The service is an easy to install API allowing most payment methods to be used on your platform, along with many extra features for lower fees, better execution and detailed data. What's the story of the company and how are they different from the likes of Stripe?

The story of checkout.com

Founded in 2012 by Guillaume Pousaz, a Swiss alumni of EPFL and HEC Lausanne, Checkout.com started with the goal to cut through payment complexities and help businesses challenge status quo and create new transaction opportunities.

They found that the old payment method was too complex, that the system was not agile, nor optimized for global businesses. In the same year of their founding, they were authorized as a payment institution, and quickly became a principal member of Visa, Mastercard, Union Pay, Diner and Discover.

As of 2018, the company had over 200 employees in 8 offices. The following year saw them raise $230 million in a record European Series A, and they grew to over 500 employees across 10 offices. 2020 was also quite an active year for Checkout.com, as they acquired French start-up ProcessOut as well as Australian start-up Pin Payments. Finally, they raised $150 million in Series B funding, which tripled their valuation to $5.5 billion. In the same year, the London-based company managed to convince some of the world's largest leading companies and added over 500 merchants to their client base in the last 12 months including Grab, Revolut, Careem, Glovo, Robinhood, Fartech, Klarna and Remitly. Their transaction value has increased 250% year over year as the pandemic fueled online transactions.

As of today, Checkout.com supports over 150 currencies and has a direct access to Visa, Mastercard, American Express, all major international cards as well as most popular alternatives and local payment methods. They also have large clients, such as TransferWise, Deliveroo, EasyGroup and Samsung.

Guillaume Pousaz in his offices (Source: Checkout.com)

The service of checkout.com: making online payments simple

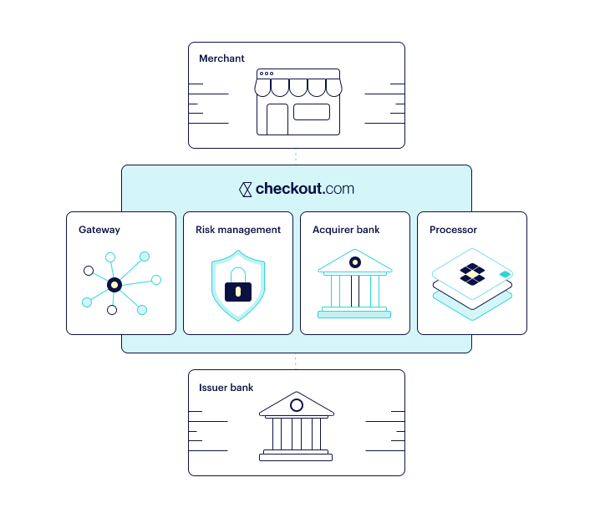

Checkout.com offers direct access to domestic acquiring across payment methods and geographies. It is an all-in-one payment technology which eliminates the need for intermediaries. The company proposes a single and unified integrated platform which gives businesses better performance and more control through advanced data features, fraud, and risk management tools as well as comprehensive reporting.

The service includes:

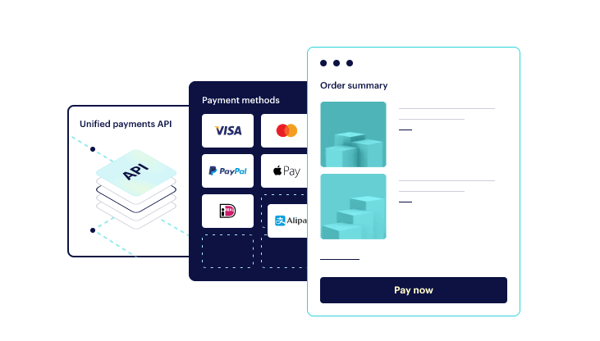

- A Unified API: once built, it can connect to everything. All payments are brought together through one integration, making the company ready for anything. Not only do companies get an edge with a market-leading technology, they're also creating a simplified customer experienced and are staying ahead of regulations, risks and frauds. That is a more global coverage, the streamlining of payment processes and a detailed reporting of what's happening.

- Integrated payment solution: you can build it the way you want. The customization of the payment process is seamless and easy. Whether you have a pre-built e-commerce payment platform, a customized frame on your website, payment through mobile, they support it all. If you choose not to host your payment service, they even offer to do it for you.

