Industries where things are almost always done the same way tend to be ripe for disruption when new technologies arrive. Real estate is no exception. And blockchain offers some tremendous advantages over the way we currently buy and sell real estate.

Forewords: sources of this blog include TechCrunch, Cushman & Wakefield Blog and Realcomm Advisory.

Imagine a new real estate world:

• Where buyers and sellers can rely on a truly electronic, secure property sale process, where paper deeds and title fraud were history;

• With a secure electronic record tied to each corporate or individual entity showing their credit history and other details;

• Where digital lease will automatically withdrew rent payments and service charges with no human error and a full audit trail;

• Where buildings would have all systems securely connected, adjusting the needs of their occupants without human intervention.

All of these ideas may soon be reality via blockchain technology.

When talking about blockchain in the real estate or in any other industry, the community usually falls into two camps: one group thinks it could revolutionize the way the industry works while the other stops listening when one mentions it involves bitcoin. While a recent survey by Deloitte found that forty percent of US senior executives have very little knowledge about the blockchain technology, it also shows that for those who are informed about blockchain, almost half of them either have the technology in production or plan to within 12 months. The majority of those who understands what it is said that not using it would be a competitive disadvantage.

Indeed, Blockchain is not just a new trendy idea coming from the Silicon Valley. It is real enough that firms like IBM, Deloitte, KPMG and others are putting lots of time and efforts into it.

What is blockchain?

At a basic level, a blockchain is similar to a type of database, electronic ledger or transaction history. Each of the pieces of information in the database – known as blocks – are stitched together using code into a longer “chain” containing the entire history of that particular item.

As a real world example, think of a real estate deed. Just like public records available today, the blockchain record for a property would include all the recent owners, sale prices, transaction dates, etc.

The key part of blockchain systems are the security they create. First, each transaction is encrypted, and because each entry is linked in the “chain” to everyone after it, it is essentially impossible to erase or tamper with the data without changing the code that follows.

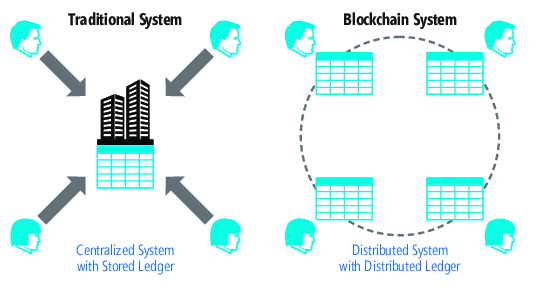

The other security-driven aspect of the system if there is no “central” database where everything is stored that can be hacked. Multiple copies of each chain are distributed across the world. So even if someone tampered with one version of the ledger, the other versions would reject that change. That makes it ideal for any transactional situation.

At this stage, applications of the blockchain technology seem infinite. It actually might be leveraged wherever the need for transparent, secure, verifiable information is exchanged across interested parties.

Bitcoin was one of the first “mainstream” ways it was used, using its own blockchain ledger to track financial transactions (more details on this in the previous edition of Perspectives). But much like the Internet during the 1990s, blockchain is envisioned to enable a wide variety of applications and has the potential to transform a multitude of sectors. Real Estate should be one of them.

How will blockchain matter in real estate?

Buying a home is the biggest investment that most people will make in their lifetimes, yet, to date, there have been few technological advances to expedite the process and make it more secure for buyers, lenders and homeowners alike.

Below, we look at the four ways in which Blockchain could potentially revolutionize the real estate industry: 1. Disintermediation; 2. Fraud prevention; 3. Money 2.0 and; 4. Smart contracts.

1. Disintermediation

Real estate transactions are slow because of the numerous parties involved in the transfer of a property. The whole process starts with agents and brokerages, and is followed by contracts, an escrow company, a title company, a wide range of inspectors from multiple entities, financial institutions, potentially government offices, notary publics and lawyers.

Currently, these steps are in place with the objective to secure transactions. All these middlemen exist because they hold information that you can’t access or have skills/ licenses you don’t have and which are needed to operate in the existing property transaction ecosystem.

