Asset manager Schroders is creating a ‘British opportunities trust’ fund to invest in undervalued UK stocks. Time to have a second look at buying British?

Must know

- Schroders is seeking to raise £250m for a new investment trust it will float in London focusing on what PM Rory Bateman calls a “once in a generation opportunity to invest in the future of British business”

- The listing of two other UK-based trusts have been pulled in the last few weeks due to a lack of investor interest

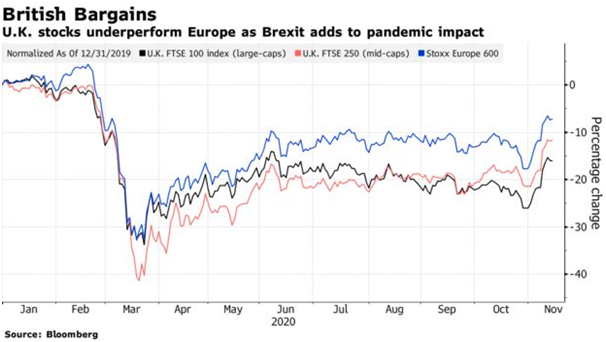

- The UK benchmark FTSE 100 index has fallen 15% this year compared with a 6.3% drop in the Stoxx Europe 600 index, while the mid-cap FTSE 250 index is down 10%.

- Brexit will be finished on December 31 of this year. It is still unknown what (if any) trade deal between the EU and UK will take shape.

What’s happening?

Stocks from the United Kingdom have lagged the rest of Europe since the 2016 EU referendum, owing to the economic, political and currency risk imposed by the event. This underperformance has continued through 2020 and the uncertainty created by the coronavirus pandemic. Domestic UK equities, best represented by the FTSE 250 fell more than the STOXX Europe 600 in March and the FTSE 100 has notably fallen behind during the recovery over the rest of the year.

Chart

The year-to-date performance of the FTSE 100, FTSE 250 and Euro STOXX 600 indices

“Generational opportunity”

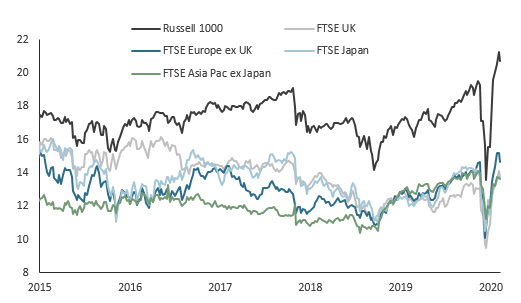

Schroders' Bateman might be over-egging the pudding but the opportunity he is talking about principally refers to valuations. The relatively weak performance of UK equities versus geographic neighbours is directly related to investors being unwilling to pay equivalent prices for equivalent earnings growth.

This chart shows the historical P/E ratios for the Russell 1000 index, FTSE UK, FTSE Europe ex-UK and FTSE Asia Pac ex-Japan.

It can be observed that the valuation recovery for the UK has not yet materialised because the 2020 P/E bounce-back was more pronounced in Europe.

Brexit

The ‘opportunity’ stems from the valuation differential being filled at some point in the near future. Schroders is raising money now for its UK-based funds so it may take several months before the fund - if it comes to fruition - is fully invested.

We do not necessarily need to understand what will drive this change, one need only understand that the UK remains a dynamic economy with strong global companies where valuations should return to the mean.

However, one possible explanation would be the conclusion of Brexit. The economic landscape will continue to change, especially if the UK chooses to diverge in economic policy away from Europe but the uncertainty of the exit will have passed. The passing of the uncertainty by itself encourages more investment and can improve valuations.

Timing

One thing to understand from the Schroders approach to their proposed UK fund is that they will look to acquire new equity from the companies they investment in. They would not be buying stocks in the open market (like you and I might do). The mix will be half public companies and half private equity.

The logic from Schroders is that UK companies have borrowed unsustainable amounts during the pandemic, almost exclusively relying on debt-financing to get them through tough times. It follows that as a recovery takes hold, the companies could look to pay down this debt by selling shares. A flood of new rights issues would dilute any equity investment taken in UK companies today.

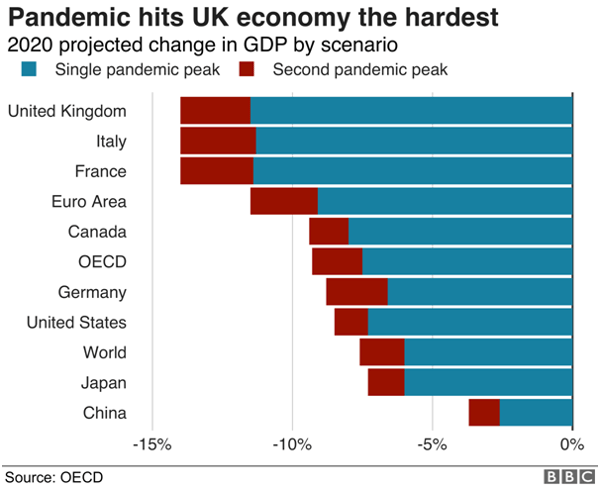

2nd wave

The OECD projects the UK economy will suffer the most because of the pandemic, which did so far play out in second and third quarter GDP figures. If the UK economy falls so far behind, it will be an uphill struggle for companies to grow earnings relative to other parts of the world. However, the soft GDP outlook is arguably already baked into current prices and any investment today means looking out to the next 12-18 month outlook.

How to play it

CFDS

UK100 and UK250

ETFs

EWU iShares MSCI United Kingdom ETF

SRLN SPDR Blackstone/ GSO Senior Loan ETF

FLGB Franklin FTSE United Kingdom ETF

Sources:

Read our next article: Top 7 Tweets of the day - 18th of November