Is Thematic ETF investing for you? Explore this short review article to gain some insight into the world of specialized ETFs.

Thematic ETFs Overview:

If you have a special interest in an industry or trend or if you have a set of values that you would like your investments to reflect, you have access to more than 800 funds with over $180 billion in asset under management that will help you achieve this. As you have read in FlowBank’s Space Investing article about Catherine Wood’s ARKX fund, you can invest in her Space Exploration ETF soon. Because thematic investing is a non-diversified portfolio of stocks, it is also known as specialized investing, the opposite of broad-based investing.

Let us take Clean Tech as an example. The underlying companies that would compose a Clean Tech ETF are relatively close in terms of business operations, competition and buyers and sellers. In this example, companies like Marvell (MRVL), Plug Power (PLUG), First Solar (FSLR), could be chosen because they work on similar goals like clean batteries, storage, and solar energy. Together them make up the patchwork of a Clean Tech underlying.

However, this increases a portfolio’s risk (beta) because one industry shock would probably hinder all three firms and punish the investor. If each of the three firms belonged to separate industries, the risk would be diluted, but so too could the returns. It is crucial to study the ETF’s financial reports before jumping in and learning about where the revenue is coming from. Ask yourself these questions:

- Are most returns coming from a small portion of the portfolio?

- What is the concentration of the portfolio by sub-category?

- How high are the current stock prices and ratios of the underlying?

If you want to learn more about Thematic ETFs, click here.

Has Thematic Investing Seen a Lot of Success?

Less than half of the thematic ETFs started a decade ago still exist today, but this is not stopping the influx of new thematic ETFs launches. This influx could be because of media-induced hype which generate quick fee revenue for Funds. Such Funds however, usually close if assets fall under $50 million after three years, and many do as the theme’s interest fades. Examples of specialized funds that closed this year are SLIM and DIET who focused on obesity, and healthy eating trends, and political ETFs like the Republican Policies Fund (GOP) and the Democratic Policies Fund (DEMS).

Not all themes are created equal, however. The Robotics, and automation theme has seen great success in the likes of the ROBO and the BOTZ ETFs. Other such winners are ETFs like PHO, who since 2005 have seen positive gains in the theme of Water and Alternative Energy. Not to mention Catherine Woods’ great success in her ARK ETFs. But would you decide to invest now when ARKK is at the highest point simply because it has seen recent success? Read on.

Thematic ETF Investing Caveat for The Rational Investor

A recent study entitled Competition for Attention in the ETF Space, conducted at the Fisher College of Business in Ohio, suggested that while thematic ETFs are one of the most remarkable financial innovations in the past thirty years, they often times lead to negative risk-adjusted returns, at least on average. Poor performance of specialized ETFs is accompanied by negative capital flows suggesting that investors who use ETFs as a hedging tool are disappointed by poor returns. Institutional investors are also much less invested in specialized ETFs than they are in broad based ETFs as opposed to retails clients for which it is the inverse.

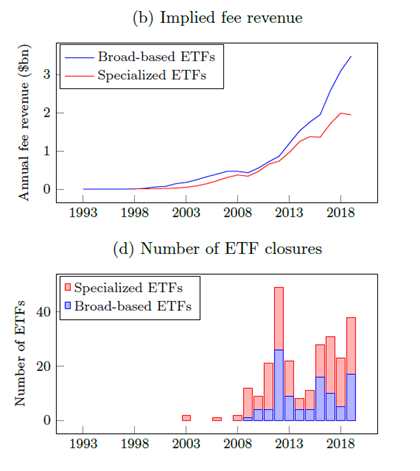

Such ETFs make money as a business in part through fees. Despite fees, the number of ETFs closures since 2008 has increased tenfold adjusted for the 2008 crisis and excluding Chinese outfits which begs the question; are fees really an engine to thematic ETFs launches?

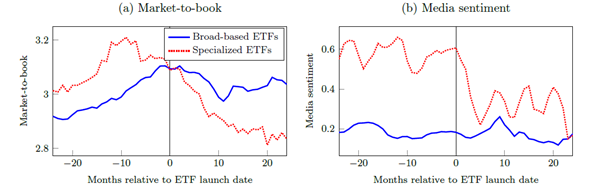

The study highlights that a mediatic hype factor behind thematic ETFs does not negate the fact that they usually consist of overvalued underlying assets (high market-to-book, short interest, and high P/E ratios), but funds clearly attempt to capitalize on this hype. Underlying stocks usually have benefited from a recent uptick in performance and can induce retail investors to neglect risks from undiversified portfolios and erroneously conflate present performance for future gains.

The study showcases an ETF return model that factors in market sentiment to derive a relationship between ETF launch time and the beginning of a fall in risk-adjusted returns as well as market-to-book values for the underlying assets. Post launch, the hype typically falls, especially for specialized ETFs, and so too do market-to-book values as seen in the graph on the left below. Broad based ETFs remain much steadier.

The conclusion of the study states that specialized ETFs deliver on average a negative -4% alpha a year and attract retail and beginner investors who may not be aware of the low risk adjusted returns, and fees associated with ETF machines. According to this research, thematic ETFs add, and I quote ‘‘no value to investors’’. [Z]

SOURCES:

[Z] Ben-David, Itzhak and Franzoni, Francesco A. and Kim, Byungwook and Moussawi, Rabih, Competition for Attention in the ETF Space (January 14, 2021). Fisher College of Business Working Paper No. 2021-03-001, Charles A. Dice Center Working Paper No. 2021-01, Available at SSRN: https://ssrn.com/abstract=3765063 or http://dx.doi.org/10.2139/ssrn.3765063