With travel numbers having recovered from Covid-19, the travel industry could be set to benefit this year, particularly from people prioritising travelling and visiting family. With strong bookings, could travel stocks see a holiday boost?

The busiest travel period of the year is the week between Christmas and New Year, with nearly 120 million people travelling in the US alone. During the roughly 10-day periods, many people will travel by air and stay at hotels and resorts. In addition, a survey showed about 25% of American travellers are planning to take a dream vacation by March 2023, suggesting the outlook for travel and leisure next year could be robust.

Are airlines stocks a buy?

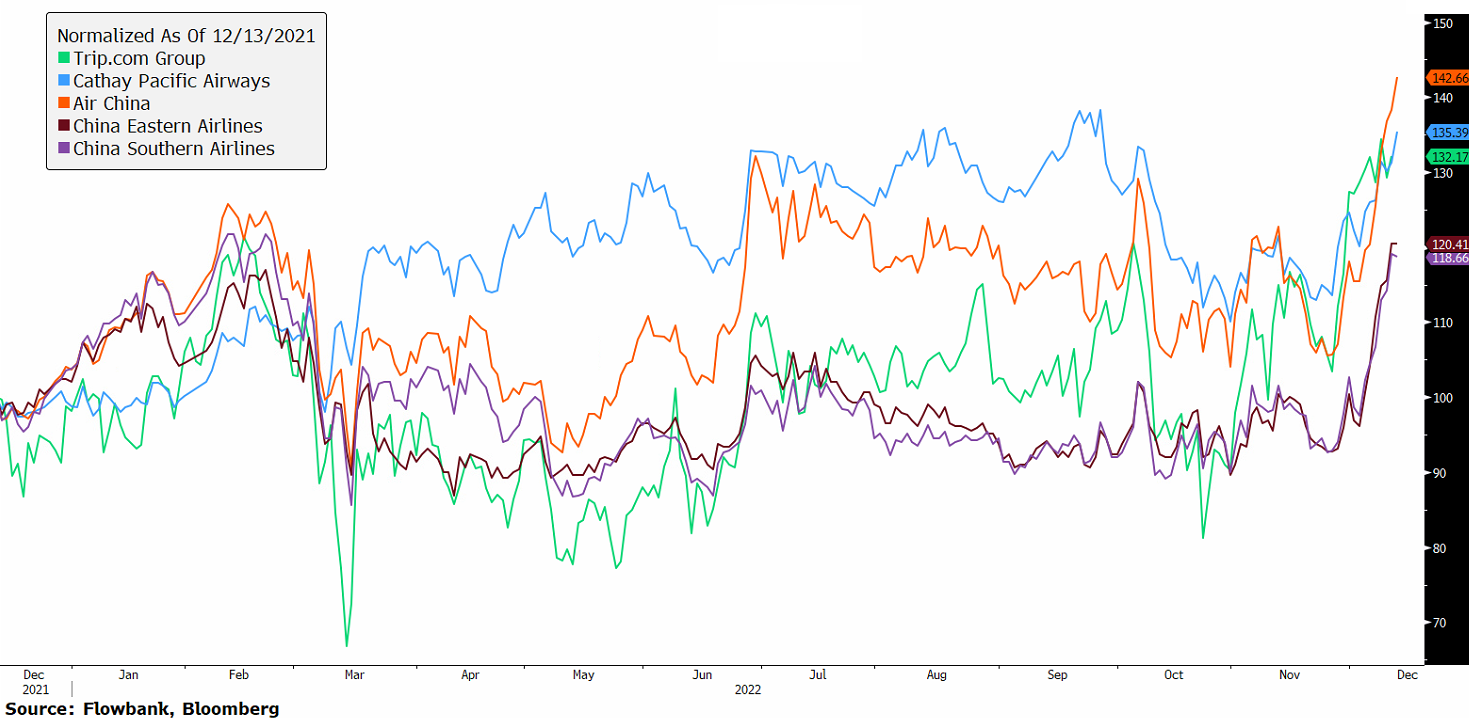

The aftermath of the global pandemic continues to drive more people to purchase airline tickets. In the US, 70% of Americans are looking at travel as a reward after enduring lockdowns and in China, as the country is re-opening, a similar recovery in air travel numbers could potentially repeat. In that sense, Chinese airlines such as Hong Kong-listed Cathay Pacific have jumped recently on the enthusiasm of gradual lift of Covid travel restrictions. Nasdaq and Hong Kong-listed Trip.com (TCOM) also saw its shares recover considering China lifting travel restrictions.

In the US and Europe, travellers have long emerged from the pandemic but nonetheless, airlines have struggled because of difficulty in finding staff and managing costs due to high energy fuel prices and inflation.

Looking at technical analysis, the US Global Jets ETF (JETS) could be on the merge of a breakout on the upside if it managed to break above its descending channel since 2020.

Traders will need to monitor guidance numbers during quarterly earnings and search for any hints of deceleration that could jeopardise the positive outlook.