So how could blochain technology help? Blockchain can’t speed up the time needed for appraisals, inspections, and the steps required by government offices. But because public blockchains are a distributed database where anyone can record information, without it being censored, and without needing permission, the access to information can thus be accelerated.

A distributed ledger is a network that records ownership through a shared registry

Blockchain will enable every property, everywhere, to have a corresponding digital address that contains occupancy, finance, legal, building performance and physical attributes that conveys perpetually and maintains all historical transactions. Additionally, the data will be immediately available online and correlated across all properties. The speed to transact will be shortened from days/weeks/months to minutes or seconds.

But it might not stop there. Currently, the title to a property is a piece of paper. To transfer a property, you fill in the blanks on a deed, sign it with a pen, drive to a notary who puts their rubber stamp on it and then drive this paper to the recorder’s office to be placed in their database. Time and money are wasted. Instead of a paper title, Bitcoin or Ethereum can create a digital title. This is a cryptographically secure token that can be transferred as effortlessly, quickly and cheaply as an email.

Before email, to send a letter you needed envelopes, stamps, trucks, sorting facilities, and postal workers to organize and distribute the mail. The digitization of messages disintermediated the mail middlemen. Once people can easily verify property records themselves and transfer a title digitally, brokers, escrow companies, title insurance companies, county recorders, and notary publics will follow the decline of the post office.

2. Fraud prevention

One of the main reasons that buyers and sellers have traditionally used escrow and third-party verifications is to reduce the chances of either parties getting burned by real estate fraud. Real estate fraud costs buyers millions of dollars each year and is aggravated by buyers or sellers who want to make a quick deal and are consequently willing to forego safety measures. The internet and advances in computer technology have made forgery of documents and advertising of fake properties much easier. Fraud is accomplished by forging paper documents such as driver licenses, bank statements, and deeds. How can Bitcoin prevent real estate fraud?

By offering a 100 percent incorruptible resource, whereby the sender and recipient of funds was logged, and where “digital ownership certificates” for properties are saved, the blockchain would effectively make forged ownership documents and false listings a thing of the past. The unique “digital ownership certificates” would be almost impossible to replicate, and would be directly linked to one property in the system, making selling or advertising properties you don’t own almost impossible.

With a total transparent system of real estate ownership and the possibility to track down the transaction history of each property in the market the risk of fraud becomes less. Each year a lot of money is involved with the verification of ownerships, rights and titles transfers. Blockchain makes it possible to have accurate records which identify the current owner and provide a proof that he is indeed the owner.

That makes it easier, safer and faster to buy and sell a property.

3. Money 2.0

Bitcoin is a digital currency. Ethereum has its “Ether” token. Unlike the Dollar or Euro, blockchain currencies aren’t paper that are later represented by software, but are 100% software from birth. The power of software is its programmability. You can code it to play music. Without software, you’d need humans with guitars. The power of cryptocurrency is you can program it to escrow and distribute itself. With fiat (Non-crypto) money, you need humans and banks.

When someone rents an apartment, the landlord takes a security deposit in case the tenant damages the property. By law, he’s supposed to keep the funds in a separate escrow account and not spend it. Once the lease ends, the tenant has to rely on the good faith of the landlord to return the deposit. But if you’ve ever attended small claims court you know how frequently this human/trust-based system fails.

Bitcoin has a function called multi-signature. In bitcoin, you use your private key to approve the sending of the digital currency to another person. With “multisig,” you can create a transaction with three private keys, where at least two are required for spending.

Bitcoin can be used to create a programmable escrow.

Instead of sending the landlord dollars to a bank account, the tenant and landlord create a multi-signature transaction. The tenant and landlord each has one private key, and a third one is given to neutral third party (Arbitrator). For the security deposit to be spent, two out of the three people will need to use their private key. The funds are locked in crypto-escrow for the duration of the lease.

The tenant will almost always want his deposit back, and so he’ll approve the transaction with his private key. When the lease ends, if the tenant didn’t damage the property, the landlord uses his private key to release that bitcoin deposit.

If the tenant damaged the property, then the landlord will send evidence to the arbitrator. The tenant can respond. After the arbitrator hears both sides, he/she will use his/her private key to send the deposit to the winning party. The bitcoin can be sent instantly, 24 hours a day, 7 days a week.

