Price action trading strategies should be the starting point and heart of any trading strategy, even if the trader later uses technical indicators too.

- Is price action trading the best?

- Is price action trading profitable?

- How to read price action

- Price action vs. indicators

- Using price action to find a trend

- Price action strategy for risk management

Is price action trading the best?

Think of it like this - when you place an order to buy or sell, you do it through a security’s price. It is the price movements that dictate whether traders make a profit or loss. If a trader’s technical analysis emphasises price action, it is emphasising the same thing that determines the trading success or failure.

For example, if your price action strategy says to buy EUR/USD at 1.20 and cut your losses with a stop loss at 1.1950 (50 pips lower) and take profit at 1.21 (100 pips higher) then you have determined your entries, exits and money management all using the price.

What does price action mean in trading?

Price action is the way the price itself is moving. Price action traders focus solely on price to develop a price action strategy.

There is not just one way to display price - it can be via a ticker tape, it can be from market depth (the level 2) or a line chart. But most commonly price action traders use bar charts and candlestick charts.

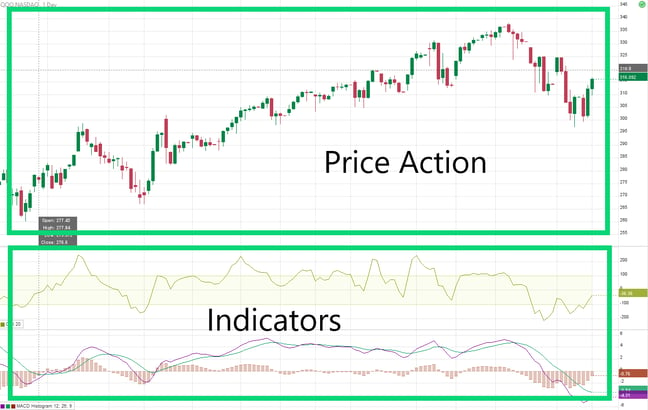

Price Action chart

On a candlestick chart, when we talk about price action trading, we are talking about the action in the price from minute to minute, day to day etc. You can think of price action trading as happening exclusively to upper half of the chart, excluding all underlay charts.

Is price action better than indicators?

There is nothing wrong with technical indicators - they can be used effectively. But the problem is with how they get misused by uninformed or new traders. It is especially true that forex traders overlook price action forex trading in favour of technical indicators. Let’s look at the below as an example of what not to do:

Chart: How NOT to use technical indicators

I think you will agree that the above chart is almost impossible to read. With all those technical indicators showing different things - how can a trader know when to buy or sell? There are too many conflicting trading signals to offer the trader a good trade idea. It's hard to even see but there is an RSI indicator at the top and a MACD indicator at the bottom as well as moving averages and Bollinger bands.

To be a consistent trader with a good track record, the above chart must be avoided at all costs.

From a technical analysis standpoint, the opposite of price action trading strategies are indicator trading strategies. However, there is no need to take an extreme position on whether price action is better than technical indicator trading.

In this article, we make the argument that price action should be the focus of technical analysis but there is no reason not to use indicators to confirm price movements. After all, technical indicators are mathematical indicators based on the price action. It makes sense that pure price should be the first consideration, but other techniques can also be employed.

How to calculate price action

There are three things we need to do for an accurate trading strategy and all three can be done using price action techniques.

- Determine the trend

- Find trade entries and exits

- Manage risk

Let’s review all three parts of our trading strategy next:

Best price action strategy to find the price trend

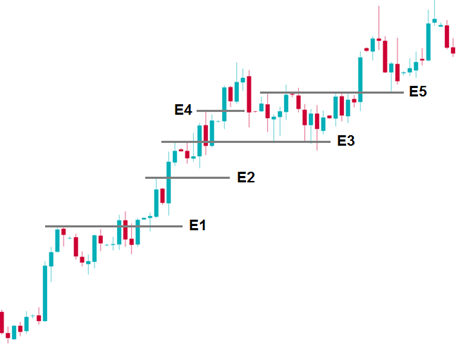

Can you tell what the price is in this chart? Do you need a technical indicator to tell you that the price is moving from the bottom left to the top right of the chart?

In this case the chart is clearly showing that there is an uptrend. So then the once the trend of the market is established, the trader must find a price action trading strategy that works in an uptrend, likely involving going long rather than going short the market.

Price action to find Trade Entry and Exits

Can you spot any potential trade entry points from this same uptrend? Is a technical indicator necessary for any of these simple price action trading systems?

Entry 1 is a breakout trade

Entry 2 is another breakout trade

Entry 3 is firstly a breakout trade but then secondly a pullback trade

Entry 4 is a minor breakout pattern

Entry 5 is a trading a price action pattern breakout (a bull flag pattern)

Risk Management with Price action

What about if the trend is sideways? Are there some ways to spot low risk entry and exit price inside this price range without technical indicators?

Here, using price action alone -a price action trader can see that price is moving sideways within a 100 pip price range. Buying in the bottom 20 pips of the range and selling in the top 20 pips, would result in a 4:1 risk: reward ratio.

Why do price action traders fail?

It is possible to trade profitably with a price action trading strategy, but the analysis of price alone will not guarantee profits. A sound risk management system as well as monitoring fundamental data via an economic calendar and even complimenting the price action techniques with technical indicator analysis all add to the probability of successful trading.

Does price action trading really work?

Ultimately, price action traders will be successful at trading for the same reasons traders turn profitable with any strategy.

Here are 5 tips to become a consistent trader:

- Don’t reinvent the wheel There are many tried and tested price action trading strategies. A price action trading system can be found in trading books, a price action course or free on the internet

- Back test a price action strategy. Don’t take our word for whether price action works, scroll back through the charts in your trading platform and see for yourself whether they have worked in the past

- Forward test your strategy using a live trading account. A demo account is good to get familiar with the platform but it is not a true reflection of how you will trade with real money.

- Use a trading journal to record the success of the price action trading strategies you are using.

- Give the strategy time. One of the most common newbie trader mistakes is to jump from one strategy to the next without giving it a chance to work