Are hotels stocks a buy?

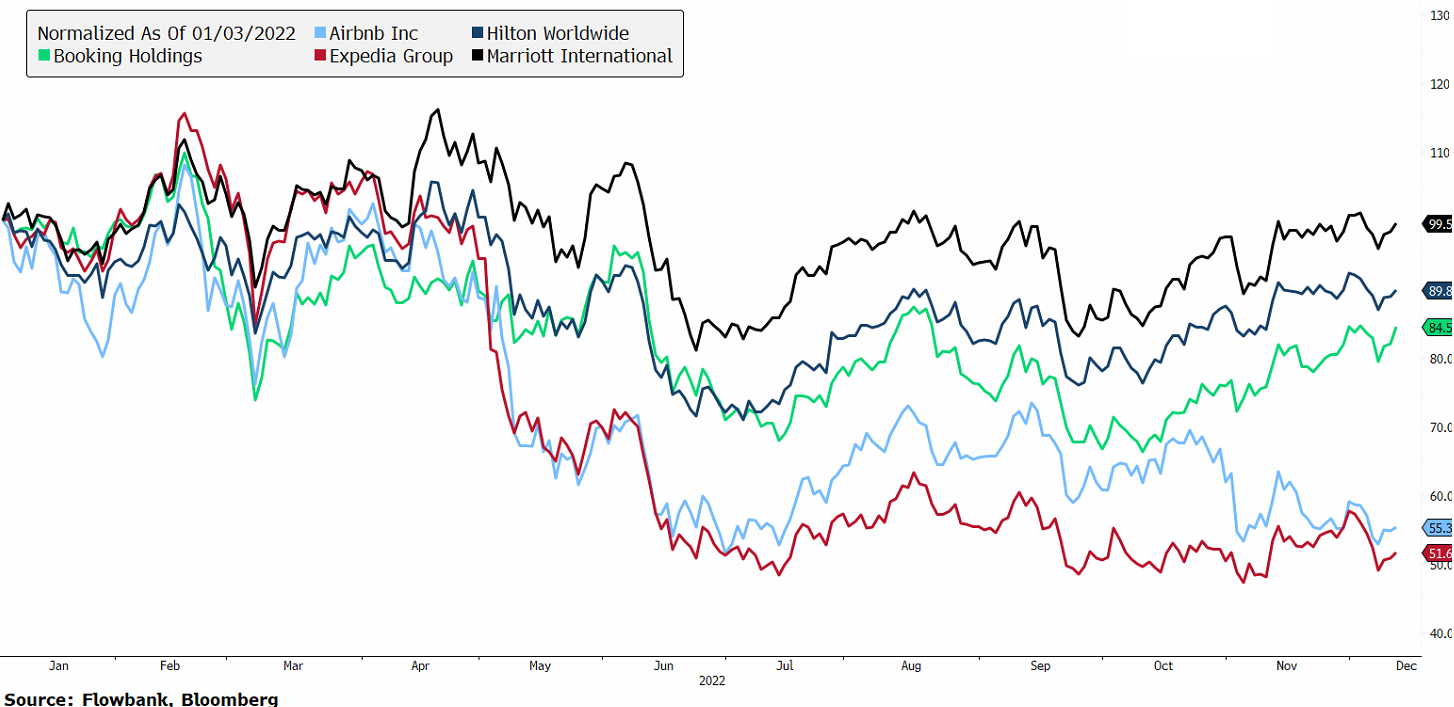

Top hotel brands such as Hilton, Marriott, and Hyatt could be some of the beneficiaries of consumers asking for more travel and holidays. But not only, platform businesses such as Booking.com, Expedia, and Airbnb should benefit from leisure and holiday spending.

In last, hotel REITs could also present opportunities for more stable dividend income and given they have a history of being well-managed. Some of the top names in the US are Apple Hospitality (APLE), Summit Hotel Properties (INN), Park Hotels & Resorts (PK), Hersha Hospitality Trust (HT), and Pebblebrook Hotel Trust (PEB).

Are cruise line stocks a buy?

Cruise lines own and operate cruise ships in various destinations worldwide, offering all-inclusive packages often booked well in advance. The largest cruise lines include Royal Caribbean Cruises (RCL), Carnival (CCL), and Norwegian Cruise Line (NCLH). Royal Caribbean is the strongest one in the lot, equipped with a stronger balance sheet. Its entire fleet has returned to service since June. In the third quarter of 2022, it delivered positive EBITDA and operating cash flow for the first time since the pandemic began. Forward bookings for 2023 are also encouraging, higher than 2019 levels.

Conclusion

As we wrote here about travel stocks making a comeback in June, given the strong travel bookings it could be that travel and leisure stocks extend their gains in Q1 and beyond thanks to a holiday boost. But investors should stay alert for signs of a looming recession that could further pressure financial assets and cause consumers to delay spending and travel plans.