No waiting on a mailed paper check or dealing with routing and account numbers and banking hours for a wire transfer.

By using bitcoin, real estate escrows can be done more securely, quickly, and cheaply.

4. Smart contracts

Blockchain protocols such as Bitcoin and Ethereum have the ability to perform “Smart contracts.” This concept started with Nick Szabo. He gave the example of a vending machine which releases an item after a selection is made and the correct value is deposited. The goal of a smart contract is to reduce the need for humans to process and verify an agreement. A software protocol automates and self-executes an action when certain conditions are met. How could a smart contract be used in a property contract?

Examining a simple real estate transaction can demonstrate how smart contracts could drastically alter the way business is conducted. Presently, Party A and Party B would enter into a contract that requires Party A to pay $200,000.00 to Party B in exchange for Party B agreeing to convey title to Party B’s condominium unit to Party A upon receipt of payment. If Party A pays the money, but Party B later refuses to convey title, Party A is required to hire an attorney to seek specific performance of that contract, or to obtain damages. The determination of the outcome will be made by a third party: a judge, jury, or arbitrator.

Using a smart contract, however, avoids the potential for one party to perform while the other refuses or fails to perform. Using a smart contract, Party A and Party B can agree to the same transaction, but structure it differently. In this scenario, Party A will agree to pay $200,000.00 worth of virtual currency to Party B, and Party B will agree to transmit the title to the condominium in a specialized type of coin on the blockchain. When Party A transfers the virtual currency to Party B, this action serves as the triggering event for Party B, which then automatically sends the specialized coin which signifies the title to the condominium at issue to Party A. The transfer is then complete, and Party A’s ownership of the condominium is verifiable through a publicly available record on the blockchain.

Structuring this transaction as a smart contract ensures that the transfer occurs as soon as funds are received, and results in a publicly available, verifiable record of the transfer. Because the contract automatically performs based upon the predetermined rules agreed to by the parties to the contract, there is little risk of fraud, and virtually no need for external measures to enforce performance of the agreement. Thus, no specific performance action would ever be necessary to compel the transfer after payment is made because the coin, which represents title to the condominium, is automatically transferred, and the transfer is automatically published, to third parties on the blockchain.

Real estate markets where blockchain has already been working.

Sweden became the first western country to explore the use of blockchain for real estate in July last year. At the time, the Swedish Land Registry partnered with blockchain startup ChromaWay to test how parties to a real estate transaction – the buyer, seller, lender, government – could track the deal’s progress on a blockchain.

Other countries at the forefront of blockchain for real estate include The Republic of Georgia, Honduras and Brazil which announced a pilot program earlier this year. While this might seem like a disparate list, it is in these countries where the long-term potential of a blockchain for real estate are most significant.

Systemic corruption and insecure database management in these countries,, and many other emerging economies, is seen as a major constraint on growth and prosperity. Some developing countries have no existing system of land transfer registration, or like Kenya, the current process is painfully time consuming. That presents an opportunity to create an entirely new system, which, in theory, is superior to what’s been built up over the years in the Western countries.

Conclusion

The internet made it possible for individuals to transfer information, quickly, cheaply and paperless without obtrusive intermediaries. Similarly, blockchain technology offers the same advantages for transferring VALUE. As we have been using the internet to transfer words and pictures, we would be using blockchain platforms to transfer money and assets.

The real estate industry might be among the ones which could face the biggest disruptions thanks to blockchain. The transformation will not happen overnight. Blockchain technology is still in its infancy and it will take the examples of a few innovative and forward-thinking real estate firms to lead the way and convince the masses that blockchain is the correct path to take. There are also risks attached to it; Blockchain’s advantages in restricting any changes to historical records becomes a disadvantage when incorrect or fraudulent entries are added. But in the future, blockchain technology could make buying or selling a house, applying for a mortgage or taking out a property loan a streamlined, safe and transparent process. Think where we were 10 years ago. Would we have ever imagined that people would apply for mortgages on their phones and digital signatures would be so readily accepted for everything? If nothing else, the next stage in real estate technology will definitely be very interesting.