Mastercard plans for an open banking future where crypto payment transaction data may just equate to corporate survival.

CipherTrace: compliance as a service?

CipherTrace, like its name suggests, traces or tracks activities happening on various blockchains. They sell a capability to de-anonymize transactions (not at the individual level) that go from exchanges through banks and they find out who the illicit activity comes from—money laundering, criminal activity ransomware, the usual. Their clients are law enforcement, banks, or crypto exchanges.

How do they accomplish this? Via a layered technology that is embedded in about 800 blockchains, cryptocurrencies and virtual assets. They track the good and bad activity. It’s the automated crypto compliance software company and they have 6 years of data stored. From this data, CipherTrace CEO Dave Jevans has come out saying that only 1-2% of crypto activity is actually criminal.

After a $27M raise in June backed by Third Point Ventures, and after having MasterCard as a client for some time, the credit card giant decided to bring CipherTrace on board. This also comes during a time when Chainalysis, CipherTrace’s rival company raised $100M in a series-D round valuing the company at $2B-$4B. It is unknown what CipherTrace is valued at now, but with the recent $27M raise one might guesstimate a range north of $100M, and south of $500M.

Data is the new status quo

Major payment networks are going to have to participate in the crypto landscape at one point or another. With the legitimization of crypto with things like the price surges of Bitcoin and Ethereum, and El Salvador legalizing BTC as a legal tender, Mastercard realizes it needs to prepare protecting 20,000 banks and 500 million customers that use payment technology. Ultimately, it’s a card network acquiring a forensic compliance startup.

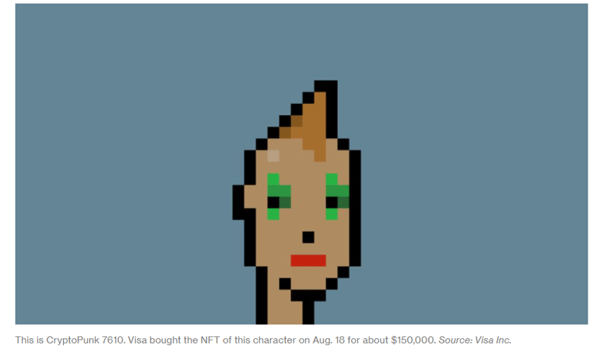

But also, this is a broader competition between Mastercard and Visa. In a sense, this acquisition is Mastercard’s way of stabbing at Visa’s recent move on CryptoPunk, a NFT marketplace where Visa bought CryptoPunk 7610 for $150,000. The CipherTrace move also follows Mastercard’s Finicity acquisition last year, e-billing solutions, clearing and instant payment services buyouts and its Aiia purchase last week. Mastercard is pathing its way into Open Banking, and the financial warzone with Visa.

The need for access to the open banking world was made clear by Visa when they tried to buy Plaid, and instead turned to Swedish-based Tink (connecting 3,400 banks). There is clearly a competition for leadership in this space now that Mastercard owns Aiia (2,900 EU banks) and Finicity (US market). Data is more important than money itself right now.

Open banking and crypto

Payment firms like Mastercard have to get involved in global financial value networks, or they might risk being disintermediated by a next generation technology. Card networks actually don’t have much of a choice in this regard. In the European Union for example, banks are mandated to transition to open banking in what is called the second payment service directive i.e., PSD2.

Payment companies are central in the directive as they sit in the middle of transactions and Mastercard is creating its presence in the open banking space by providing the payment network with platforms for data connectivity and infrastructure, where data privacy and security measures take center stage (thus CipherTrace for the crypto end of things).

Mastercard gains from money going digital

With CipherTrace, a few things come to light about their strategic take on the future of finance. They will have a better framework to integrate blockchains into their ecosystem. If there is a compliance structure that ‘’layers’’ itself into blockchains and cryptos and flows of funds that is managed by Mastercard, then your network becomes more valuable to use. Think of CipherTrace as a net or filter for all the future digital funds to go through.

Mastercard also positions itself to support banking efforts in all matters of digital assets thus digging its ties deeper yet with established capital. CipherTrace in other words derisks bank activity in crypto and be the ally for any risk-oriented depository parties.

Now, Mastercard also gets to spy on all crypto payment activity which is probably the most valuable aspect of this deal. This is because by observing the large number of nodes and data of major blockchain assets they build a super ecosystem making their network more in tune with the next generation of finance.

Conclusion

- The overall message from this deal seems to be that there is a major flow of funds going into crypto and blockchain applications and that data access is becoming increasingly more lucrative for the long term.

- Mastercard sees this, and is preparing for a certain future scenario. A possible future scenario where open banking becomes more important than ever and where being the company that can provide the government with this data will translate to more earning power.