Many will be familiar with ‘Breakouts’ a popular trade entry technique during rising markets. Now we address ‘breakdowns’ for use in a market decline.

“Markets go up the stairs and down the elevator.”

- Breakouts. Buying a breakout is buying when the price rises above an area of resistance, or to its highest in a certain period - popular measures are 52-week highs or all-time highs.

- In a falling market, when price is expected to continue moving lower Breakdowns are the preferred entry technique. Going short at the breakdown is selling when the price falls below an area of support, or to a new 52-week low or record low.

Example trade

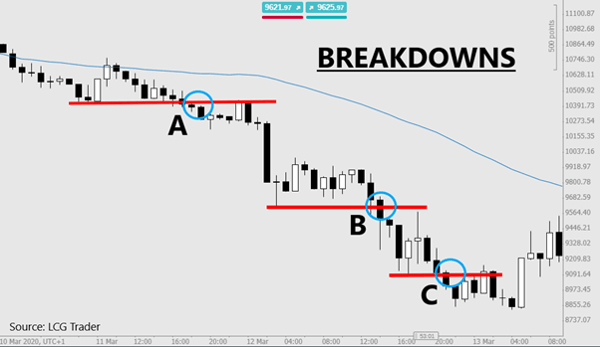

Germany 30 (1H candlestick chart) when the price fell below the critical 10,000 level.

There are 3 clear-cut examples to trade a breakdown in this Germany 30 price downtrend.

Opportunity A. Breakdown at beginning of downtrend. Price first retests the breakdown area then falls steeply.

Opportunity B. Breakdown in the middle of the downtrend. Price falls first then afterwards retests breakdown area, before falling again.

Opportunity C. Breakdown at the end of the trend. Price does not move much further lower before moving above the breakdown area.

Although all trend act differently- the tendency is for the biggest move to happen at the first breakdown (A) because this catches traders by surprise and those who are long the market (buying) react with the most fear/panic. (B) Provides a later but more forecast-able entry once the downtrend has begun but the price does not go as far. Then (C) the third breakdown opportunity is ‘too late’ and price does not follow through much lower because expert traders who were already short the market (selling) take profit and perhaps initiate new long positions.

Read our next article: Top 7 Tweets of the day - 16th of September 2020