We have never seen more inflows towards ESG funds. Aside from ethics, is this a good trend for investors in terms of returns, and where is this trend going?

Key takeaways on ESG investments

- Environmental, Social and Governance are the three composing factors of ESG, an indicator informing investors of how sustainable a company is.

- ESG funds have attracted $340 billion last year, almost twice as much as any other stock-based funds combined.

- While “sin stocks” might have offered better results in the short term, it seems that ESG is the right path for the longer-term investor.

- Governments are increasingly encouraging investors to go for ESG investments, and going against this will soon become absurd, for both companies and shareholders.

What is ESG again?

“ESG” stands for Environmental, Social and Governance. An evaluation based on those metrics tells us how advanced a company is on a sustainability dimension.

The first term, ‘’Environmental’’, refers to how a company manages its waste, greenhouse gas emission and energy efficiency. Regarding all the publicity made on global warming, it is most likely the most talked about aspect of ESG.

‘’Social’’ refers to human rights and labor standards in the supply chain and the general consideration about the health and safety of customers and employees.

Finally, ‘’Governance’’ is the set of rules defining interactions between the company and its stakeholders. A well-conceived governance makes sure that objectives are aligned for all actors in the long term.

ESG funds inflows are soaring

Performance and flows are often affected by market signals, and these days, the market is screaming at companies to get their activities in order, especially regarding their ESG dimension.

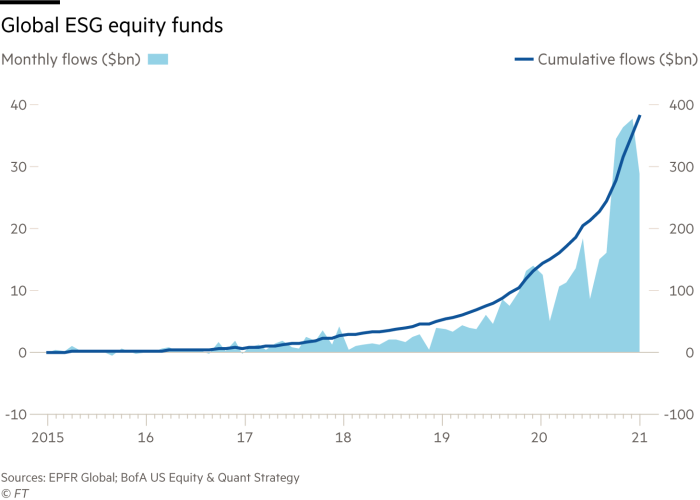

All things considered, ESG funds have attracted about $340 billion in the past 2 years, which is almost twice as much as the rest of other funds combined.

Global ESG equity funds are seeing increasingly higher monthly flows (Source: FT)

Global ESG equity funds are seeing increasingly higher monthly flows (Source: FT)

We have to mention that the past decade was very pleasing to stock which did good on an ESG standpoint (such as tech stocks) and relatively ruthless to others (such as energy stocks for example). Decent returns along with a mind at peace, what more could you ask for?

“Sin stocks” might offer better returns in the short term

‘’Sin stocks’’ are companies involved in activities deemed unethical, such as tobacco, alcohol, gambling adult entertainment, and weapons. A study conducted in 2018 by Frank Fabozzi, showed that ‘’sin stocks’’ generated excess returns compared to other stocks in all 21 studied countries between 1970 and 2007.

There were a couple reasons for this. First, investors are shying away from these investments, so these stocks are often cheaper than what their fundamentals would indicate. Second, it is much harder for new competition to enter the market, due to the difficulties it would have raising capital – try launching a new cigarette company, you will see how hard it will be to find investors to tag along. This offers ‘’sinful’’ companies a great protection against new competition and reap larger profits.

But ESG investing should bear better results over the long-term

Studies differ on the matter, but the main argument is that by and large, companies that care about the environment, have a good social impact and are well governed tend to be well-run companies which naturally perform well over the long-term.

This backed by data: The MSCI Global index of ESG Leaders shows a 164% return over the past decade. Many papers showed that ESG boosted returns, and even M. Fabozzi revised its study on sin stocks to see that results were not so pronounced once adjusted for other factors such as size.

Another study conducted by Scientific Beta found that once all factors were taken away, ESG itself did not offer higher results. But investors – and especially the new generation – do tend to care about sustainability a lot more. While ESG might not be directly responsible for the excess return, it is responsible for the increased popularity of the stock or fund, which in turns makes it responsible for growing inflows and market value.

Beware of the “E”: Governments want you to buy green

Aside from it being ethical and good for your portfolio, governments are doing a lot to encourage investors entering ESG positions. Leaders of all main economies have pledged to drastically cut carbon emissions in the medium- to long-term. With the US, Canada, Japan announcing plans to cut emissions by 30 to 50%, non-green companies will most likely not thrive.

Considering that all of these efforts will not be enough to reach climate goals, it is likely that even more targets and regulations will be set in place, making matters even worse for non-complying firms.

How to play it the ESG trend?

Rarely have we witnessed the launch of so many sustainability related ETF, especially on European markets. In Europe, 33 products were launched in the first quarter of this year. And this only follows the surge that happened in 2020.

After a recent pullback on energy stocks this year, a decent entry point might be possible. “The recent market correction affecting clean energy stocks, driven by short-term catalysts and what we view as unsubstantiated medium-to-long term catalysts, presents a buying opportunity,” said Société General analyst Rajesh Singla.

While there are many options to choose from there are many ways to conduct your choice. In this article we help you determine which ETF have the lowest carbon emission and fossil fuel use. With the tool explained, you can also easily make sure that the ETF is on the top of its game regarding all ESG variables.

Otherwise, Kiplinger recently published its favorite picks, among which: