Inflation, rising interest rates, and falling stock prices have added pressure on the consumer. Could Black Friday sales offer investors clues about what to expect of the holiday shopping?

The day following Thanksgiving, known as Black Friday (25th November) is one of the busiest shopping days of the year, particularly prominent in the US. Giant retailers such as Walmart and Amazon offer large discounts to attract consumers with limited time offers for a variety of goods. It is also followed by Cyber Monday (28th November) where many companies offer deals online.

Nearly 13% of all retail sales in the US occur between Black Friday and Christmas. As a result, investors give Black Friday sales a lot of attention, as it could be a preview of what’s to expect from the holiday season.

State of US consumer spending

The state of consumer spending can be analysed through several lenses such as retail sales, personal savings, but also by identifying changes in consumer spending patterns.

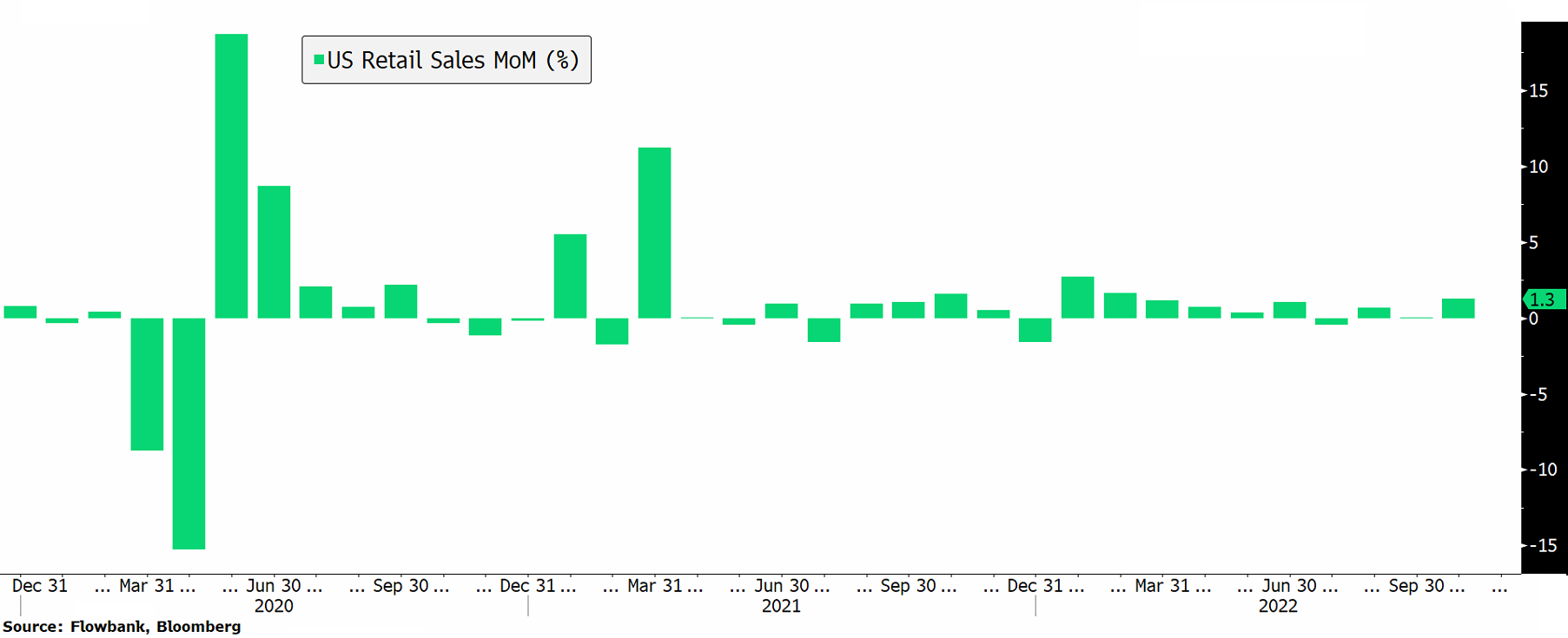

US retail sales gained solidly in October, increasing more than expected, as consumers stepped up purchases of motor vehicles and a range of other goods.