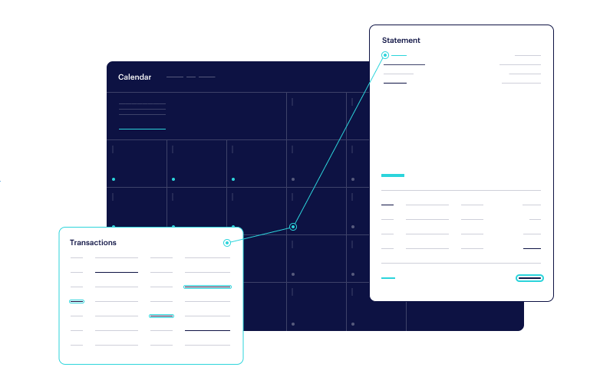

- Reporting and data: a granular picture of the payment process. The detailed and comprehensive reporting feature helps businesses understand every boost and decline in their conversion, which may guide them through complex process transformation and updates. Information is easily accessible, and there is even an option for real-time reporting to make sure everything runs smoothly. The system also offers ad breakdown of all fees associated to pay-outs and an automated reconciliation.

- International Coverage: Checkout.com processes over 150 currencies, processes payments in over 50 countries and has nearly 20 settlement currencies. This makes for a much better acceptance rate, lower fees and the avoidance of expensive conversion rates. All major debit and credit cards are accepted, as well as most popular local payment methods and digital wallets.

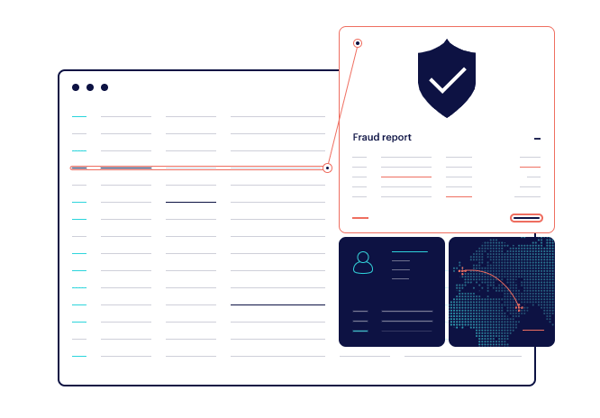

- Fraud Protection: cutting edge tools to prevent fraud and taking care of regulations updates so you do not have to. Their machine learning models are trained on millions of transactions to help them detect any form of fraud. Businesses can set custom-built rules according to their preferences and fraudulent payments are automatically stopped by smart algorithms. The company also takes the responsibility of complying with all payment regulations and their updates.

How does Checkout.com differ from Stripe?

When TechCrunch asked this question to Checkout.com's CEO, Guillaume Pousaz, it all came down to a different philosophy and market approach. “We only do enterprise. We really only work with the big merchants. There are a few exceptions here and there but it’s mostly enterprise-only and it’s purely online,” Pousaz said. “I once met Patrick Collison [Stripe CEO] and I joked with him. I said, ‘you might have a million merchants, I have 1,200 merchants but I know every single one by name and they all process tens of millions every year.’ So I think it’s just a different business.”

In other words, where Stripe is aiming to help everyone, Checkout.com is focused on offering an even superior value proposal to bigger fishes.

A product orientated, frugal and prudent philosophy

While Checkout.com is cash-rich right now, it is not thanks to luck. The company has been around for 10 years now and reached profitability back in 2012. Since the beginning, Checkout.com has been very cautious regarding its spending.

They want to remain as lean as possible, and although they don't challenge the "raise a lot, spend a lot" model, they decided to embrace cautiousness and frugality as their main finance principles. No spray and pray for Checkout.com.

This philosophy also explains why the company focuses almost exclusively on its product development. Two thirds of the companies are dedicated to making the service better, while only 13% are working in sales, which is rather low compared to industry standards.

The funding of a venture division and potential IPO

Following the footstep of other successful start-ups like Stripe, Checkout.com is also launching its own venture arm. Its first investment was made into a Singaporean payments company called Thunes, investing "double-digit" millions.

They are examining different investment alternatives, and prefer investing quietly, building a portfolio, especially when founders will not want to sell their company entirely (yet). They now have a dedicated team tracking around 30 potential fintech investment targets.

In addition to this portfolio-building activity, the company also seem to have a clear "acquire to hire" strategy, with the acquisition of ProcessOut and Pin Payments in 2020. The company states that they are not paying for the revenue but are looking to invest in talents: “We don’t buy revenue; we pay for the team…You’re not going to see us drop 200m-300m to buy something [we could build].” The company is said to have spent $40-$50 million across the three deals.

Checkout.com is also considering a US listing, according to the CEO. Nothing is certain yet, but he ensures that if they do go public, it is highly likely to be on the NASDAQ rather than the London Stock Exchange.

Sources:

Europe’s unexpected new fintech investor: Checkout.com, in Sifted

What makes Checkout.com different from Stripe, in TechCrunch

Article images are all sourced from the Checkout.com website