It's not all about buying low and selling high! Shareholders earn income through cash dividends. In this guide we explain how to get started income investing with stocks.

- What is a dividend?

- Is dividend investing right for me?

- How do dividends work?

- How can I grow my dividends?

- Reinvesting dividends & compound interest

- How to pick dividend stocks

What is a dividend?

You can think of a dividend as a reward for being a loyal shareholder! Companies offer the reward to shareholders as an incentive for them to buy and hold shares of the company.

Another way to think of it is that the company is giving a percentage of its profit back to its de facto owners. It not obligatory to pay a dividend and many companies choose not to pay one and instead reinvest the profits in the growth of the company. The Board of Directors decides the amount of the dividend and it is then approved by shareholders.

Is dividend investing right for me?

The idea behind investing is to earn steady cash income from your stock ownership. The dream scenario is that your dividends can be a major source of your income, and in retirement can be the only source of income. If dividend investing is done correctly, it can bring your retirement date sooner and/or increase your income when retired.

Investing for dividends does not have to mean waiting for retirement. The dividends are paid quarterly and can be collected straight away by the shareholder. However, we will shortly explain the benefits of reinvesting the dividend.

A distinction is often drawn between dividend investing (or income investing) and growth investing. Investing for growth means buying the stock and ideally selling later at a higher price and earning the difference between the buy and sell price. In reality, investing is not so black and white and actually some of the best stocks both grow and pay a dividend.

How dividends work

Most dividends are paid in cash on a quarterly basis. But other variations exist such as being paid in stock or being paid annually, monthly or on a special one-off basis. Your broker will typically offer you the option of accepting the cash into your brokerage account or automatically reinvesting the dividend payment back into the same stock.

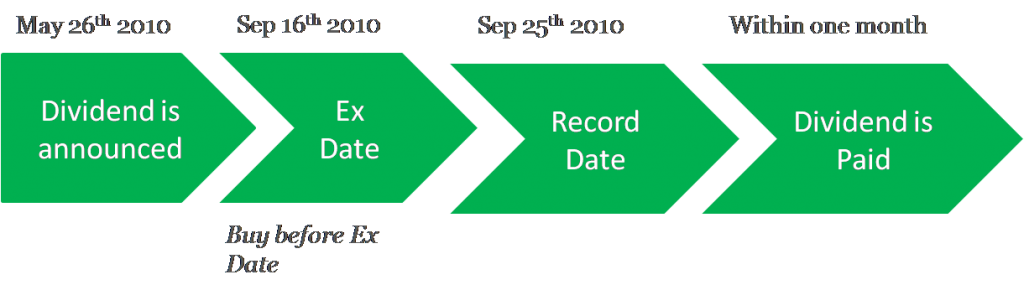

There are some different dates to keep in mind in the calendar of your dividend payout.

The first is your trade date, i.e. when your bought your stock. The second is the settlement date because although you may have placed the trade on one day, the trade only settles on the next business day, known as T+1. Your trade needs to have settled for you to be eligible for the dividend.

The third date to consider is known as the record date, that is when a company’s board of directors choose to declare the dividend. The fourth date is the ex-dividend date, which is set by the stock exchange and is usually one or two days before the record date. You must own the stock before the ex-div date to qualify for the dividend. Hence the name! if you buy the stock on or after it goes ex-div, you are buying the stock excluding the right to the upcoming dividend payment. Saving the best ‘til last is the payment date, when the divided is actually paid.

You will notice a stock price drops on its ex-div date because market makers are adjusting the price of the stock. Since it no longer includes receiving the forthcoming dividend, the stock is worth less by the exact amount of the dividend.

How can I grow my dividends?

There are two simple ways the value of your dividend can go up:

- The company raises the dividend

- You own more stock

These two elements should form a part of your dividend investing strategy. That is to say, you need to invest in a company that raises its dividends and you need to increase your stock holdings on a regular basis. One way to own more of the stock is to reinvest your dividend payments.

Reinvesting dividends

Without getting too soothsayer – this is how the magic happens with dividends. It is through the power of compound interest, what Einstein called the eighth wonder of the world.

It is a simple idea. Instead of the cash dividend being paid into your bank or brokerage account, the cash is automatically reinvested into the stock. This can be done through a DRIP (Dividend Reinvestment Program) straight through the company or via an agreement with your brokerage, which might involve a transaction fee.

"But I want the money now!" Of course, we’d all like to enjoy our passive income from our dividends now but there are some major incentives to reinvest them instead. By reinvesting, we are increasing our stake in the company and so increasing the size of dividend we are entitled to next time.

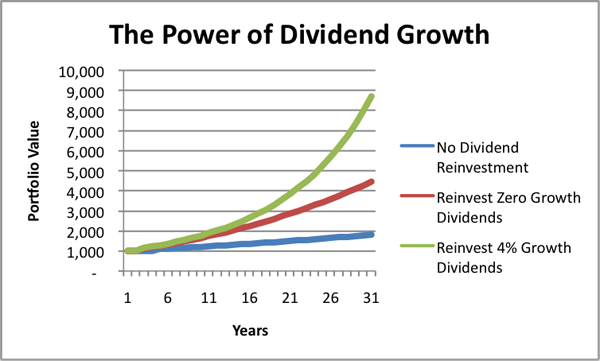

I can sense you are not convinced! Let’s look at a chart I prepared earlier…

Source: Seeking Alpha

When looking at the price history of an investment, there are two versions to consider. The ‘price change’, which is simply the change in the share price and the ‘total investment return’, which includes returns from dividends.