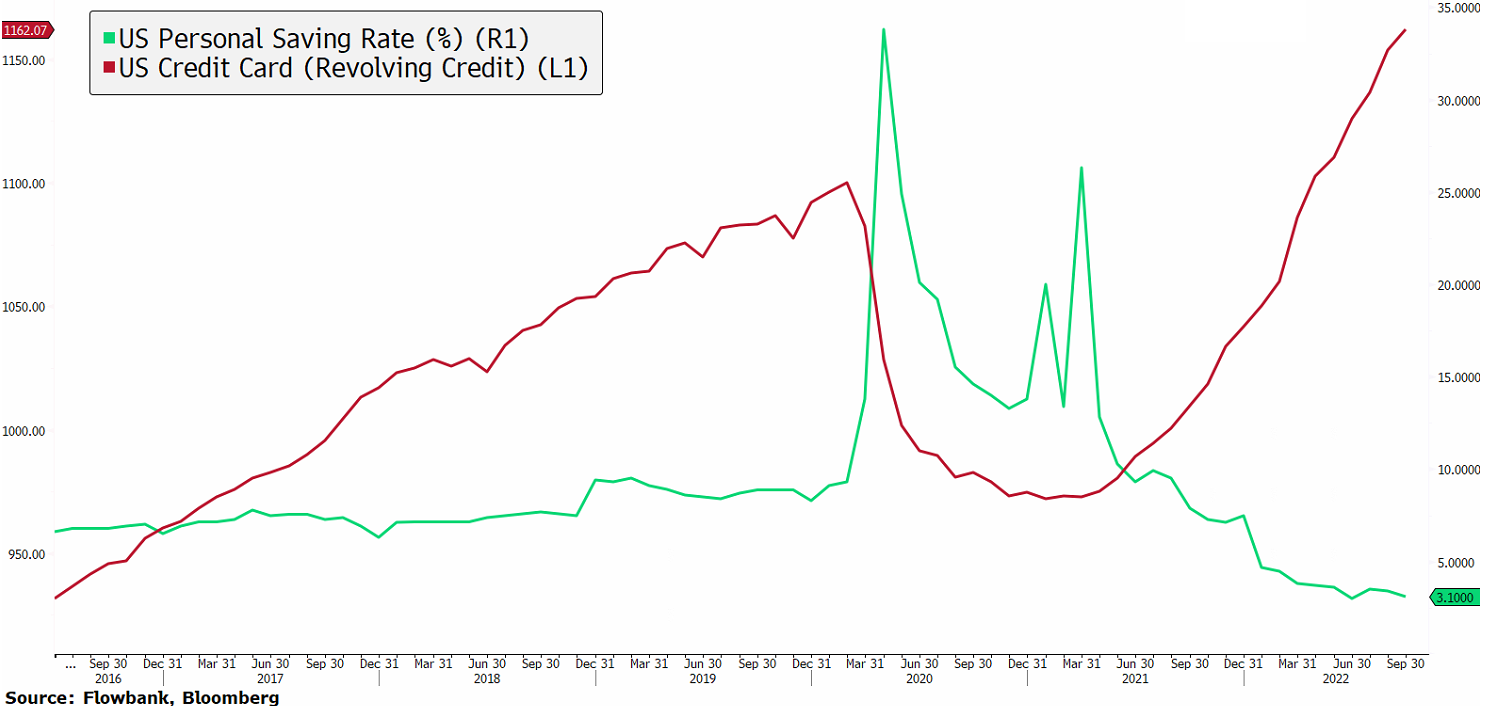

According to the US Federal Reserve, since late last year, households have spent about one-quarter of their excess savings, as the personal saving rate has dropped below its pre-pandemic level of 9.3% in February 2020 to just 3.1% in September this year. It is worrying as it suggests that most consumers do not have much financial cushion to absorb the price increases caused by inflation without cutting back on unnecessary expenses.

Unpaid credit card balances in the US, which have surged 15% year-over-year, the most in 20 years, are also suggesting that lower-income consumers are struggling.

Insights from several companies are suggesting:

Strong resilience for high-end shoppers

Earnings reports from luxury goods houses such as LVMH, Hermes, and Richemont show that categories aimed at higher-income shoppers remain very resilient. Nonetheless, still, some luxury brands such as Ferrari have noted some demand is shifting to lower-priced models, versus last year.

Travel demand has surged this year and the trend continues to be encouraging as we enter the holiday season. But the holidays will test consumers’ spending priorities as even the higher-income shoppers may face trade-offs between making expensive purchases or spending on trips and entertainment.

Consumers are finding cheaper alternatives

A reported 53% of US adults have changed their eating and drinking habits due to inflation (Barkepedia). McDonald’s recently said customers are ordering cheaper options cutting out combos. The giant fast-food chain also noted some higher-income customers are now eating at McDonald’s as a cheaper alternative to fine dining.

Walmart, known for its mantra of “everyday low prices” for its groceries, is attracting more shoppers and new customers, including higher-income households. It said 75% of its market share gains for groceries in the last two quarters have come from households with an annual income of more than USD100K a year. Walmart continues to nurture its reputation as a discounter, as consumers increasingly cut their spending budgets. For instance, for Thanksgiving, it will hold down the price of turkey and ready-to-eat macaroni and cheese, to last year’s level. In that way, budget retailers and other consumer staples could continue to do well, even as consumers’ budget shrinks.

Durable goods sales such as electronics and sporting goods should struggle more as Target’s most recent earnings report suggests. Consumers will most likely prioritise groceries and gas, cutting back on unnecessary expenses.

How Thanksgiving and Black Friday affect stocks

Market sentiment tends to improve during the period of Thanksgiving to the New Year. Strong Black Friday sales could move sentiment in either direction, to a certain extent, but in the past, it has particularly benefitted stocks of retailers. In fact, most retailers saw their stock increase recently, following the better-than-feared quarterly earnings report.

However, investors should keep the crucial dates for US inflation data in mind. The PCE, the preferred inflation index of the US Federal Reserve, will be announced on December 1st, and the CPI on December 13th.

The US Federal Reserve will release its interest rate decision on the 14th of December, which could also add to volatility and possibly add further pressure on consumers.

Conclusion

Consumers still want to spend this Christmas season despite worries about inflation, which is recently showing signs of easing. Investors should be able to get a sneak peek at where consumers will spend their money this year during Black Friday shopping. As the economy weakens, staples (groceries and other necessities), budget stores, and well-known brands that target consumers with higher incomes should continue to perform well.