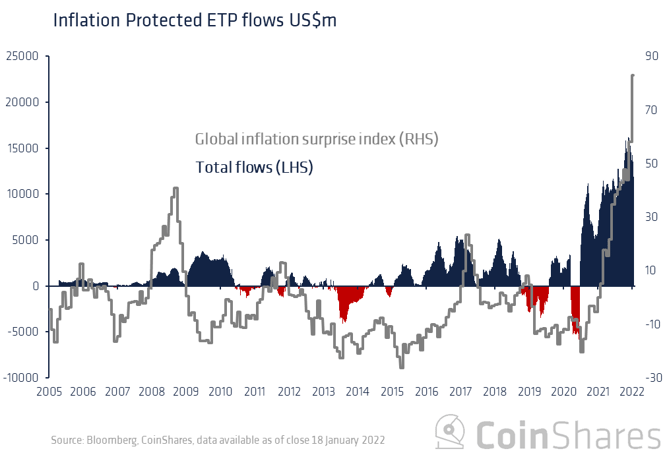

Today, while markets have turned hawkish and are now pricing in 4 interest rate hikes from the Federal Reserve this year, investors are not entirely convinced it will suffice to contain inflation. Despite the recent more hawkish comments from the FED, the outflows from inflation-protected exchange traded products in reaction to this have been relatively minor. In fact, assets under management in inflation-protected exchange traded products have risen by 51% over the 6 months, prompted by a flurry of inflows that began in mid-2020, showing a consensus view of higher inflation. It also alludes to the point that many investors believe the US Federal Reserve and other central banks are potentially behind the curve.

Regardless of the outcome for inflation, there remains a risk that central bankers lose control of inflation. Therefore, inflation hedges are increasingly popular, as highlighted by the aforementioned fund flows. There is a small selection of hard assets that should outperform during a bout of inflation, and we believe bitcoin is one of those.

Bitcoin as an inflation hedge

Conceptually, it makes sense that bitcoin would be a hedge against inflation. It is what an economist would call a “real asset”—an asset of limited and predictable supply that is often priced in US dollars. Therefore, if the supply of US dollars is rising, or that of any other fiat currency, then it is likely that bitcoin will appreciate against those currencies, even if its purchasing power were to remain stagnant.

Data suggests that bitcoin is beginning to fulfil this inflation hedge role. Observing its price changes relative to changes in inflation over two-year periods since it was created in 2009, highlights that the relationship is improving, with a current R2 of 0.30 (since 2019). Incidentally, the relationship between bitcoin and inflation is currently better than between inflation and gold.

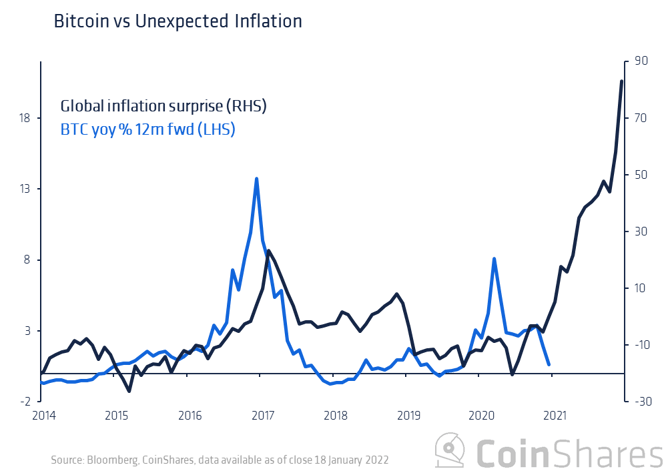

Citi compiles an index that tracks unexpected, or ‘surprise’ inflation, by measuring inflation forecasts versus delivered results. At levels above zero, inflation is higher than expected. Bitcoin also has an early but potentially compelling relationship with unexpected inflation. Our analysis highlights that bitcoin does appear to react to unexpected inflation, rising when delivered inflation figures are higher than expectations.

We appreciate that bitcoin’s relationship with inflation is most likely inconclusive at this juncture as the sample size is quite low. That said, it is interesting to note that as time has progressed, the relationship has been steadily improving, adding credence to the concept that bitcoin is a real asset.

Bitcoin is maturing as an asset

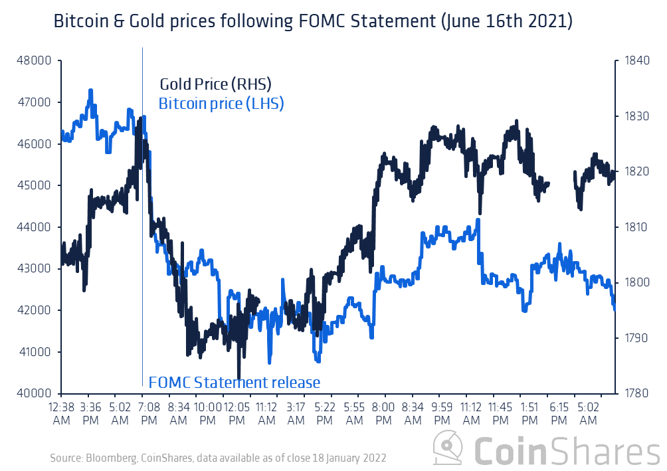

There is increasing evidence that bitcoin is maturing as an asset. After the most recent FOMC statement (5 January) where an unexpectedly hawkish tone was expressed, prices moved in a very similar way to gold. This is highlighting that bitcoin is behaving as investors would expect from a real asset, by appreciating when the US dollar declines and vice versa.

We remain unsure as to exactly what will happen to inflation over the coming 5 years, but we see adding bitcoin and other real assets as a prudent measure to protect portfolios from the tail-risk of out-of-control inflation. What was originally a conceptual idea of bitcoin having inflation protection credentials, is now being proven through increasing investor participation, as evidenced by its improving relationship with consumer prices.