Want to trade large batches of security away from the public eye on exchanges such as the New York Stock Exchange, or know how this is possible? Read on.

What are dark pool exchanges and dark pool trading?

Dark Poolexchanges are alternative trading systems that emerged in 1979 when the United States passed a law that allowed securities to be traded off the exchange it was listed on. They are a private exchanges for trading securities. Dark Pools were normally designed only for financial institutions so that they could carry out large orders by institutional investors outside the public market. The goal was that the movement could be seen only at the end of the day, so that companies and other market participants did not have to show their intention publicly. In 2010, the volume in the pools amounted to 16% of the total US stock market and rose to 40% in 2017. These are large trades and the trading volume is as those you would find in a traditional market.

On the other hand, dark pool liquidity refers to the trading volume created by institutional orders on an alternative trading system.

Before electronic trading systems, dark pool trading was done by brokers, face to face, outside trading hours.

To illustrate, say you own 10% of a company and want to sell it. If you go on the public market, by the time you finished selling your shares, you will have made the stock crash. Dark pools could be seen as entering a pitch-black room. You go in with your order and if you bump into someone willing to buy a large volume of the stock, you make the transaction and no one will know about it, so the price on the public exchange will not move. This maneuver avoids over-negative or -positive signals that can disturb the market.

The “dark” term comes from the fact that the investor are blind and cannot see the order book with the volumes and price levels being currently operated.

The different types of dark pools and institutional investors

- Broker – dealer – owned : setup by large brokers, derive price from order flows and get an element of price discovery (actors in the market making the price by matching supply and demand). Credit Suisse’s CrossFinder or Goldman Sachs’ SIGMA X are known examples.

- Agency broker or exchange owned: no price discovery, prices are derived from exchanges. NYSE Euronext is one exchange owned dark pool.

- Electronic market makers dark pools: held by independent operators like Knight Link

Pro and cons of Dark Pools

The largest advantage of dark poolsand dark pool trades is the diminished market impact of the orders and lower fees. Indeed, you don’t pay the exchange’s trading fees and you can often place orders on the “bid-ask” midpoint, meaning you don’t incur the full spread. For example, if stock X is trading at 80.00 - 80.10 on the public stock exchange, you can often place your order at 80.05 in the dark pool. You can also place a bulky limit order and let it work in the pool.

One of the risks is that with the increase in popularity of dark pools, prices on the stock market could not reflect the real prices anymore. If a large institution sells 10% of the stocks in a dark pool, it will have little market impact, on the other hand, retail investors could be paying too much on the stock exchange for a share that could soon collapse, as the devaluation that would have naturally happened, did not.

Furthermore, as you are blind in the pool – as its name suggests –, you are not assured to have been closed at the best possible price. Indeed, if you trade in a broker-owned dark pool against the brokers’ own traders, a conflict of interest could arise. The brokers could also have sold access to the dark pools to High Frequency Traders (HFT) who can front run the client’s orders, thus resulting to the same price as on the stock market.

Dark Pool Pinging

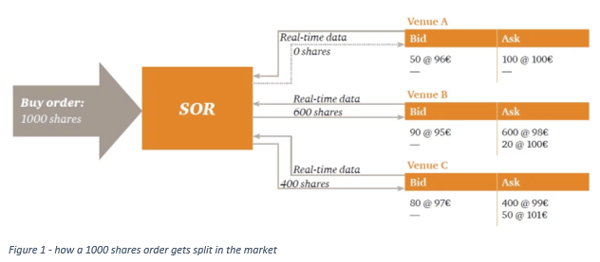

High Frequency traders engage in what is called in their lingo as “pinging” the pools. Traders use algorithms to break their large orders in many small chunks to be sent to the market:

Figure 1 - how a 1000 shares order gets split in the market (Source: Value Walk)

Figure 1 - how a 1000 shares order gets split in the market (Source: Value Walk)

You can see that the algorithms go in different exchanges to guarantee the best price for the client but also to limit the market impact.

Orders are not only split between different exchanges but also between exchanges and dark pools. HFT place bid and ask orders on every security, of about 100 shares/lots in the pools and wait for an execution (a ping) to try and discover large hidden orders. Once the prey is spotted, HFT are quick to go and buy most the security available and then and resell it straight away to the trader (in the case of a large buy order). Pinging is also referred as “baiting” as the purpose is to push institutions with large orders to reveal their hand.

If you want to learn more about HFT, I would recommend reading Flash Boys by Michael Lewis.

New regulations and Key Takeaways on Dark Pools

The SEC (Securities and Exchange Commission) announced new regulation in 2018 to protect clients by adding operational transparency rules. Information to disclose include fees, procedures to protect secret trading information and deals with subscribers of the trading venue. These regulations followed fines imposed to dark pool operators for abuses. Indeed, Deutsche Bank paid $37 million in settlement over an investigation about how they sent orders to their dark pools.

Institutions might only be allowed to trade for their clients in pools if they can have a cheaper price than on the stock exchange.

Sources:

SEC votes to improve oversight of dark pools, in the Financial Times

Understanding High-Frequency Trading Terminology, in Investopedia

10 Things You Need to Know about Dark Pools, in Dummies

What is a Dark Pool? in Corporate Finance Institute

An Introduction to Dark Pools, in Investopedia

AN OBJECTIVE LOOK AT HIGH-FREQUENCY TRADING AND THE FLASH CRASH, in Value Walk

Read our next article: Top 7 Tweets of the day - 9th of November 2020