The above chart assumes average annual share price growth of 5%. An investment of $1000 would double in 30 years to $2000 when dividends are taken as cash. However, that same $1000 would return $4000 if the dividends are reinvested. The same investment again would increase to $9000 if the company raises the dividend by 4% each year.

How to pick dividend stocks

There are 7 important considerations for when to invest in a dividend stock (all helpfully listed below!) The idea is that none of these numbers should be taken in isolation but considered holistically as a group to give a ‘weight of evidence’ approach to whether the stock will make a good income investment. In essence, as many of the below factors want to back each other up to tell you if you’ve found a good dividend stock.

1. Dividend yield

The dividend yield is how much you are getting paid in dividends for every dollar invested in a stock.

For example: You own 1 Apple stock and each share is worth $100 so your total investment is worth $100. If Apple pays a dividend of $10 per share annually, you earn an annual dividend of $10 from owning your stock. Since you earned $10 from your $100 investment, your dividend yield is 10%. Let’s consider now, if this year Apple’s stock price rises to $200. You are now earning $10 from an investment worth $200, which means a dividend yield of 5%.

So the highest dividend yield is best right? Hold your horses!

The dividend yield should firstly be an amount you deem worthwhile versus the other way you can invest your money. Secondly it should be competitive within its sector and with benchmarks like the S&P 500. [Note: at the time of writing, central banks have slashed interest rates to 0% and the dividend expected from investors is low by historical comparison.]

If a dividend yield is very high that can be a bad omen. You need to avoid what is called a dividend trap, when a dividend yield is so unsustainably high that the dividend will probably be reduced or cut altogether. As an example, the company issues a profit warning and the stock price plummets. The dividend payout suddenly looks very attractive relative to the price (high dividend yield). But, as soon as the company reports its earnings, the profits have dropped like it warned and it cuts the dividend because it no longer has the profits to pay it.

2. Payout ratio

The payout ratio is a representation of how much the company is paying from its earnings as a dividend. It is calculated as follows:

Naturally, a company that pays out a smaller percentage of its earnings has a higher scope to raise its dividend later, while a company that pays out a large portion of its profit as a dividend has less room for growing its dividend and a greater likelihood of cutting the dividend. A payout ratio of 50% is generally considered the marker point between what is high and low.

3. Coverage Ratio

The coverage ratio gives you a quick feeling about how able a company is to pay its dividend. It basically shows how many times a company could pay its dividend using its net income over a year. The higher the coverage ratio, the better – since it shows a greater ability to pay – making the dividend more sustainable.

4. Track Record

It makes a lot of sense that if a company has a track record of growing its dividend, it is easier to believe it will continue to do so. This is by no means a guarantee but it at least it shows past good intent from the board of the company and an ability to grow the dividend by the management. It is no use buying a stock for its dividend if the dividend is kept steady year after year, severely limiting future returns.

One ratio to measure track record is the dividend growth rate, which is simply the annual growth rate of the dividend over a period of time, often five years.

5. Steady earnings growth

It goes without saying that the company must first make earnings in order for it to be able to pay a dividend. For a dividend investment, ‘steady’ earnings growth is better than ‘fast’ earnings growth. You want to see consistent earnings to know that the company can consistently pay you your dividend. The most common variable watched by investors during earnings season is earnings per share (EPS). EPS growth is simply a measure of the change in earnings from one year to the next.

For example, earnings will fluctuate according to the business environment but as long as they are within a certain range of acceptable coverage ratios, then the dividend can still be reliably grown with minimal risk of being cut.

6. Valuation

Like any stock market investment, valuation matters. The reason for your income stock investment is not capital appreciation (stock price rising) but you still don’t want to see the stock price tank!

If a stock is priced too high relative to its expected earnings, normally one of the two data points has to adjust to come back into line with a sensible valuation. When investing for dividends, you don’t want the risk that all your dividend income is offset by a falling stock price. The best chance of avoiding this is to look for companies with a Price-Earnings (P/E) ratio that is comparable to its industry and a market benchmark like the S&P 500 if it is in the USA or SMI if it is in Switzerland. There is no one rule of thumb – but if there were one it’s that over 20 is a higher valuation and under 20 is a lower one.

7. Competitive advantage

We are finishing up with a qualitative judgement about the company to decide whether it is a good investment. Very first things first – do you understand what the company does? If not, follow Warren Buffett’s rule and step aside and let somebody who does understand invest. You should only invest in companies where you can understand what they are doing and be able to make a judgement whether it will be successful or not.

It is a company’s competitive advantage that allows it to keep its market share over time because it is needed. This could be from a naturally monopoly, brand recognition, patent ownership etc. The point is that the company is delivering a product or service that others cannot easily replace.

Conclusion

Dividend investing is a great way to make passive income. Combined with dividend reinvestments and compound interest, it can make a huge different for when you retire and the quality of your retirement.